India’s foreign exchange reserves have exceeded $700 billion for the first time, reaching $704.89 billion in the week ending September 27, 2024. This marks a record increase of $12.58 billion, with foreign currency assets (FCAs) rising by $10.4 billion to $616 billion and gold reserves increasing by $2 billion to $65.7 billion. The surge is attributed to RBI’s dollar purchases and favorable valuation adjustments, driven by declining U.S. Treasury yields, a weakening dollar, and rising gold prices.

Key Global Standing

With this achievement, India joins China, Japan, and Switzerland as the only economies to have surpassed $700 billion in forex reserves. This growth has been bolstered by robust economic fundamentals, increased foreign inflows, and RBI’s proactive market interventions.

Future Outlook

India’s reserves are projected to continue rising, potentially reaching $745 billion by March 2026, further strengthening RBI’s control over the rupee’s valuation in global markets.

Components of Forex Reserves

- Gold Reserves: Increased by $2.184 billion to $65.796 billion.

- Special Drawing Rights (SDRs): Up by $8 million to $18.547 billion.

- IMF Reserve Position: Decreased by $71 million to $4.387 billion.

Investment Inflows and Stability

So far in 2024, foreign inflows have hit $30 billion, bolstered by investments in local debt. This has positioned India’s reserves to cover over a year of projected imports, providing stability against external shocks. Analysts expect reserves to reach $745 billion by March 2026, enhancing the RBI’s ability to manage currency volatility.

Historical Context and Future Projections

Since 2013, when India faced significant capital outflows, macroeconomic improvements and effective inflation control have led to a steady accumulation of forex reserves. The RBI’s proactive stance ensures a less volatile rupee, making Indian assets increasingly attractive to foreign investors.

Here’s the table with key points relevant for exams:

| Key Points | Details |

|---|---|

| Why in News | India’s forex reserves surpass $700 billion for the first time, reaching $704.89 billion in the week ending September 27, 2024. |

| Total Forex Reserves | $704.89 billion, a record increase of $12.58 billion. |

| Components of Forex Reserves | – Foreign Currency Assets (FCAs): $616 billion (up by $10.4 billion) – Gold Reserves: $65.7 billion (up by $2 billion) – Special Drawing Rights (SDRs): $18.547 billion (up by $8 million) – IMF Reserve Position: $4.387 billion (down by $71 million) |

| Key Global Standing | India joins China, Japan, and Switzerland in having forex reserves surpassing $700 billion. |

| RBI’s Market Interventions | Surge attributed to RBI’s dollar purchases and favorable valuation adjustments. |

| Factors for Growth | – Declining U.S. Treasury yields – Weakening dollar – Rising gold prices |

| Foreign Inflows | $30 billion in 2024, bolstered by investments in local debt. |

| Reserve Coverage | Reserves now cover over a year of projected imports, providing stability against external shocks. |

| Future Projections | Forex reserves projected to reach $745 billion by March 2026. |

| Historical Context | Forex reserves have steadily accumulated since 2013, with improvements in macroeconomics and inflation control. |

| RBI’s Role | Proactive stance to manage currency volatility and make Indian assets attractive to foreign investors. |

India’s Forex Reserves Fall $2.11 Billio...

India’s Forex Reserves Fall $2.11 Billio...

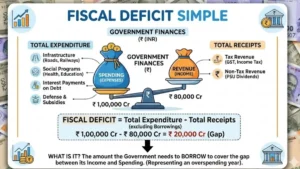

India’s Fiscal Deficit Hits ₹9.8 Trillio...

India’s Fiscal Deficit Hits ₹9.8 Trillio...

India’s GDP Growth Slows to 7.8% in Q3FY...

India’s GDP Growth Slows to 7.8% in Q3FY...