Data provided by the National Securities Depository indicates that in the fiscal year 2022-23, overseas capital flows into Indian capital markets originating from Mauritius experienced the sharpest decline, while Norway and Singapore gained popularity.

Buy Prime Test Series for all Banking, SSC, Insurance & other exams

Assets under custody (AUC): Recent Situation:

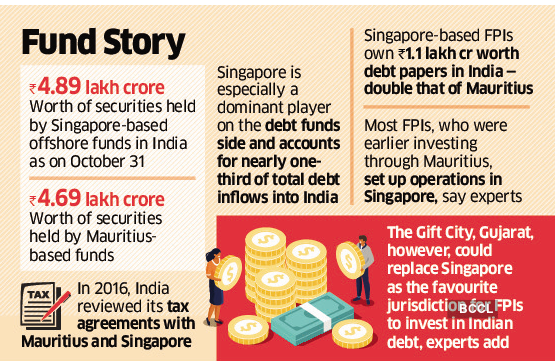

The assets under custody (AUC) from Mauritius decreased by almost 42% to Rs 6.66 trillion by the end of March 2023, down from Rs 10.88 trillion the previous year. Experts suggest that the renegotiation of the India-Mauritius tax treaty and increased scrutiny of capital flows have reduced the island nation’s appeal as a preferred destination for foreign investment into India.

Meanwhile, Norway and Singapore experienced a 13% and 5% increase in AUC, respectively.

India and Foreign Portfolio Investor:

Singapore is now the second largest jurisdiction for foreign portfolio investor flows after the US, while Mauritius has dropped to fourth place. Some observers note that Mauritius faces tough competition from Gift City, where investment rules are being relaxed, but the country is making efforts to strengthen its variable capital company regime and improve anti-money laundering standards to remain attractive to investors.

Current Scenario of Foreign Portfolio Investor (FPI):

In fiscal year 2022-23, Foreign Portfolio Investor (FPI) assets under custody (AUC) declined by 4.44% due to asset price depreciation and capital outflows amounting to over Rs 35,000 crore. This decline was seen across the board and not limited to any particular jurisdiction.

Find More News on Economy Here

Which Country Officially Uses Two Differ...

Which Country Officially Uses Two Differ...

Historic Glory! Jammu & Kashmir Win ...

Historic Glory! Jammu & Kashmir Win ...

Three Major Inland Waterways Projects Op...

Three Major Inland Waterways Projects Op...