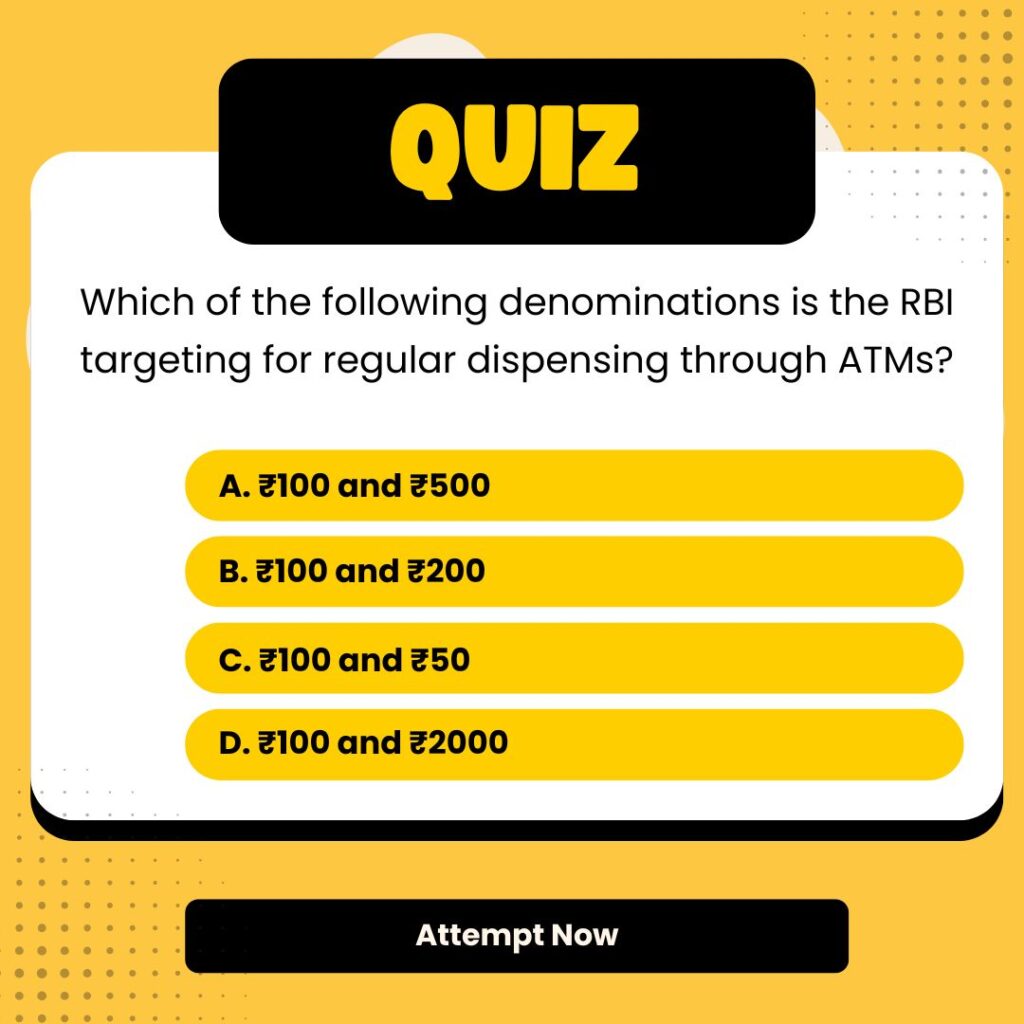

In a move aimed at improving accessibility to frequently used currency denominations, the Reserve Bank of India (RBI) has mandated that banks and White Label ATM Operators (WLAOs) ensure that ATMs dispense ₹100 and ₹200 denomination banknotes on a regular basis. This directive is set to roll out in phases, with specific deadlines for implementation.

Why in the news?

The RBI’s latest directive addresses a common public concern: the availability of smaller denomination notes in ATMs. By ensuring that ₹100 and ₹200 notes are available regularly, the RBI aims to make it more convenient for people to access the most commonly used denominations.

Objective

- The primary goal of this directive is to improve public access to ₹100 and ₹200 notes. These denominations are frequently used for everyday transactions, and the RBI wants to ensure that they are available in sufficient quantities across ATMs.

