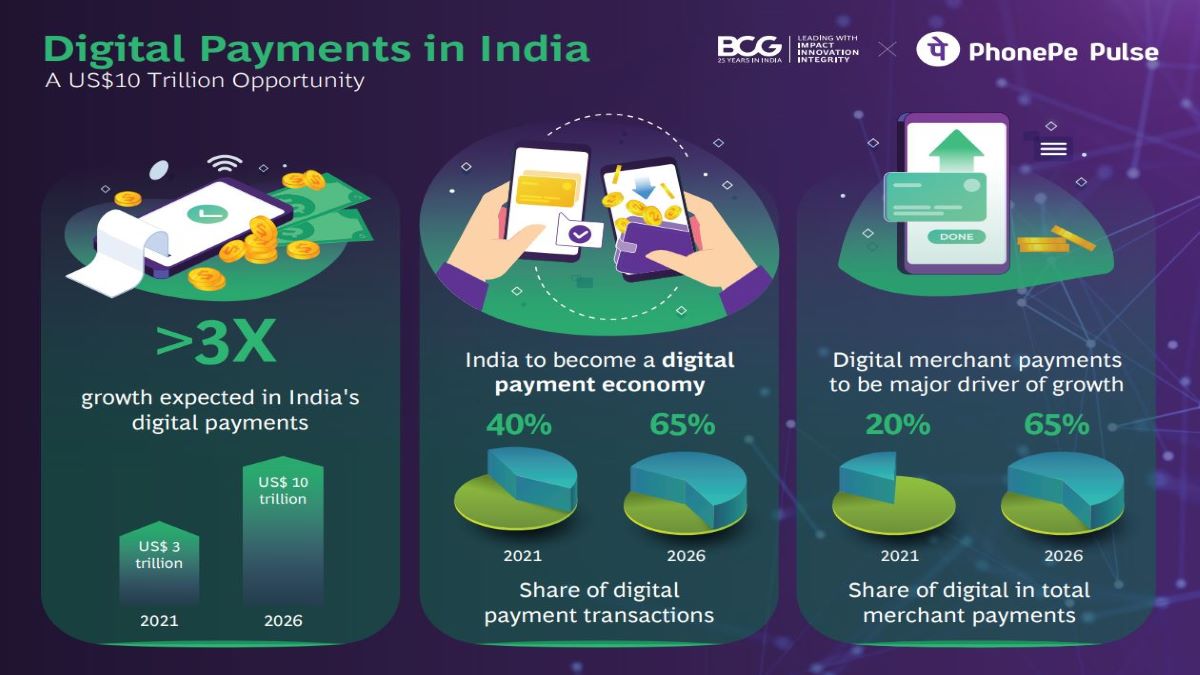

The digital payment markets in India are expected to increase triple from the current three trillion dollars to ten trillion dollars in the coming four years, which is by 2026. This was confirmed by the report issued by PhonePe after the collaboration with Boston Consulting Group (BCG), the report was titled ‘Digital Payments in India: A $10 trillion opportunity. The report highlights the growth of India’s digital payments in the last five years. The growth in five years has resulted in aiming those digital payments will aim to constituting two out of three payment transactions by 2026.

Buy Prime Test Series for all Banking, SSC, Insurance & other exams

Key points of the report:

- The report highlights the in-depth scenario of the growth of digital payments in India and focuses on factors and enablers to understand and unleash the potential of digital payments and its massive growth in the Country.

- The head of the strategy and investor relations, PhonePe, Karthik Raghupathy said in the report that “This report is part of the PhonePe Pulse initiative, which was launched last year, in our effort to give back to the fintech ecosystem.

- PhonePe Pulse has been received by all the key stakeholders in the ecosystem. As India’s fintech platform we have seen the growth of a unified payments interface (UPI) over the last few years.

- UPI has helped with India’s transition to non-cash payments when it comes to both person-to-person (P2P) and person-to-merchant (P2M) transactions.

- UPI saw about a nine times transaction volume increase in the past three years, increasing from five billion transactions in FY19 to about 46 billion transactions in FY22: accounting for more than 60% of non-cash transaction volumes in FY22. This indicates that digital payment has gained acceptance across the country.

- While tier 1 and tier 2 cities have witnessed the acceptance of digital payments, penetration in tier 3 – 6 cities shows headroom for growth. The next wave of growth is expected to come from tier 3-6 locations, as evidenced in the past two years wherein tier 3-6 cities have contributed to nearly 60-70% of new customers for PhonePe,”

The report says that multiple platforms offer digital payments now, which has disrupted the digital payments ecosystem. It also listed the reasons for the growth of digital payments in India shortly. It includes simplified customer onboarding, increases in consumer awareness, increases in merchant acceptance, infrastructure upgradation, merchants getting access to credit, and growth of untouched regions by setting up financial services marketplaces.

Weekly Current Affairs One Liners 16th t...

Weekly Current Affairs One Liners 16th t...

Which District is known as the Medical C...

Which District is known as the Medical C...

Which was the First Women's University i...

Which was the First Women's University i...