The Insurance Regulatory and Development Authority of India (IRDAI) has unveiled a revolutionary plan called Bima Trinity during the 9th Bima Manthan, held on February 13-14, 2025. This initiative is set to transform India’s insurance industry, aiming to make insurance more accessible, affordable, and efficient. The plan, a three-pronged approach, is designed to address critical gaps in insurance accessibility and coverage across the country. The 9th Bima Manthan meeting was an important platform where IRDAI engaged with the CEOs of insurance companies to discuss the performance of the sector and its future strategies.

What is the Bima Trinity Plan?

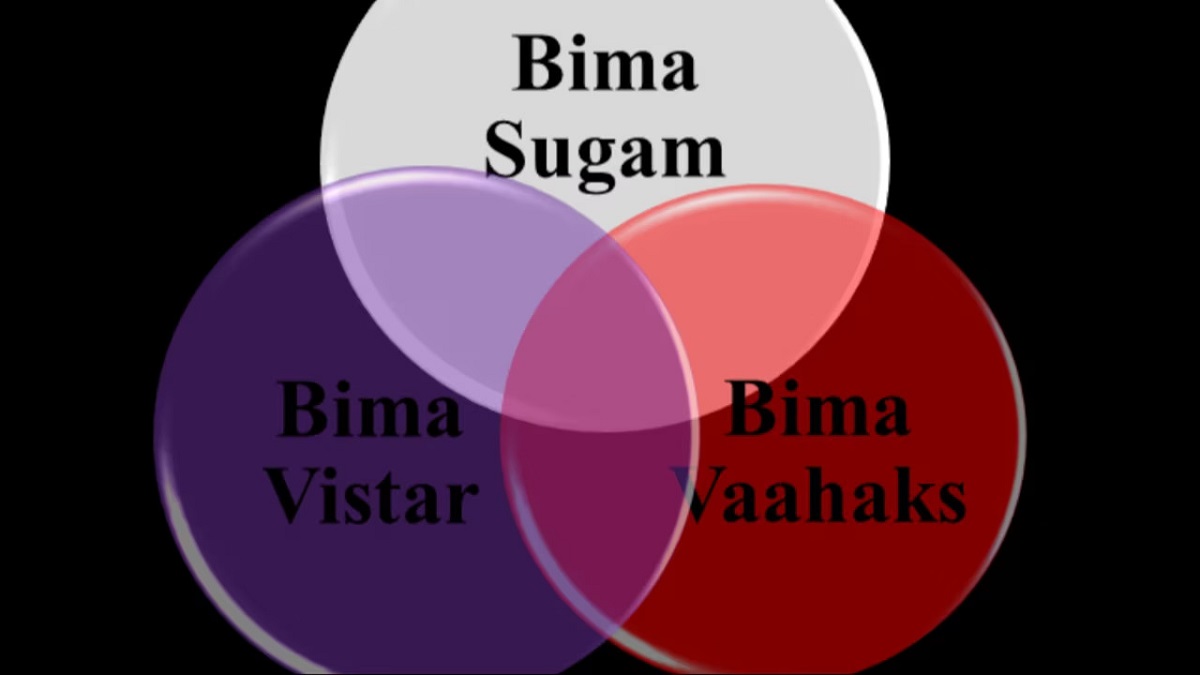

The Bima Trinity plan is a strategic move by IRDAI to ensure more inclusive growth in India’s insurance sector. This initiative introduces three key components:

Bima Sugam

Bima Sugam is a unified digital marketplace that aims to simplify the process of buying, servicing, and claiming insurance policies. This platform will bring together different insurance companies under one digital roof, offering consumers a seamless experience. By doing so, Bima Sugam will streamline the entire process, making insurance more user-friendly and efficient.

Bima Vistaar

Bima Vistaar is a composite insurance product that will provide coverage for a range of needs: life, accidents, property, and hospitalization. This product is designed to offer comprehensive protection under a single policy, reducing the complexity of managing multiple insurance plans. Consumers will find it easier to secure a wide range of benefits with just one plan, making it an attractive option for many.

