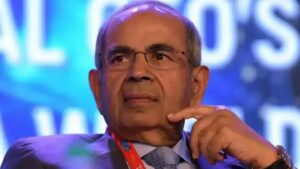

The Reserve Bank of India’s Central Board of Directors met for the 595th time. The meeting was held through video conferencing under the chairmanship of RBI Governor Shaktikanta Das, according to the RBI. The Board approved the appointment of Executive Director Dr. Rajiv Ranjan to the Monetary Policy Committee as an ex-officio member. Ranjan replaced Mridul Saggar, who retired on April 30. Ranjan is the MPC’s third (ex-officio) internal member.

Buy Prime Test Series for all Banking, SSC, Insurance & other exams

Key Points:

- The meeting included Deputy Governors and other Central Board Directors, as well as Secretary Ajay Seth of the Department of Economic Affairs.

- The RBI raised the benchmark lending rate by 40 basis points (bps) to 4.40 percent, after an unscheduled MPC meeting to limit inflation, which has stayed stubbornly over the target of 6% for the last three months.

- To suck out Rs 87,000 crore of liquidity from the banking system, the Monetary Policy Committee (MPC) led by RBI Governor Shaktikanta Das increased the percentage of deposits banks are required to retain a cash reserve by 50 basis points to 4.5 percent.

- The CRR increase will take effect on May 21.

- This is the first rate hike since August 2018 and the first time the MPC has raised the repo rate without warning (the rate at which banks borrow from the RBI).

- The MPC agreed unanimously to raise interest rates while remaining accommodating.

- The retail inflation rate in March came in at 6.9%.

- The MPC decision, according to the governor, reversed the May 2020 interest rate drop by an equal amount.

- On May 22, 2020, the central bank altered its policy repo rate, or short-term lending rate, in an off-policy cycle to boost demand by decreasing the interest rate to a historic low of 4%.

QS Asia Rankings 2026: IITs Slip as Chin...

QS Asia Rankings 2026: IITs Slip as Chin...

“Business Titan Gopichand Hinduja, Chair...

“Business Titan Gopichand Hinduja, Chair...

Guru Nanak Jayanti 2025: Date, Importanc...

Guru Nanak Jayanti 2025: Date, Importanc...