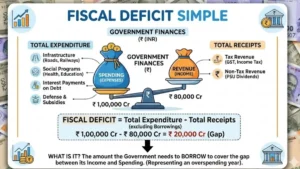

Fitch, a global ratings agency, forecasts India’s fiscal deficit to reach 5.4% of GDP in FY25, surpassing the government’s target of 5.1% announced by Finance Minister Nirmala Sitharaman. The agency views the government’s adjustment of the FY24 deficit target to 5.8% from 5.9% as modest. Achieving the FY25 target is seen as critical for reaching the goal of a 4.5% deficit in FY26. However, Fitch believes this target might be challenging due to potential setbacks, particularly from increased spending before general elections.

Challenges in Fiscal Consolidation

- Fiscal Deficit Projections: Fitch predicts a fiscal deficit of 5.4% for FY25, beyond the government’s 5.1% target.

- Impact of Capital Expenditure: An 11% rise in capital expenditure for FY25, if executed as planned, could drive real GDP growth to 6.5%. However, this could impede fiscal consolidation efforts.

- Long-Term Growth Outlook: Fitch sees India favorably positioned for sustained growth relative to peers, with emphasis on capex supporting this view.

- Risk of Economic Shocks: The slow pace of fiscal consolidation post-pandemic may leave India vulnerable to major economic shocks, underscoring the need for balanced growth and consolidation.

Government Response

- Emphasis on Transparency: Finance Minister Sitharaman highlights India’s transparent fiscal glide path in discussions with media, urging credit rating agencies to consider this aspect.

India’s Forex Reserves Fall $2.11 Billio...

India’s Forex Reserves Fall $2.11 Billio...

India’s Fiscal Deficit Hits ₹9.8 Trillio...

India’s Fiscal Deficit Hits ₹9.8 Trillio...

India’s GDP Growth Slows to 7.8% in Q3FY...

India’s GDP Growth Slows to 7.8% in Q3FY...