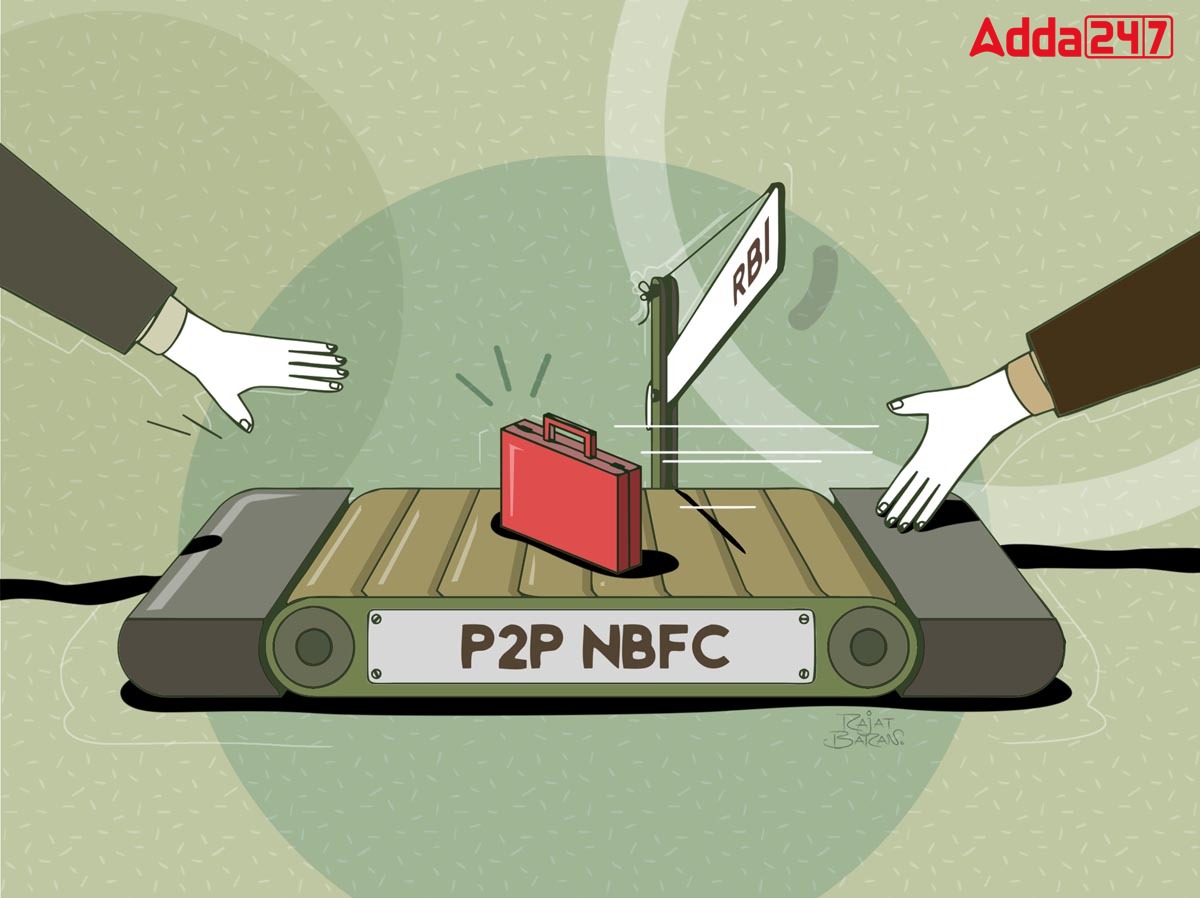

The Reserve Bank of India (RBI) has intensified its oversight on peer-to-peer (P2P) credit card payments facilitated by third-party service providers. This follows the discovery of retail customers utilizing credit cards for rent and tuition fee payments through third-party apps, prompting regulatory action.

Regulatory Norms and Scrutiny:

- RBI defines credit cards as payment instruments with pre-approved credit limits for purchasing goods/services or withdrawing cash.

- Funds routed through third-party escrow accounts bypass regulations, attracting regulatory scrutiny.

- Rent payments are a significant segment under scrutiny for such transactions.

Involvement of Fintechs and Commissions:

- Fintech companies like CRED, OneCard, and NoBroker offer credit card payment services, charging commissions ranging from 1.5% to 3% in addition to GST.

- Transactions via third-party intermediaries are considered outside the scope of current licensing, akin to Business Payments Solution Provider (BPSP) transactions.

Compliance and Licensing Issues:

- Some fintechs operate with Third Party Application Provider (TPAP) licenses from NPCI and seek Payment Aggregator (PA) licenses from RBI.

- The central bank recently prohibited Visa from offering its BPSP facility to entities not accepting card payments directly, signaling a strict stance on compliance.

SEBI Revamps New Mutual Fund Rules 2026 ...

SEBI Revamps New Mutual Fund Rules 2026 ...

PhonePe Launches AI-Powered Natural Lang...

PhonePe Launches AI-Powered Natural Lang...

ICICI’s New Swasthya Pension Scheme: A S...

ICICI’s New Swasthya Pension Scheme: A S...