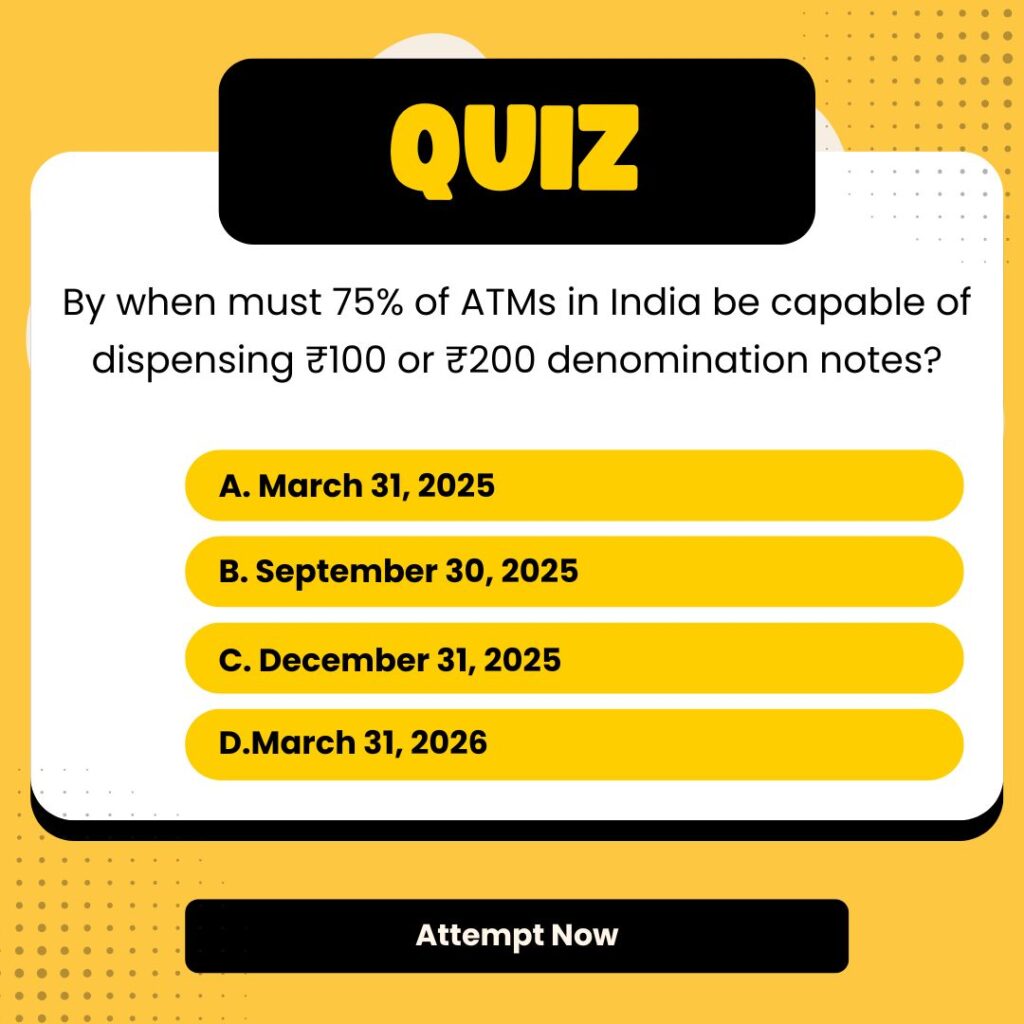

Timeline for Implementation

- By September 30, 2025: 75% of all ATMs in India should be capable of dispensing either ₹100 or ₹200 denomination notes from at least one cassette.

- By March 31, 2026: This figure is set to increase to 90%, meaning 90% of ATMs should regularly dispense ₹100 or ₹200 denomination notes from at least one cassette.

Targeting High-Demand Denominations

- ₹100 and ₹200 notes are among the most commonly used denominations in India. By making them widely available through ATMs, the RBI is addressing a key issue of currency accessibility, especially in areas where people depend on ATMs for quick withdrawals.

Enhanced Public Convenience

- This move is expected to alleviate the public’s frustration with the lack of smaller denominations in ATMs. People often face difficulties when receiving ₹500 or ₹2,000 notes, which are not as easily accepted for smaller transactions, leading to inconvenience and a reliance on currency exchanges.

Impact on ATM Operators

- Banks and WLAOs will need to make adjustments to their ATM systems to accommodate the dispensing of ₹100 and ₹200 notes. This will require modifications to cassette systems and perhaps additional investments in infrastructure to meet the RBI’s deadlines.

Public Accessibility and Financial Inclusion

- By ensuring these denominations are readily available, the RBI also promotes greater financial inclusion. This is particularly beneficial for lower-income groups and in rural areas where people may rely more on ATMs for their cash needs.

| Summary/Static | Details |

| Why in the news? | RBI Directs Banks to Ensure Regular Dispensing of ₹100 and ₹200 Notes |

| RBI Directive | Ensure ATMs dispense ₹100 and ₹200 regularly |

| Deadline (Phase 1) | 75% of ATMs to dispense ₹100/₹200 by Sept 30, 2025 |

| Deadline (Phase 2) | 90% of ATMs to dispense ₹100/₹200 by March 31, 2026 |

| Objective | Increase access to commonly used currency denominations |

| Target Denominations | ₹100 and ₹200 notes |

| Expected Outcome | Improved public convenience, greater financial inclusion |

PhonePe Launches AI-Powered Natural Lang...

PhonePe Launches AI-Powered Natural Lang...

ICICI’s New Swasthya Pension Scheme: A S...

ICICI’s New Swasthya Pension Scheme: A S...

RBI’s New Rulebook: UTI Required for All...

RBI’s New Rulebook: UTI Required for All...