In a significant move to boost infrastructure funding without increasing public debt, the Indian government has raised ₹1,42,758 crore through asset monetisation till FY25, using mechanisms like Toll-Operate-Transfer (ToT), Infrastructure Investment Trusts (InvIT), and securitisation. This strategic monetisation of existing assets enables long-term private investment while ensuring public infrastructure expansion.

Asset Monetisation: Key Highlights

Amount Raised and FY25 Target

- Total raised till FY25: ₹1,42,758 crore

- FY25 projection: ₹30,000 crore

This achievement comes under the government’s broader aim of monetising public infrastructure assets to fund new infrastructure without adding to fiscal burden.

Three Major Monetisation Models Used

1. Toll-Operate-Transfer (ToT)

- Open market bids are invited.

- Concession period ranges 15–30 years.

- Awarded to the highest bidder above a reserve price.

- Ensures immediate liquidity from mature highway assets.

2. Infrastructure Investment Trust (InvIT)

- NHAI’s National Highways Infra Trust (NHIT) operates InvIT model.

- Offers road stretches to NHIT for 15–30 years.

- NHIT raises funds via bonds and SEBI-regulated unit sales.

- Compares offer price to reserve price for value maximisation.

3. Securitisation

- Long-term finance raised through banks and bonds.

- Involves securitizing toll revenue from stretches like the Delhi-Mumbai Expressway.

- Handled via Special Purpose Vehicles (SPVs).

- These models collectively contribute to efficient capital recycling, promoting infrastructure upgrades without relying on budgetary allocations.

India’s Forex Reserves Fall $2.11 Billio...

India’s Forex Reserves Fall $2.11 Billio...

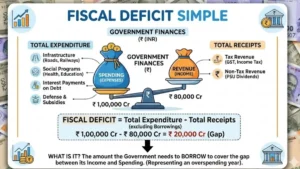

India’s Fiscal Deficit Hits ₹9.8 Trillio...

India’s Fiscal Deficit Hits ₹9.8 Trillio...

India’s GDP Growth Slows to 7.8% in Q3FY...

India’s GDP Growth Slows to 7.8% in Q3FY...