On Tuesday, March 25, 2025, the Lok Sabha passed the Finance Bill 2025 along with 35 government amendments. One of the key amendments includes the abolition of the six per cent digital tax on online advertisements. The passage of the Finance Bill 2025 marks the completion of the Budgetary approval process in the Lower House. Now, the bill moves to the Rajya Sabha for further consideration, after which the Budget process for FY 2025-26 will be formally concluded.

Finance Bill 2025 and Budgetary Overview

The Union Budget 2025-26 outlines a total expenditure of ₹50.65 lakh crore, reflecting a 7.4 per cent increase over FY 2024-25. The government has proposed a capital expenditure of ₹11.22 lakh crore, with an effective capital expenditure of ₹15.48 lakh crore. The projected gross tax revenue collection stands at ₹42.70 lakh crore, while the estimated gross borrowing is ₹14.01 lakh crore.

Key Announcements in Finance Bill 2025

Finance Minister Nirmala Sitharaman highlighted that the Finance Bill 2025 aligns with India’s vision for Viksit Bharat by 2047 and ensures tax certainty. She emphasized the following objectives:

- Rationalization of tax provisions to enhance ease of doing business.

- Unprecedented tax relief measures for individuals and businesses.

- A strong focus on increasing tax mobilization from individuals with foreign assets.

According to budget documents, the allocation for Centrally Sponsored Schemes for FY 2025-26 is ₹5,41,850.21 crore, a substantial increase from ₹4,15,356.25 crore in FY 2024-25. Similarly, Central Sector Schemes will receive ₹16.29 lakh crore compared to ₹15.13 lakh crore in the previous fiscal year.

Budget Estimates for FY 2025-26

The budget estimates have been revised upwards due to several economic and strategic factors:

- Rise in interest payments on market loans, treasury bills, external loans, and provident funds.

- Increased capital expenditure for the Armed Forces.

- Provisions for employment generation schemes.

State Allocations and Fiscal Deficit

The total resource transfer to states in Budget 2025-26, including state share devolution, grants/loans, and Centrally Sponsored Schemes, stands at ₹25,01,284 crore. This marks an increase of ₹4,91,668 crore compared to the actuals of 2023-24.

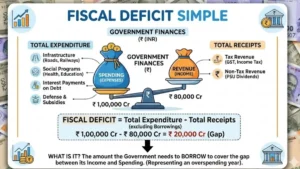

The fiscal deficit for FY 2025-26 is projected at 4.4 per cent of GDP, down from 4.8 per cent in the current fiscal. Additionally, the GDP for FY 2025-26 is estimated at ₹3,56,97,923 crore, a 10.1 per cent increase over the Revised Estimates for FY 2024-25 (₹3,24,11,406 crore) released by the National Statistical Office (NSO).

Summary of Finance Bill 2025

| Category | Details |

|---|---|

| Why in News? | Lok Sabha passed Finance Bill 2025 with 35 amendments on March 25, 2025. |

| Major Amendment | Abolition of six per cent digital tax on online advertisements. |

| Total Expenditure | ₹50.65 lakh crore (7.4% increase over FY 2024-25). |

| Capital Expenditure | ₹11.22 lakh crore (Effective: ₹15.48 lakh crore). |

| Gross Tax Revenue | ₹42.70 lakh crore. |

| Gross Borrowing | ₹14.01 lakh crore. |

| Allocation for Centrally Sponsored Schemes | ₹5,41,850.21 crore (up from ₹4,15,356.25 crore in FY 2024-25). |

| Allocation for Central Sector Schemes | ₹16.29 lakh crore (up from ₹15.13 lakh crore in FY 2024-25). |

| Resource Transfer to States | ₹25,01,284 crore (increased by ₹4,91,668 crore over 2023-24). |

| Fiscal Deficit | 4.4% (reduced from 4.8% in FY 2024-25). |

| GDP Estimate for FY 2025-26 | ₹3,56,97,923 crore (10.1% increase over FY 2024-25). |

| Next Steps | Approval by Rajya Sabha to complete the Budget process. |

This detailed breakdown provides a comprehensive understanding of the Finance Bill 2025 and its implications for India’s economy. Let me know if you need any refinements!

India’s Forex Reserves Fall $2.11 Billio...

India’s Forex Reserves Fall $2.11 Billio...

India’s Fiscal Deficit Hits ₹9.8 Trillio...

India’s Fiscal Deficit Hits ₹9.8 Trillio...

India’s GDP Growth Slows to 7.8% in Q3FY...

India’s GDP Growth Slows to 7.8% in Q3FY...