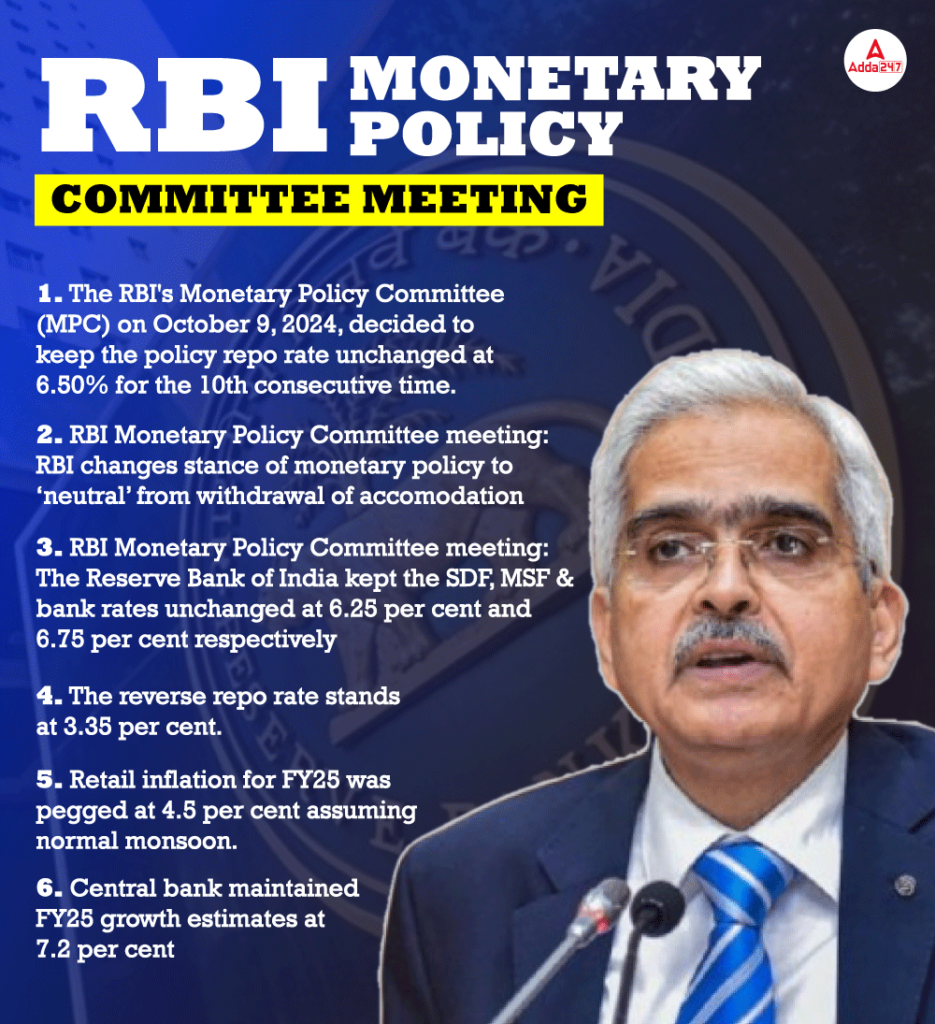

The Reserve Bank of India (RBI) has decided to keep the repo rate unchanged at 6.5% for the tenth consecutive time. This decision reflects a shift in the monetary policy stance from ‘withdrawal of accommodation’ to ‘neutral.’ As a result, all external benchmark lending rates linked to the repo rate will remain stable, providing relief to borrowers as their equated monthly instalments (EMIs) will not rise.

Here’s a summary of the key details from the RBI MPC meeting held from October 7-9, 2024:

-

Repo Rate Decision: The Reserve Bank of India (RBI) kept the repo rate unchanged at 6.5%. This marks the 10th consecutive time the rate has been held steady.

- Monetary Policy Stance: The Monetary Policy Committee (MPC) shifted its stance from “withdrawal of accommodation” to a “neutral” position. This change allows for flexibility in adjusting interest rates based on inflation trends.

- MPC Voting: The decision to maintain the repo rate was reached with a majority vote of 5 out of 6 members in favor.

-

Inflation Projections: The RBI forecasted inflation for the third quarter of FY25 at 4.8% and a decline to 4.2% in the fourth quarter. Retail inflation for FY25 was projected at 4.5%, assuming normal monsoon conditions. The inflation rate for Q1FY26 is expected to be 4.3%, slightly above the 4% target.

-

Economic Growth Estimates: The RBI maintained its GDP growth estimate for FY25 at 7.2%. Growth estimates for specific quarters are: 7.0% for Q2FY25, 7.4% for Q3FY25, 7.4% for Q4FY25, and 7.3% for Q1FY26.

-

Reverse Repo Rate and Other Rates: The reverse repo rate was maintained at 3.35%. The Standing Deposit Facility (SDF) and Marginal Standing Facility (MSF) rates remained unchanged at 6.25% and 6.75%, respectively.

RBI Monetary Policy Committee (MPC) Meeting Outcomes and Projections

Impact on Borrowers and Lenders

While borrowers linked to the repo rate will benefit, those with loans tied to the marginal cost of fund-based lending rate (MCLR) might face higher interest rates, as the full transmission of previous repo rate hikes has not been realized. Since May 2022, the MCLR has increased by 170 basis points (bps). In the previous MPC meeting in August, concerns were raised about persistent food inflation, which has contributed significantly to overall retail inflation.

Market Reactions and Future Outlook

The announcement has had a positive effect on the stock market, with the BSE Sensex and Nifty 50 indices rising following the news. RBI Governor Shaktikanta Das emphasized the need for caution regarding inflation dynamics and acknowledged the challenges from global economic conditions. Stakeholders, including Adhil Shetty from BankBazaar.com, noted that while current rates are stable, potential future rate cuts could be anticipated if inflation remains in check.

RBI Monetary Policy Committee (MPC) Meeting Outcomes and Projections

| Key Aspect | Details |

|---|---|

| Repo Rate Decision | The Reserve Bank of India (RBI) has kept the repo rate steady at 6.5% for the 10th consecutive time. |

| Monetary Policy Stance | The MPC has shifted its policy stance from “withdrawal of accommodation” to “neutral,” providing flexibility in response to inflation trends. |

| MPC Voting | The decision was supported by a majority vote of 5 out of 6 MPC members. |

| Inflation Projections | – Q3FY25: 4.8% – Q4FY25: 4.2% – FY25 overall: 4.5% (assuming normal monsoon) – Q1FY26: 4.3% |

| Economic Growth Estimates | – FY25 GDP growth: 7.2% – Q2FY25: 7.0% – Q3FY25: 7.4% – Q4FY25: 7.4% – Q1FY26: 7.3% |

| Reverse Repo Rate | Unchanged at 3.35% |

| Standing Deposit Facility (SDF) | Remains at 6.25% |

| Marginal Standing Facility (MSF) | Maintained at 6.75% |

| Impact on Borrowers | Lending rates linked to the repo rate will remain stable, providing relief to borrowers as their EMIs will not increase. |

ICRA Projects India’s GDP Growth to Mode...

ICRA Projects India’s GDP Growth to Mode...

India’s GDP May Hit 8.1% in Q3FY26: SBI ...

India’s GDP May Hit 8.1% in Q3FY26: SBI ...

Forex Reserves of India Hit Record High ...

Forex Reserves of India Hit Record High ...