The Reserve Bank of India has directed all Scheduled Commercial Banks (excluding RRBs), all Small Finance Banks and all Local Area Banks to link all the new floating rate loans to medium enterprises with external benchmarks. The decision has been taken by the RBI to further strengthen the monetary policy transmission.

RBI has directed the banks that all the all new floating rate loans to the Medium Enterprises extended by banks shall be linked to the external benchmarks. The above directions will be effective from April 01, 2020.

The floating rate loans shall be benchmarked to one of the following:

- Reserve Bank of India policy repo rate

- Government of India 3-Months Treasury Bill yield published by the Financial Benchmarks India Private Ltd (FBIL)

- Government of India 6-Months Treasury Bill yield published by the FBIL

- Any other benchmark market interest rate published by the FBIL.

The floating rate loans to Micro and Small Enterprises (MSEs) extended by banks have already been linked to external benchmarks from October 01, 2019. According to RBI, the monetary policy transmission has become better in the sectors where the new floating rate loans have been linked to external benchmarks like repo rate etc.

Important takeaways for all competitive exams:

- RBI 25th Governor: Shaktikant Das; Headquarters: Mumbai; Founded: 1 April 1935, Kolkata.

States and Capitals - How Many States in...

States and Capitals - How Many States in...

Indian Railways Launches 20% Return Fare...

Indian Railways Launches 20% Return Fare...

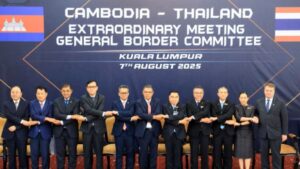

Thailand and Cambodia Finalize Ceasefire...

Thailand and Cambodia Finalize Ceasefire...