India’s services trade surplus reached an unprecedented $44.9 billion in the October-December quarter of FY24, marking a 16% year-on-year increase. This surge in surplus, amidst challenging global conditions, is anticipated to alleviate the current account deficit (CAD) for the period.

Key Statistics and Outlook

-

Services Export Growth: Services exports expanded by 5.2% to $87.7 billion during Q3, while services imports saw a 4.3% contraction, totaling $42.8 billion for the same period.

-

CAD Trends: The CAD has moderated to 1% of GDP in the first half of FY24, down from 2.9% in FY23, driven by a lower merchandise trade deficit and higher net services receipts.

-

Projections: Fitch Ratings forecasts a further narrowing of CAD to 1.4% of GDP in FY24 and 2024-25, compared to 2% in FY23, while IDFC Bank revises its estimate to 1.2% of GDP, incorporating the increased monthly services surplus.

Contributors to Services Exports Growth

-

IT Dominance: India’s services exports, led by software exports, encompass a broad spectrum ranging from IT services to medical professionals’ services abroad.

-

Emerging Sectors: “Other business services” exports, notably Global Capability Centers (GCCs), have witnessed significant growth, constituting 26.4% of total services exports in H1 FY24, up from 19% in 2013-14.

Government Targets and Global Position

- Export Goals: The Indian government aims for combined goods and services exports to reach $2 trillion by 2030, leveraging the resilience of the services sector.

-

Global Trade Share: India holds a 4% share in global commercial services exports and a 3.52% share in global commercial services imports for 2021, while its merchandise trade accounts for 1.77% of world exports and 2.54% of world imports.

India’s Forex Reserves Fall $2.11 Billio...

India’s Forex Reserves Fall $2.11 Billio...

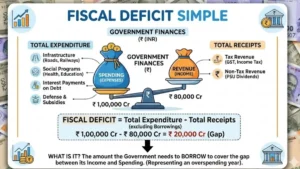

India’s Fiscal Deficit Hits ₹9.8 Trillio...

India’s Fiscal Deficit Hits ₹9.8 Trillio...

India’s GDP Growth Slows to 7.8% in Q3FY...

India’s GDP Growth Slows to 7.8% in Q3FY...