The Reserve Bank of India (RBI), in its ongoing commitment to maintain the integrity and adherence to banking regulations, has imposed monetary penalties on three co-operative banks. These banks, namely Saraswat Co-operative Bank Limited, Bassein Catholic Co-operative Bank Ltd, and Rajkot Nagarik Sahakari Bank Ltd, were found to have deficiencies in regulatory compliance. The penalties levied by the RBI serve as a stern reminder to financial institutions to uphold the highest standards of governance and compliance.

Saraswat Co-operative Bank Limited Faces ₹23 Lakh Penalty

- Saraswat Co-operative Bank Limited, headquartered in Mumbai, has been penalized with a monetary penalty of ₹23 lakh.

- The bank has contravene various provisions of the Banking Regulation Act, 1949 (BR Act), and the directions issued by RBI on ‘Loans and advances to directors, their relatives, and firms/concerns in which they are interested.’

- The RBI found that the bank had violated these provisions when it renewed a credit facility granted to a borrower company, all while a director of the bank held the position of an independent director in the borrower company.

Bassein Catholic Co-operative Bank Ltd Penalized ₹25 Lakh

- The RBI imposed a monetary penalty of ₹25 lakh on Bassein Catholic Co-operative Bank Ltd, based in Vasai, Maharashtra.

- This penalty was imposed for contravening the provisions of Section 20 read with Section 56 of the Banking Regulation Act, 1949 (BR Act), and the RBI’s directives on ‘Exposure Norms and Statutory / Other Restrictions.’

- The violation in question involved the bank extending multiple unsecured loans to one of its directors and his proprietorship firm.

Rajkot Nagarik Sahakari Bank Ltd Penalized ₹13 Lakh

- The RBI also penalized Rajkot Nagarik Sahakari Bank Ltd., Rajkot, with a monetary penalty of ₹13 lakh for non-compliance with the directions issued by the RBI on ‘Interest Rate on Deposits.’

- The bank failed to pay eligible interest at the time of repayment on term deposits that matured on Sundays, holidays, or non-business working days, subsequently paying them on the following working days.

- Additionally, the bank did not pay eligible interest on matured unpaid term deposits for the period they remained unclaimed with the bank.

Deficiencies in Regulatory Compliance

It is essential to note that the actions taken by the Reserve Bank were solely based on identified deficiencies in regulatory compliance. These actions were not intended to pass judgment on the validity of any transactions or agreements entered into by the banks with their customers. The RBI’s primary objective is to ensure that banks adhere to the prescribed regulations and guidelines to maintain the stability and integrity of the Indian banking system.

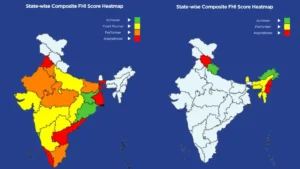

NITI Aayog Releases Fiscal Health Index ...

NITI Aayog Releases Fiscal Health Index ...

How Many Indian States Border Uttar Prad...

How Many Indian States Border Uttar Prad...

Iran Pulls Out of FIFA World Cup 2026 Am...

Iran Pulls Out of FIFA World Cup 2026 Am...