The Union Ministry of Finance plans to divest a 6.78% stake in General Insurance Corporation of India (GIC Re) through an offer-for-sale (OFS) to raise approximately Rs 4,700 crore. This will be the first stake sale since GIC Re’s listing in 2017. The sale will commence on Wednesday for non-retail investors, with retail investors and GIC employees able to bid on Thursday.

The floor price is anticipated to be around Rs 395 per share, which is about 6% below the current market price of Rs 420.8. The government, which currently holds an 85.78% stake in GIC Re, is following a strategy similar to the one used during LIC’s IPO, aiming to increase public shareholding.

Details of the Sale

Stake and Pricing: The government will offer 3.39% of its equity in GIC Re, with an additional 3.39% as a green shoe option. The floor price is set at approximately Rs 395 per share.

Current Ownership: The government owns 85.78% of GIC Re. The move aligns with previous strategies, such as the LIC IPO, to support inclusion in index funds.

Future Plans: GIC Re Chairman Ramaswamy Narayanan indicated that the government might divest around 10% of its stake after the general elections, though no specific timeframe has been confirmed.

Regulatory Requirements: GIC Re must increase its public shareholding to 25%, up from the current 14%. The OFS aims to address this requirement without needing additional capital.

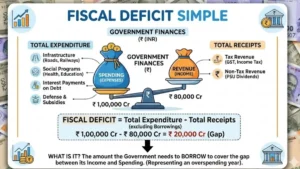

Budgetary Implications

The government has not set a separate disinvestment target for FY24. The FY25 Union Budget has revised the miscellaneous capital receipts target, including disinvestment, to Rs 50,000 crore from Rs 30,000 crore for FY24.

India’s Forex Reserves Fall $2.11 Billio...

India’s Forex Reserves Fall $2.11 Billio...

India’s Fiscal Deficit Hits ₹9.8 Trillio...

India’s Fiscal Deficit Hits ₹9.8 Trillio...

India’s GDP Growth Slows to 7.8% in Q3FY...

India’s GDP Growth Slows to 7.8% in Q3FY...