The Reserve Bank of India has said that public sector banks reported over a 51 per cent fall in the amount involved in frauds to Rs 40,295.25 crore during the financial year 2021-22 (FY22). As many as 12 PSBs (Public Sector Banks) had reported frauds worth Rs 81,921.54 crore in the preceding fiscal 2020-21, the central bank said in response to an application under the Right to Information (RTI) Act.

Buy Prime Test Series for all Banking, SSC, Insurance & other exams

However, the number of fraud cases didn’t fall at the same pace as a total of 7,940 frauds reported by the PSBs in 2021-22, against 9,933 incidents reported in FY21, said the RBI’s reply to Madhya Pradesh-based RTI activist Chandrashekhar Gaur.

Key points of the reports:

- According to the RBI data on frauds reported by PSBs in all categories during FY22, the highest amount of Rs 9,528.95 crore was reported by the city-based Punjab National Bank (PNB), involving 431 such incidents.

- The country’s largest lender State Bank of India reported frauds worth Rs 6,932.37 crore in as many as 4,192 cases — reflecting incidents of a large number of small value frauds.

- Bank of India reported frauds worth Rs 5,923.99 crore (209 incidents), followed by Bank of Baroda at Rs 3,989.36 crore (280); Union Bank of India Rs 3,939 crore (627), while Canara Bank reported frauds worth Rs 3,230.18 crore in just 90 cases — showing that the transactions were of high-value frauds.

Important takeaways for all competitive exams:

- RBI Founded: April 1, 1935;

- RBI Headquarters: Mumbai, Maharashtra;

- RBI Governor: Shaktikanta Das;

- RBI Deputy Governors: Mahesh Kumar Jain, Michael Debabrata Patra, M Rajeshwar Rao, T Rabi Sankar.

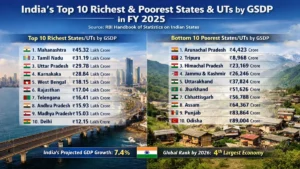

India’s Top 10 Richest and Poorest State...

India’s Top 10 Richest and Poorest State...

Delhi Airport Jumps to 5th Spot in Apac!...

Delhi Airport Jumps to 5th Spot in Apac!...

Which Island is known as the Island of P...

Which Island is known as the Island of P...