RBI Monetary Policy 2022:

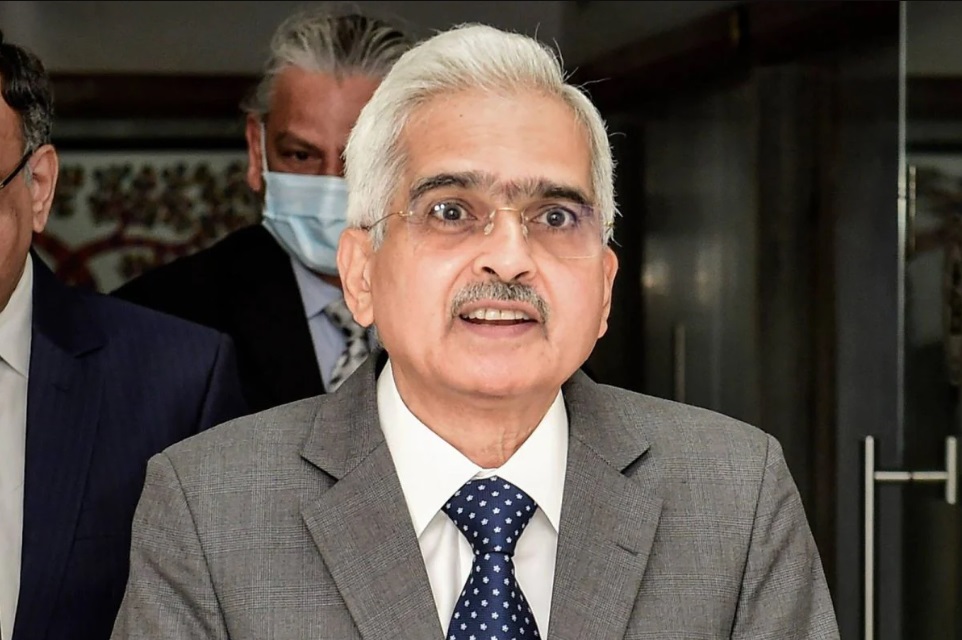

The decision of the Reserve Bank of India (RBI) Governor Shaktikanta Das headed six-member Monetary Policy Committee (MPC) has been announced. In the consecutive fifth hike this year, the RBI’s Monetary Policy Committee has raised the repo rate by 35 basis points (bps) to 6.25 per cent with immediate effect, making loans expensive. The policy rate is now at the highest level since August 2018. The RBI has maintained policy stance at ‘withdrawal of accommodation’.

Notably: The next meeting of the MPC is scheduled during February 6-8, 2023.

Buy Prime Test Series for all Banking, SSC, Insurance & other exams

RBI Repo Rate: Consequently, the various rates are as under

- Policy Repo Rate: 6.25% (Changed)

- Standing Deposit Facility (SDF): 6.00% (Changed)

- Marginal Standing Facility Rate: 6.50% (Changed)

- Bank Rate: 6.50% (Changed)

- Fixed Reverse Repo Rate: 3.35%

- Cash Reserve Ratio (CRR): 4.50%

- Statutory Liquidity Ratio (SLR): 18.00%

Key Points of the Monetary Policy:

- RBI has maintained consumer price index (CPI) inflation forecast for FY23 at 6.7%. Real FY23 GDP forecast lowered to 6.8% from 7%.

- Inflation expected to be above 4% in the next 12 months.

- Standing Deposit Facility rate, Marginal Standing Facility rate also increased by 35 basis points each to 6% and 6.5%

- India’s retail inflation fell to a three-month low of 6.77% in October, down from 7.41% in September. However, remained above the RBI’s tolerance band for the 10th consecutive row.

- Equities open flat with a negative bias as Sensex dips over 55 points, Nifty falls 0.2% ahead of RBI’s policy decision.

- Liquidity conditions are set to improve. Weighted average lending rate is up 117 bps in May-October.

The Monetary Policy Committee

Section 45ZB of the amended RBI Act, 1934 provides for an empowered six-member monetary policy committee (MPC) to be constituted by the Central Government by notification in the Official Gazette. The first such MPC was constituted on September 29, 2016. The present MPC members, as notified by the Central Government in the Official Gazette of October 5, 2020, are as under:

- Governor of the Reserve Bank of India—Chairperson, ex officio;

- Deputy Governor of the Reserve Bank of India, in charge of Monetary Policy—Member, ex officio;

- One officer of the Reserve Bank of India to be nominated by the Central Board—Member, ex officio;

- Prof. Ashima Goyal, Professor, Indira Gandhi Institute of Development Research —Member;

- Prof. Jayanth R. Varma, Professor, Indian Institute of Management, Ahmedabad—Member; and

- Dr. Shashanka Bhide, Senior Advisor, National Council of Applied Economic Research, Delhi—Member.

(Members referred to at 4 to 6 above, will hold office for a period of four years or until further orders, whichever is earlier)

What is the role of MPC?

- The MPC determines the policy repo rate required to achieve the inflation target.

- The MPC is required to meet at least four times in a year. The quorum for the meeting of the MPC is four members.

- Each member of the MPC has one vote, and in the event of an equality of votes, the Governor has a second or casting vote.

- Each Member of the Monetary Policy Committee writes a statement specifying the reasons for voting in favour of, or against the proposed resolution.

Find More News on Economy Here

Inflation in India Hits 10-Month High — ...

Inflation in India Hits 10-Month High — ...

KSRTC Wins National Award for Dhwani Spa...

KSRTC Wins National Award for Dhwani Spa...

International Rail Coach Expo 2026 Inaug...

International Rail Coach Expo 2026 Inaug...