Private sector rocket maker Skyroot Aerospace Private Ltd successfully tested its Kalam-100 rocket that will power the Vikram-1 rocket’s third stage/engine. The company announced the completion of the milestone of full duration test-firing of its Vikram-1 rocket stage. The third stage, named Kalam-100 after former President APJ Abdul Kalam, was fired for a duration of 108 seconds.

About the test:

- During the test, the rocket produced a peak vacuum thrust of 100 kN (about10 tons) showing its structure built with a high-strength carbon-fibre structure, solid fuel, Ethylene-Propylene-Diene terpolymers (EPDM) thermal protection system, and carbon ablative nozzle.

- The rocket’s stage was tested at the facilities of Solar Industries India Ltd, one of the investors in Skyroot.

- This is the largest rocket stage ever designed, manufactured, and tested completely in the Indian private sector.

- This is best in class rocket stage of this size, with record propellant loading and firing duration, and using all-carbon composite structures for delivering the best performance

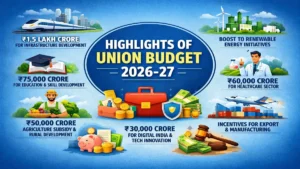

HIGHLIGHTS OF UNION BUDGET 2026-27

HIGHLIGHTS OF UNION BUDGET 2026-27

Rheumatoid Arthritis Awareness Day 2026:...

Rheumatoid Arthritis Awareness Day 2026:...

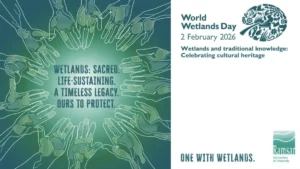

World Wetlands Day 2026: Can Traditional...

World Wetlands Day 2026: Can Traditional...