In an important development in India’s banking sector, HDFC Bank has received approval from the Reserve Bank of India (RBI) to acquire up to 9.5 per cent stake in IndusInd Bank. The approval allows HDFC Bank, along with its group companies, to make a strategic investment within the regulatory framework prescribed by the central bank.

Details of the RBI Approval

- According to HDFC Bank’s filing, the RBI has permitted the bank, in its capacity as promoter and sponsor of various group entities, to acquire an aggregate holding of up to 9.50 per cent of the paid-up share capital or voting rights in IndusInd Bank.

- The approval was conveyed by the RBI through a letter dated December 15, 2025, and is valid for a period of one year, that is, until December 14, 2026.

- During this period, HDFC Bank must ensure that the aggregate holding does not exceed the approved threshold at any time.

Which HDFC Group Entities Are Covered?

The RBI’s permission applies not only to HDFC Bank but also to its major group entities. These include,

- HDFC Mutual Fund

- HDFC Life Insurance Company Limited

- HDFC ERGO General Insurance Company Limited

- HDFC Pension Fund Management Limited

- HDFC Securities Limited

The combined shareholding of these entities, along with HDFC Bank, will be treated as “aggregate holding” for regulatory purposes.

Regulatory Context: Why RBI Approval Matters

- Under India’s banking regulations, any acquisition of a significant stake in a bank requires prior approval from the RBI, especially when the investor is another regulated financial entity or a promoter group.

- The 9.5 per cent cap is crucial because crossing certain thresholds can trigger additional regulatory scrutiny, including requirements related to management control, voting rights, and fit-and-proper criteria.

- By granting approval with a clear upper limit and time-bound validity, the RBI has ensured regulatory oversight while allowing strategic investment flexibility.

Key Takeaways

- RBI approved HDFC Bank group to acquire up to 9.5% stake in IndusInd Bank.

- Approval communicated via letter dated December 15, 2025.

- Valid for one year, till December 14, 2026.

- Applies to HDFC Bank and its group entities (mutual fund, insurance, pension, securities).

- Stake limit refers to aggregate holding of paid-up share capital or voting rights.

- Reflects RBI’s role in banking regulation and ownership norms.

Question

Q. RBI has approved HDFC Bank to acquire up to what percentage stake in IndusInd Bank?

(A) 5%

(B)7.5%

(C) 9.5%

(D) 10%

India & ADB Sign Loans Worth Over $2...

India & ADB Sign Loans Worth Over $2...

Ravi Ranjan Takes Charge As SBI New Mana...

Ravi Ranjan Takes Charge As SBI New Mana...

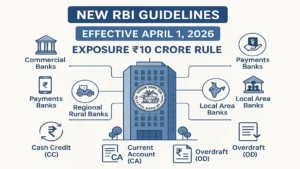

RBI Issues New Guidelines on Transaction...

RBI Issues New Guidelines on Transaction...