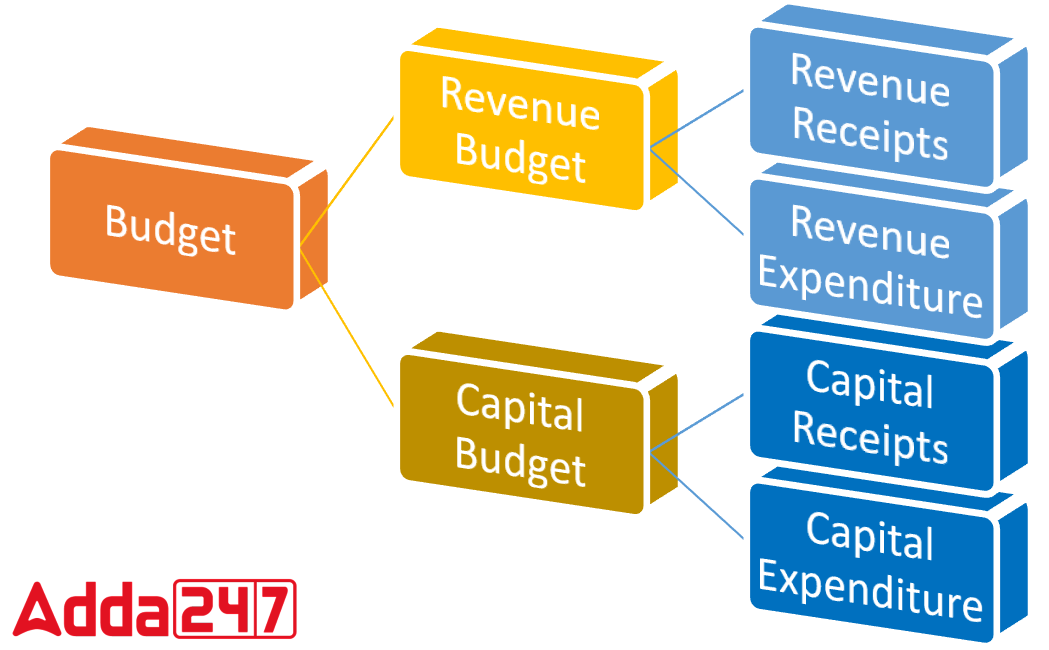

In the realm of government financial planning, two crucial components are the Capital Budget and the Revenue Budget. While both contribute to the overall fiscal framework, they have distinct impacts on the government’s assets and liabilities.

Capital Budget

The Capital Budget involves transactions that directly influence the government’s assets and liabilities. This budget encompasses both capital receipts and capital expenditures.

Components of Capital Budget

- Capital Receipts: These include borrowings, loans from public or foreign governments, and funds acquired from the central bank by the government.

- Capital Expenditure: This involves long-term investments and disinvestments that alter the government’s asset portfolio.

Revenue Budget

In contrast, the Revenue Budget comprises items that do not affect the government’s assets and liabilities. It deals with day-to-day operational finances without altering the overall financial standing of the government.

Components of Revenue Budget

- Revenue Receipts: Money earned by the government through taxes (like Excise Duty and Income Tax) and non-taxes (such as dividend income and profits).

- Revenue Expenditure: Operational expenses, including administrative costs, salaries, and pensions.

Key Differences

| Revenue Budget | Capital Budget |

|---|---|

| Revenue receipts are earned through taxes and non-taxes. | Capital receipts lead to a decrease in assets or an increase in liabilities. |

| Revenue expenditure covers day-to-day operational expenses. | Capital expenditure influences the creation or reduction of liabilities. |

| No impact on government assets and liabilities. | Assets, like infrastructure projects, are part of capital expenditure. |

Related Questions

- What is the Indian Budget System?

- Who is known as the Father of the Indian Budget?

- How Many Types of Budgets are There in India?

- How is the Budget Prepared?

- Which is the Largest Volcano in the World?

- How can we Reduce Human-Wildlife Conflict?

FAQs on Capital Budget and Revenue Budget

Q: What is Capital Budget and Revenue Budget?

A: The revenue budget causes no impact on the government’s assets and liabilities, while the capital budget does change the status of the total number of government assets and liabilities.

Kindly share your responses in the comment section!!

Forex Reserves of India Hit Record High ...

Forex Reserves of India Hit Record High ...

India Revises Base Year of Merchandise T...

India Revises Base Year of Merchandise T...

India’s Core Sector Growth Slows to 4% i...

India’s Core Sector Growth Slows to 4% i...