The Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) has made a pivotal announcement, maintaining the repo rate at 6.5 per cent. This decision marks the sixth consecutive time the rate has remained unchanged, following closely on the heels of the Interim Budget presented on February 1, 2024. The RBI’s stance continues to focus on the withdrawal of its accommodative monetary policy, aiming to balance inflation control with economic growth. The next meeting of the MPC is scheduled during April 3 to 5, 2024.

Repo Rate Decision

In a recent meeting that concluded on February 8, 2024, five out of six MPC members voted in favour of keeping the repo rate steady. This move was widely anticipated by financial experts, who expected the rate to remain at 6.5 per cent. RBI Governor Shaktikanta Das emphasized the importance of a disinflationary stance in monetary policy to ensure inflation aligns progressively with the target.

RBI Repo Rate are as under

- Policy Repo Rate: 6.50%

- Standing Deposit Facility (SDF): 6.25%

- Marginal Standing Facility Rate: 6.75%

- Bank Rate: 6.75%

- Fixed Reverse Repo Rate: 3.35%

- CRR: 4.50%

- SLR: 18.00%

Inflation and Growth Projections

The RBI has maintained its inflation forecast at 5.4 per cent for the fiscal year 2023-2024, with a detailed outlook for the following year predicting a Consumer Price Index (CPI) inflation of 4.5 per cent. This detailed projection includes quarterly estimates, starting with 5 per cent in the first quarter and gradually adjusting to 4.7 per cent by the fourth quarter of FY 2024-2025.

RBI projects real GDP growth of 7 pc for FY’25 with risks evenly balanced.

Real GDP growth for FY25 is projected at 7%

- For FY24Q1 is projected at 7.2%

- For FY24Q2 is projected at 6.8%

- For FY24Q3 is projected at 7%

- For FY24Q4 is projected at 6.9%

Key Announcements and Policy Measures

The MPC’s decision comes with several significant announcements aimed at strengthening the economy and ensuring financial stability:

- India’s Forex Reserve: Currently standing at $622.5 billion, India’s foreign exchange reserves are deemed comfortable for meeting all foreign obligations.

- Loan Transparency: Lenders are now required to provide “key fact statements” for loans to retail and MSME borrowers, enhancing transparency and consumer protection.

- Inflation and GDP Targets: The RBI remains vigilant, focusing on achieving a durable inflation target of 4 per cent while projecting a balanced real GDP growth.

Who are members of the RBI MPC?

The RBI MPC is comprised of six members, including both external members and RBI officials. This includes the RBI Governor, 2 deputy governors, and 3 external members

- Shaktikanta Das, Governor of RBI

- Michael Debabrata Patra, Deputy Governor of RBI

- Rajiv Ranjan, Officer of RBI nominated by the Central Board, Member

- Prof. Ashima Goyal, Professor, Indira Gandhi Institute of Development Research, Member

- Prof. Jayanth R. Varma, Professor, Indian Institute of Management Ahmedabad, Member

- Dr. Shashanka Bhide, Senior Advisor, National Council of Applied Economic Research, Member.

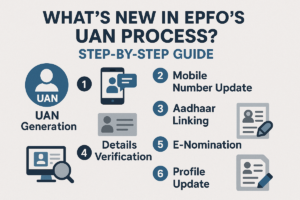

What’s New in EPFO’s UAN Process? Step-b...

What’s New in EPFO’s UAN Process? Step-b...

Rural, Urban Consumer Confidence Strengt...

Rural, Urban Consumer Confidence Strengt...

UPI Sets New Record with 707 Million Dai...

UPI Sets New Record with 707 Million Dai...