The RBI MPC February 2026 meeting is important for banks, borrowers, investors, and common people. In this meeting, the Reserve Bank of India (RBI) decided to keep the repo rate unchanged at 5.25% and continue with a neutral monetary policy stance.

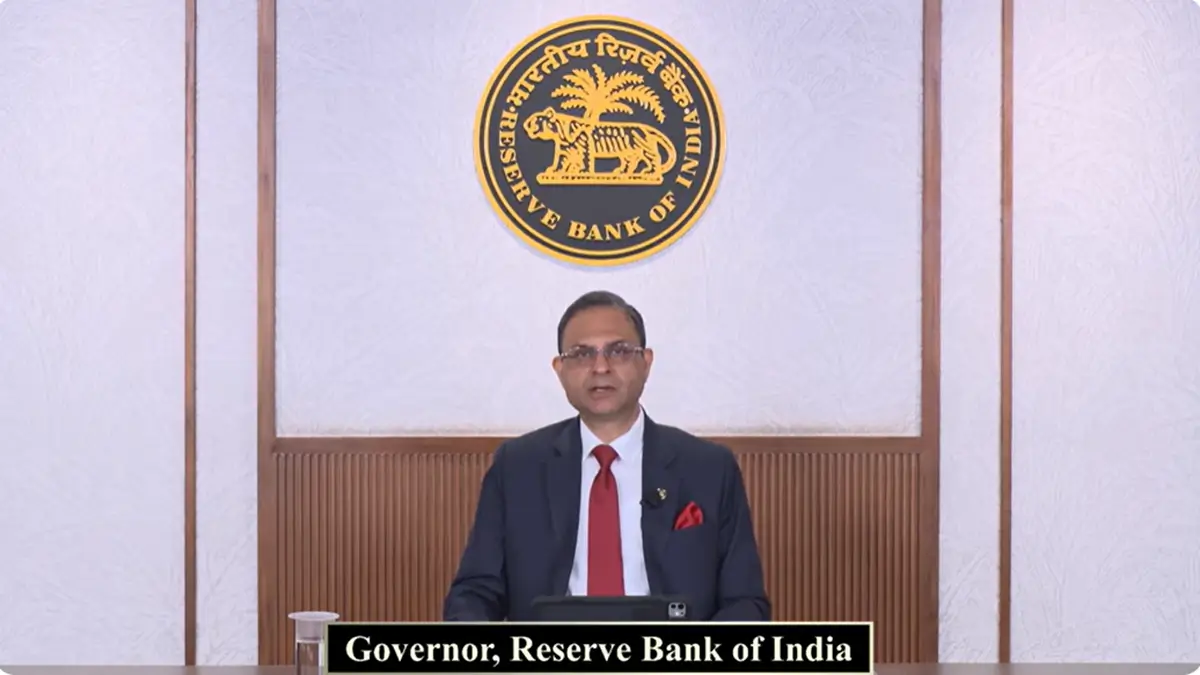

The decision was taken during the 59th meeting of the Monetary Policy Committee (MPC) held from February 4 to 6, 2026, under the chairmanship of Sanjay Malhotra, Governor of RBI.

This policy decision reflects RBI’s balanced approach towards controlling inflation while supporting economic growth.

Why RBI MPC February 2026 Is in News?

The RBI MPC February 2026 meeting is in news because:

- The repo rate was kept unchanged at 5.25%

- RBI continued its neutral stance

- Updated growth and inflation projections were released

These decisions directly affect loan EMIs, fixed deposits, bank interest rates, and inflation expectations.

Key Decisions of RBI Monetary Policy February 2026

After reviewing global and domestic economic conditions, the MPC unanimously voted to keep policy rates unchanged.

Current Policy Rates

- Repo Rate: 5.25%

- Standing Deposit Facility (SDF): 5.00%

- Marginal Standing Facility (MSF): 5.50%

- Bank Rate: 5.50%

The MPC also decided to maintain a neutral stance, meaning RBI will take future actions based on economic data.

What Does “Neutral Stance” Mean?

A neutral stance means RBI is not committed to either:

- Increasing interest rates, or

- Cutting interest rates

RBI will closely monitor inflation, growth, and global conditions before taking the next step. This gives flexibility to respond to future risks.

Global Economic Outlook

Globally, the economy showed resilience in 2025, supported by:

- Government spending

- Trade activity

- Supportive monetary policies

However, challenges remain:

- Geopolitical tensions

- Volatility in financial markets

- High interest rates in advanced economies

Despite these risks, global equity markets remained supported by strong investments in technology sectors.

India’s Growth Outlook

India’s economy continues to perform well despite global uncertainty.

GDP Growth Estimates

- 2025–26 GDP growth: 7.4%

- Driven by:

- Strong private consumption

- Rising investment

- A strong services sector

Manufacturing activity has shown improvement, while agriculture remained resilient due to good crop output.

Future Growth Projections

- Q1 2026–27: 6.9%

- Q2 2026–27: 7.0%

RBI stated that growth risks are evenly balanced.

Inflation Outlook in RBI MPC February 2026

Inflation remained very low towards the end of 2025.

- CPI inflation was 0.7% in November and 1.3% in December 2025

- Food prices stayed in deflation

- Core inflation remained under control

Inflation Projections

- 2025–26: 2.1%

- Q4 2025–26: 3.2%

- Q1 2026–27: 4.0%

- Q2 2026–27: 4.2%

RBI noted that inflation risks are also evenly balanced.

Impact of RBI MPC February 2026 on Loans and EMIs

Since the repo rate is unchanged:

- Home loan EMIs are unlikely to increase

- Personal and car loan interest rates remain stable

- Banks are not expected to change lending rates immediately

This provides relief to borrowers.

Impact on Fixed Deposits and Banks

For depositors:

- Fixed deposit rates may remain stable

- No major increase in FD returns in the short term

For banks:

- Stable interest rate environment

- Better planning for credit growth

What This Decision Means for Common People

- No sudden increase in loan burden

- Inflation remains under control

- Economic growth continues steadily

This policy supports financial stability while protecting consumer interests.

What’s Next?

- MPC meeting minutes: February 20, 2026

- Next RBI MPC meeting: April 6–8, 2026

RBI will review new GDP and CPI data before future decisions.

RBI Reports India’s Foreign Exchange Res...

RBI Reports India’s Foreign Exchange Res...

Goldman Sachs Raises India’s CY26 GDP Gr...

Goldman Sachs Raises India’s CY26 GDP Gr...

Ministry of Statistics Revises Consumer ...

Ministry of Statistics Revises Consumer ...