Bima Vahaak

The third component of the Bima Trinity is Bima Vahaak, which is specifically designed to empower women in rural and semi-urban areas. This women-centric initiative aims to increase insurance penetration by involving women as local distributors of insurance products. By creating a localized distribution model, Bima Vahaak will not only provide greater access to insurance but also promote financial inclusion and gender equality in the sector.

How is IRDAI Implementing the Bima Trinity Plan?

The implementation of the Bima Trinity plan is already in progress. During the Bima Manthan meeting, IRDAI shared updates on the status of each component.

Bima Sugam

The digital marketplace is moving forward as planned. The Bima Sugam India Federation (BSIF) has completed its foundational work and is ready to roll out the platform for industry participation. This platform will become the go-to space for consumers looking to purchase insurance policies or file claims, making it a vital part of the insurance ecosystem in India.

Bima Vistaar

While Bima Vistaar is still in the final stages of planning, discussions at the Bima Manthan meeting revealed that the operational framework for this composite product is being finalized. Once launched, it is expected to simplify the insurance process, offering more choices for consumers in a single product.

Bima Vahaak

The Bima Vahaak initiative is set for a soft launch in April 2025. By creating opportunities for women to participate in the distribution of insurance, IRDAI hopes to improve both the reach and effectiveness of insurance products in underserved areas.

What Are the Key Objectives of the Bima Trinity Plan?

IRDAI’s broader goal with Bima Trinity is to ensure “Insurance for All by 2047”. This vision highlights the government’s commitment to increasing insurance penetration across India, which currently stands at a relatively low level compared to global standards. By addressing product design, pricing, and distribution, the Bima Trinity plan is designed to bridge the existing gaps in India’s insurance sector.

With components like Bima Sugam, Bima Vistaar, and Bima Vahaak, IRDAI is working towards making insurance more accessible and affordable for everyone, from urban professionals to rural communities. These initiatives will help reach those who have historically been left out of the insurance ecosystem, thereby creating a more inclusive financial environment.

How Will the Bima Trinity Plan Impact India’s Insurance Industry?

The Bima Trinity plan is a game changer for India’s insurance sector. By embracing digitalization, simplifying insurance products, and empowering women, IRDAI is paving the way for a more inclusive and customer-centric industry. These efforts are expected to drive significant growth in insurance coverage, benefiting millions of Indian households.

The successful implementation of Bima Trinity will also have a long-term impact, as it will create a more robust insurance infrastructure, help promote financial literacy, and increase the overall insurance penetration rate in the country. As India moves towards the vision of “Insurance for All by 2047”, Bima Trinity will play a crucial role in transforming the sector and meeting the needs of diverse consumers.

Summary of the news

| Key Aspect | Details | Why in News |

|---|---|---|

| Bima Sugam | A unified digital marketplace for buying, servicing, and claiming insurance policies. | Aims to streamline insurance processes, enhancing accessibility and efficiency in the sector. |

| Bima Vistaar | A composite insurance product offering coverage for life, accidents, property, and hospitalization. | Provides comprehensive coverage under a single policy, simplifying insurance for consumers. |

| Bima Vahaak | A women-centric, localized insurance distribution model targeting rural and semi-urban areas. | Empowers women in insurance distribution, promoting financial inclusion and increasing penetration. |

| Phased Rollout | Progress on the rollout of Bima Sugam, Vistaar, and Vahaak with expected launches in 2025. | Reflects IRDAI’s commitment to transforming the insurance sector with new, accessible, and inclusive products. |

| Vision 2047 | Aligns with IRDAI’s goal of “Insurance for All by 2047”. | Aims to bridge gaps in product design, pricing, and distribution, boosting insurance penetration across India. |

2026 Business Milestone: Amazon Dethrone...

2026 Business Milestone: Amazon Dethrone...

V.O. Chidambaranar Port Authority Secure...

V.O. Chidambaranar Port Authority Secure...

Reliance Industries Limited Secures U.S....

Reliance Industries Limited Secures U.S....