The State Bank of India (SBI), the country’s largest public-sector lender, has reported impressive financial results for the fourth quarter ended March 31, 2023. The bank’s net profit witnessed a significant surge of 83 percent, reaching a record high of Rs 16,694 crore.

Buy Prime Test Series for all Banking, SSC, Insurance & other exams

Here are the key highlights from SBI’s earnings report card

-

Rise in Profit: SBI recorded a remarkable 83 percent year-on-year (YoY) increase in net profit, surpassing market estimates. The bank’s net profit rose from Rs 9,113 crore in the corresponding quarter of the previous financial year to Rs 16,694 crore. Additionally, for the entire financial year 2022-23, SBI achieved a profit of Rs 50,232 crore, a substantial rise from Rs 31,675 crore in 2021-22. This marks SBI’s highest-ever quarterly and yearly profit.

- Net Interest Income (NII) Growth: The bank witnessed a significant growth in net interest income, which is the difference between interest earned and spent. The NII for the quarter rose by 29.5 percent to Rs 40,392 crore, compared to Rs 31,197 crore in the previous fiscal year.

- Improvement in Asset Quality: SBI showcased notable improvement in asset quality during the financial year 2022-23. The bank’s gross non-performing assets (GNPA) declined to Rs 90,027 crore from Rs 1.12 lakh crore in the previous year. The GNPA ratio for the fourth quarter decreased to 2.78 percent from 3.97 percent in the year-ago period, marking the lowest GNPA ratio for the bank in a decade. Moreover, net non-performing assets (NNPA) decreased to Rs 21,466 crore in the March quarter, down from Rs 27,965 crore, and the NNPA ratio slipped to 0.67 percent from 1.02 percent in the year-ago period.

- Segment Growth: SBI witnessed growth across various segments in the March quarter. The treasury segment revenue increased to Rs 28,470 crore, showing growth from Rs 24,098 crore in the year-ago period. The corporate and wholesale banking operations also expanded, reaching Rs 29,505 crore from Rs 19,825 crore on a YoY basis. The retail banking segment, which includes digital banking, exhibited significant growth, with revenue rising to Rs 48,091 crore compared to Rs 38,075 crore in the previous year.

-

Deposit Growth: SBI’s deposits experienced a healthy YoY growth of 9.19 percent. Notably, current account and savings account (CASA) deposits grew by 4.95 percent YoY. As of March 31, 2023, the CASA ratio stood at 43.80 percent.

Also Read: RBI expects banks to completely stop using LIBOR by July

Find More News Related to Banking

India Signs On to US-Led Pax Silica Part...

India Signs On to US-Led Pax Silica Part...

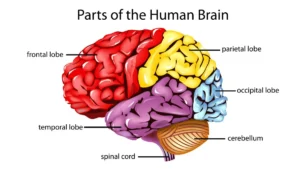

Which is the Largest Part of the Brain? ...

Which is the Largest Part of the Brain? ...

PM-SETU Gets Wings: India–France Aeronau...

PM-SETU Gets Wings: India–France Aeronau...