In a significant move, Japan’s MUFG is set to purchase a 20% stake in HDB Financial Services, a subsidiary of India’s HDFC Bank. The deal is poised at a valuation of $9-10 billion before the initial public offering (IPO), making it one of the largest transactions in India’s shadow banking sector. HDB Financial, a non-deposit-taking lender, is expected to command a valuation ranging from $9 billion to $12 billion during its IPO, contingent on prevailing market conditions.

Key Highlights

MUFG’s Strategic Investment

Bank of Tokyo-Mitsubishi UFJ (MUFG) is making a significant investment by acquiring a substantial stake in HDB Financial Services, signaling confidence in India’s financial market.

Valuation Pre-IPO

The valuation of HDB Financial Services stands at $9-10 billion before its proposed IPO, reflecting investor optimism about the company’s growth potential.

Shadow Banking Landscape

This deal underscores the robustness of India’s shadow banking sector, with HDB Financial being a major player in retail financing.

Financial Performance and Growth

HDB Financial Services has demonstrated strong growth, with its assets under management (AUM) increasing from Rs 61,444 crore as of March 31, 2023, to Rs 83,989 crore as of December 31, 2023. This growth trajectory further enhances its attractiveness to investors and potential stakeholders.

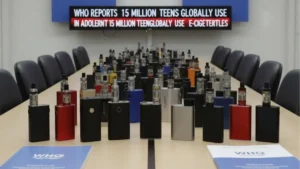

WHO Flags Teen Vaping Surge as Global Ad...

WHO Flags Teen Vaping Surge as Global Ad...

WTO Cuts 2026 Trade Forecast, Ups 2025 O...

WTO Cuts 2026 Trade Forecast, Ups 2025 O...

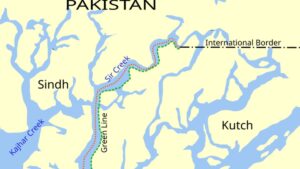

Sir Creek Dispute: Strategic Flashpoint ...

Sir Creek Dispute: Strategic Flashpoint ...