In an unscheduled meeting of the Monetary Policy Committee, the central bank, however, retained the accommodative monetary policy. The sudden RBI move — the first hike after August 2018 — is expected to push up interest rates in the banking system. Equated monthly instalments (EMIs) on home, vehicle and other personal and corporate loans are likely to go up. Deposit rates, mainly fixed term rates, are also set to rise.

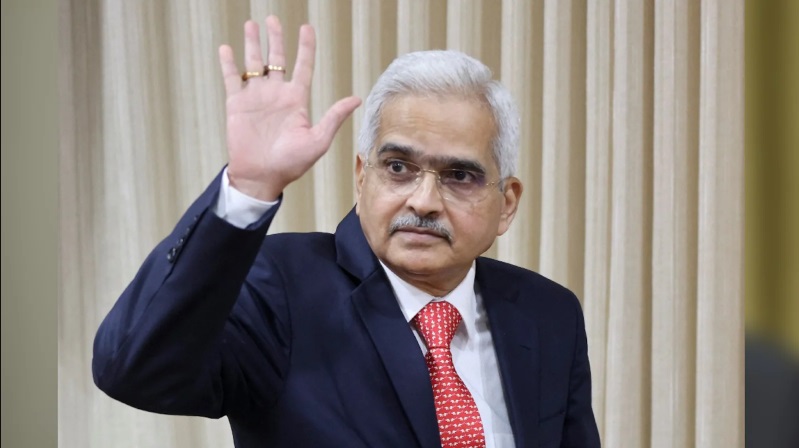

All six members of the MPC unanimously voted for a rate hike while maintaining the accommodative stance. RBI Governor Shaktikanta Das said the decision was taken in view of rising inflation, geopolitical tensions, high crude oil prices and shortage of commodities globally, which have impacted the Indian economy.

Buy Prime Test Series for all Banking, SSC, Insurance & other exams

The Reserve Bank of India (RBI) in its Monetary Policy Committee (MPC) meeting held between May 2-4, 2022 has decided to increase the policy repo rate under the liquidity adjustment facility (LAF) by 40 basis points (bps) to 4.40 per cent with immediate effect from 4.00% earlier. RBI has also hiked the cash reserve ratio (CRR) by 50 basis points to 4.50 per cent effective from May 21, 2022.

Consequently, the various rates are as under:

- Policy Repo Rate: 4.40%

- Standing Deposit Facility (SDF)= 4.15%

- Marginal Standing Facility Rate: 4.65%

- Bank Rate: 4.65%

- CRR: 4.50% (Effective from May 21, 2022.)

- SLR: 18.00%

The Government Securities (G-Sec) market reacted negatively to the rate hike. The price of the 10-year benchmark G-Sec crashed about Rs 1.90 intraday, with its yield shooting up by 28 basis points.

Important takeaways for all competitive exams:

- RBI 25th Governor: Shaktikanta Das; Headquarters: Mumbai; Founded: 1 April 1935, Kolkata.

Which Indian State has the Largest Mount...

Which Indian State has the Largest Mount...

Which Country is the Largest Producer of...

Which Country is the Largest Producer of...

List of BCCI Presidents from 1928 Till T...

List of BCCI Presidents from 1928 Till T...