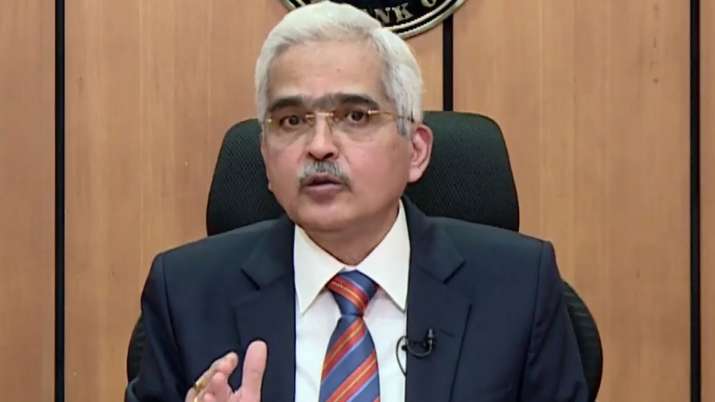

The Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) kept the repo rate unchanged in the fourth bi-monthly policy meet for the financial year 2021-22 headed by RBI Governor Shaktikanta Das has maintained the status quo. The Monetary Policy Committee kept the repo rate unchanged at 4 per cent. The reverse repo rate will continue to be 3.35 per cent. The meeting was held between October (6 to 8). The remaining will take place in December (6 to 8) and February (7 to 9, 2022).

Buy Prime Test Series for all Banking, SSC, Insurance & other exams

The Marginal Standing Facility (MSF) rate and bank rates remain unchanged:

- Policy Repo Rate: 4.00%

- Reverse Repo Rate: 3.35%

- Marginal Standing Facility Rate: 4.25%

- Bank Rate: 4.25%

- CRR: 4%

- SLR: 18.00%

RBI Monetary Policy Highlights & Key Decisions:

- FY22 GDP growth forecast maintained at 9.5%.

- CPI inflation is projected at 5.3% for the current fiscal year.

- Bond purchases under G-SAP stopped.

- Open market operations to continue as needed.

- Internal ombudsman plan for non-bank lenders.

- On-tap special LTRO of 3 years worth Rs 10,000 crore for small businesses extended till Dec 31.

- Framework planned for retail digital payments in offline mode.

- Immediate Payment Service (IMPS) limited upped from Rs 2 lakh to Rs 5 lakh

- No compulsion for banks to park money in variable reverse repo rate (VRRR).

The composition of the Monetary Policy Committee is as follows:

- Governor of the Reserve Bank of India – Chairperson, ex officio: Shri Shaktikanta Das.

- Deputy Governor of the Reserve Bank of India, in charge of Monetary Policy– Member, ex officio: Dr Michael Debabrata Patra.

- One officer of the Reserve Bank of India to be nominated by the Central Board – Member, ex officio: Dr Mridul K. Saggar.

- A professor at the Mumbai-based Indira Gandhi Institute of Developmental Research: Prof. Ashima Goyal.

- A professor of finance at the Indian Institute of Management in Ahmedabad: Prof. Jayanth R Varma.

- An agricultural economist and a senior adviser with the National Council of Applied Economic Research in New Delhi: Dr Shashanka Bhide.

Some important instruments of Monetary Policy:

The RBI’s Monetary Policy has several direct and indirect instruments which are used for implementing the monetary policy. Some important instruments of Monetary Policy are as follows:

Repo Rate: It is the (fixed) interest rate at which banks can borrow overnight liquidity from the Reserve Bank of India against the collateral of government and other approved securities under the liquidity adjustment facility (LAF).

Reverse Repo Rate: It is the (fixed) interest rate at which the Reserve Bank of India can absorb liquidity from banks on an overnight basis, against the collateral of eligible government securities under the LAF.

Liquidity Adjustment Facility (LAF): The LAF has overnight as well as term repo auctions under it. The term repo helps in the development of the inter-bank term money market. This market sets the benchmarks for the pricing of loans and deposits. This helps in improving the transmission of monetary policy. As per the evolving market conditions, the Reserve Bank of India also conducts variable interest rate reverse repo auctions.

Marginal Standing Facility (MSF): MSF is a provision that enables the scheduled commercial banks to borrow an additional amount of overnight money from the Reserve Bank of India. Bank can do this by dipping into their Statutory Liquidity Ratio (SLR) portfolio up to a limit at a penal rate of interest. This helps the banks to sustain the unanticipated liquidity shocks faced by them.

Important takeaways for all competitive exams:

- RBI 25th Governor: Shaktikant Das; Headquarters: Mumbai; Founded: 1 April 1935, Kolkata.

States and Capitals - How Many States in...

States and Capitals - How Many States in...

Top-10 Happiest States in India in 2025,...

Top-10 Happiest States in India in 2025,...

Top-5 Richest Countries in South America...

Top-5 Richest Countries in South America...