Starting from April 1, merchants carrying out transactions through the Unified Payments Interface (UPI) using Prepaid Payment Instruments (PPI) will be subjected to charges, according to a circular issued by the National Payments Corporation of India (NPCI).

Buy Prime Test Series for all Banking, SSC, Insurance & other exams

NPCI’s Prepaid Payment Instruments (PPI):

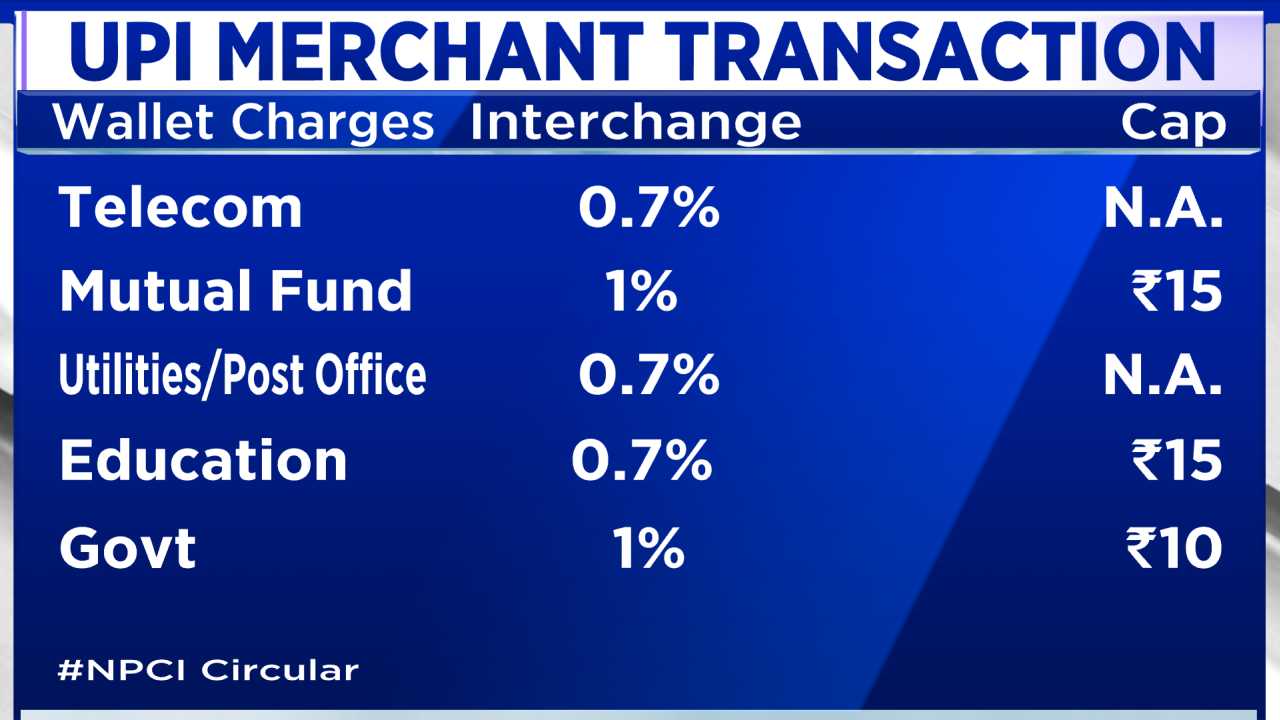

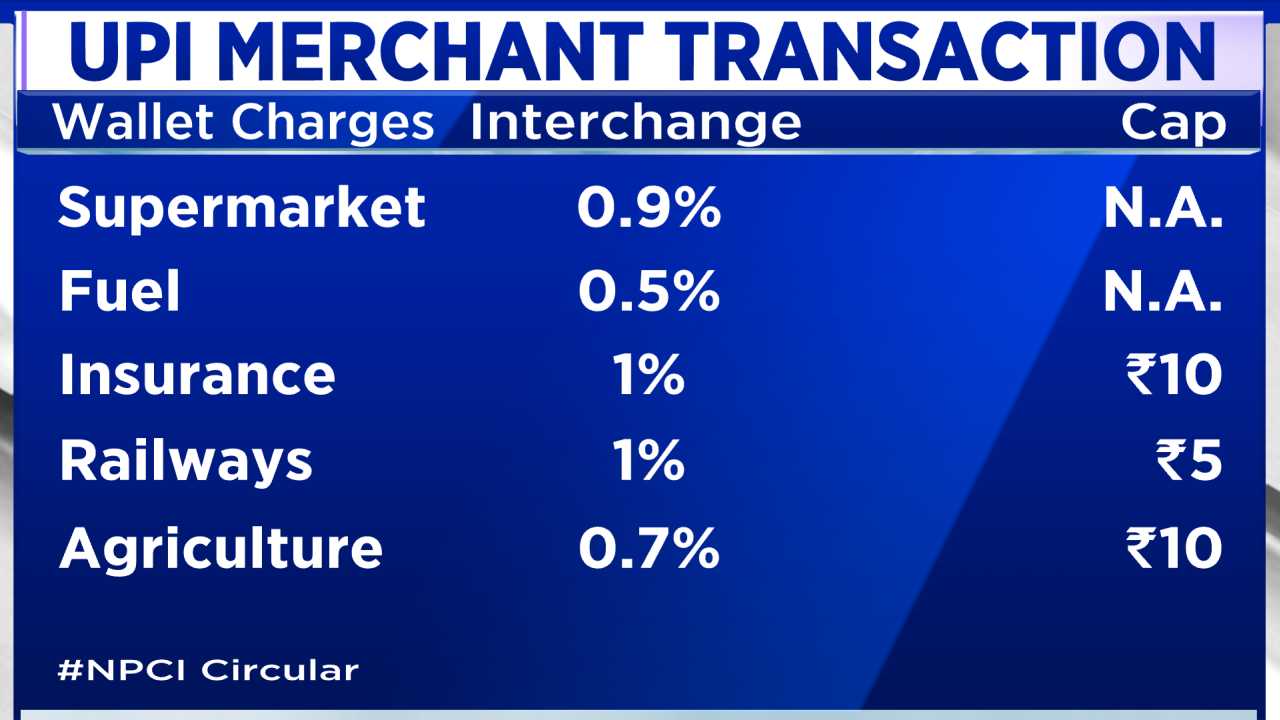

The National Payments Corporation of India (NPCI) has issued a circular stating that merchants conducting transactions on the Unified Payments Interface (UPI) using Prepaid Payment Instruments (PPI) will be charged an interchange fee of 1.1% on the transaction amount for amounts over Rs 2,000.

For merchant categories under industry programs, the interchange fee is different. In addition, a wallet-loading service charge of approximately 15 basis points will be paid by the PPI issuer to the remitter bank, but no interchange fee will be applied to peer-to-peer (P2P) and peer-to-peer-merchant (P2PM) transactions between bank accounts and PPI wallets.

You may also read this:

- YES Bank issues first electronic bank guarantee with NeSL

- First Citizens Bank Acquires Silicon Valley Bank

Legendary Bengali Author Shankar Passes ...

Legendary Bengali Author Shankar Passes ...

List of Dadasaheb Phalke Award Winners f...

List of Dadasaheb Phalke Award Winners f...

Which Dance Form is known as the Ballad ...

Which Dance Form is known as the Ballad ...