Road, transport and highways minister Nitin Gadkari launched the country’s first-ever surety bond insurance product, a move that would reduce the dependence of infra developers of bank guarantee. Surety Bond Insurance will act as a security arrangement for infrastructure projects and will insulate the contractor as well as the principal. The product will cater to the requirements of a diversified group of contractors, many of whom are operating in today’s increasingly volatile environment.

Buy Prime Test Series for all Banking, SSC, Insurance & other exams

What is a Surety Bond :Significance of this:

- The Surety Bond Insurance is a risk transfer tool for the Principal and shields the Principal from the losses that may arise in case the contractor fails to perform their contractual obligation.

- The product gives the principal a contract of guarantee that contractual terms and other business deals will be concluded in accordance with the mutually agreed terms. In case the contractor doesn’t fulfil the contractual terms, the Principal can raise a claim on the surety bond and recover the losses they have incurred.

- Unlike a bank guarantee, the Surety Bond Insurance does not require large collateral from the contractor thus freeing up significant funds for the contractor, which they can utilize for the growth of the business. The product will also help in reducing the contractors’ debts to a large extent thus addressing their financial worries. The product will facilitate the growth of upcoming infrastructure projects in the country.

What Does ‘Anjadip’ Mean? Inside the Nam...

What Does ‘Anjadip’ Mean? Inside the Nam...

PM Modi to Inaugurate ₹20,000 Crore Micr...

PM Modi to Inaugurate ₹20,000 Crore Micr...

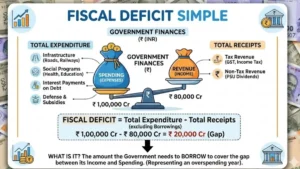

India’s Fiscal Deficit Hits ₹9.8 Trillio...

India’s Fiscal Deficit Hits ₹9.8 Trillio...