The world economy is paying a high price for Ukraine war. With the impacts of the COVID-19 pandemic still lingering, the war is dragging down growth and putting additional upward pressure on prices, above all for food and energy. Global GDP stagnated in the second quarter of 2022 and output declined in the G20 economies. High inflation is persisting for longer than expected. In many economies, inflation in the first half of 2022 was at its highest since the 1980s. With recent indicators taking a turn for the worse, the global economic outlook has darkened. In this context, we are discussing some key economic concepts.

Bank Maha Pack includes Live Batches, Test Series, Video Lectures & eBooks

What Is Recession:

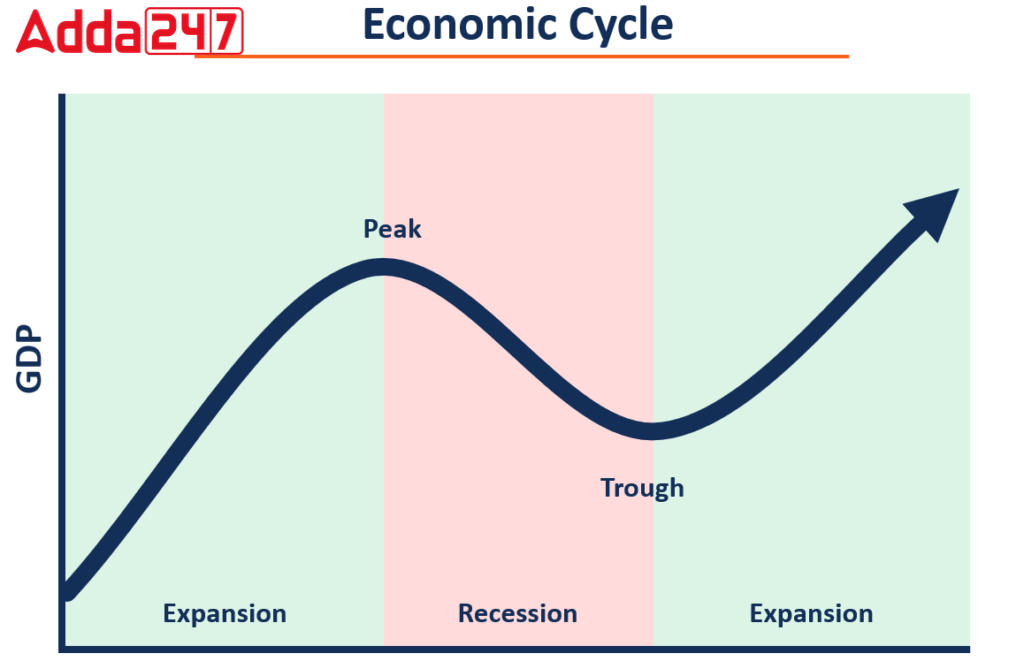

There is no standard definition for recession but a rule of thumb used by most economists and analysts is that an economy that is seeing negative growth rate or shrinking GDP for two consecutive quarters may be considered to be in a recessionary phase. A recession may be the outcome of tight monetary and fiscal policies aimed at controlling inflation or a result of over-leveraging by companies and individuals and the cut-back in consumption and investment as they try to meet their obligations.

A recession may be V-shaped where the economy sees a sharp decline followed by a strong recovery, or it may be W-shaped where there is a marginal recovery in the middle followed by a decline before the economy eventually recovers. Sometimes recessions are L-shaped where the economy goes down and then stagnates there. When recession is severe in terms of the contraction in GDP and extends over a longer period of time, it turns into a depression.

What Is Depression:

A depression is a severe and prolonged downturn in economic activity. In economics, a depression is commonly defined as an extreme recession that lasts three or more years or which leads to a decline in real gross domestic product (GDP) of at least 10%. in a given year. Depressions are relatively less frequent than milder recessions, and tend to be accompanied by high unemployment and low inflation.

Depression vs. Recession:

A recession is a normal part of the business cycle that generally occurs when GDP contracts for at least two quarters. A depression, on the other hand, is an extreme fall in economic activity that lasts for years, rather than just several quarters. This makes recessions much more common: since 1854, there have been 33 recessions in the U.S. and just one depression. Moreover, a recession is marked by economists as two consecutive quarters of negative GDP growth, even if those periods of contraction are relatively mild. A depression, on the other hand, is marked by a drop in a year’s GDP over 10% or more.

What Is Stagflation:

Stagflation is another fear that comes up when inflation is high in a period of slow economic growth. The combination is unnatural because inflation is not a condition that is generally seen when the economy is slowing or stagnant and unemployment is high. Typically, costs push inflation, caused by supply side issues, or excessive liquidity in the system cause inflationary conditions in such a situation. The high prices are likely to lead to a slowing demand that can further aggravate the economic slowdown. High prices even in one segment, say, food, can affect demand in other segments because the disposable income in the hands of the consumer comes down. High prices in a commodity like oil will have a cascading effect on the prices of other products, too, since transportation costs go up.

Policy Actions During Stagflationary Sign:

Policy prescriptions in a situation of stagflation can be tricky since increasing interest rates to control inflation will make it difficult for the economy facing slowing growth to recover. At the same time, keeping rates low to support recovery may exacerbate the inflationary situation. The data is considered over a period of time and not just at one point or a few months for a contraction to be called an economy in recession or stagflation.

Indian Olympic Medal Winners List Till N...

Indian Olympic Medal Winners List Till N...

Who is the Inventor of the Gramophone?

Who is the Inventor of the Gramophone?

HS Dhaliwal Appointed New DGP Of Andaman...

HS Dhaliwal Appointed New DGP Of Andaman...