The Reserve Bank of India (RBI) has taken proactive measures to address the prevailing liquidity deficit in the banking system. In its latest move, the central bank conducted a variable rate repo (VRR) auction of Rs 1.25 trillion, bringing the total liquidity infused through 9 VRR auctions in May 2024 to a staggering Rs 7.75 trillion.

Overwhelming Demand from Banks

The latest VRR auction witnessed an overwhelming response from banks, with bids worth Rs 11.4 trillion being placed, nearly 47% higher than the RBI’s notified amount. During the auction, banks borrowed the amount at a weighted average rate of 56%.

Liquidity Deficit Escalation in May 2024

The liquidity deficit in the banking system has escalated significantly in May 2024, with the figures highlighting the pressing need for liquidity infusion:

- May 19: Rs 1.3 trillion deficit

- May 20: Rs 1.48 trillion deficit

- May 22: Rs 2.37 trillion deficit

The average system liquidity for the first 15 days of May stood at a deficit of Rs 1.2 trillion, in stark contrast to the surplus of Rs 20,240 crore recorded in April 2024.

Role of Repo Auctions in Liquidity Management

Repo auctions are conducted by the central bank to inject liquidity into the system, allowing banks to obtain liquidity overnight through the RBI’s marginal standing facility when interbank liquidity is insufficient. These auctions play a crucial role in maintaining the smooth functioning of the banking system and ensuring adequate liquidity for credit operations.

Recent Liquidity Adjustment Facility (LAF) Operations

In April 2024, the RBI held a 4-day auction under the Liquidity Adjustment Facility (LAF), offering Rs 50,000 crore through VRR. The LAF is a monetary policy tool that enables banks to borrow money through repurchase agreements (reposals) or lend to the RBI using reverse repo contracts.

Liquidity Adjustment Facility (LAF) Explained

The Liquidity Adjustment Facility (LAF) is a crucial tool used in monetary policy, primarily by the Reserve Bank of India (RBI). It allows banks to borrow money through repurchase agreements (reposals) or lend to the RBI using reverse repo contracts. The LAF was introduced as part of the Narasimham Committee on Banking Sector Reforms of 1998 and plays a vital role in managing liquidity in the banking system.

By conducting these repo auctions and leveraging the LAF, the RBI aims to strike a balance between maintaining adequate liquidity levels and ensuring the smooth functioning of the financial system. These measures are particularly significant in the context of the current liquidity deficit, as they help banks meet their liquidity requirements and support credit operations, ultimately contributing to the overall stability and growth of the Indian economy.

Static GK:

- The current Governor of the Reserve Bank of India is Shaktikanta Das;

- Reserve Bank of India has its headquarters in Mumbai, Maharashtra.

- The Reserve Bank of India was established on April 1, 1935, under the Reserve Bank of India Act, of 1934. It was nationalized on January 1, 1949, after India gained independence.

AU Small Finance Bank Makes History: Fir...

AU Small Finance Bank Makes History: Fir...

IFC and HDFC Capital Launch $1 Billion F...

IFC and HDFC Capital Launch $1 Billion F...

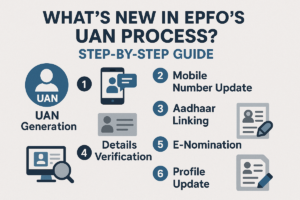

What’s New in EPFO’s UAN Process? Step-b...

What’s New in EPFO’s UAN Process? Step-b...