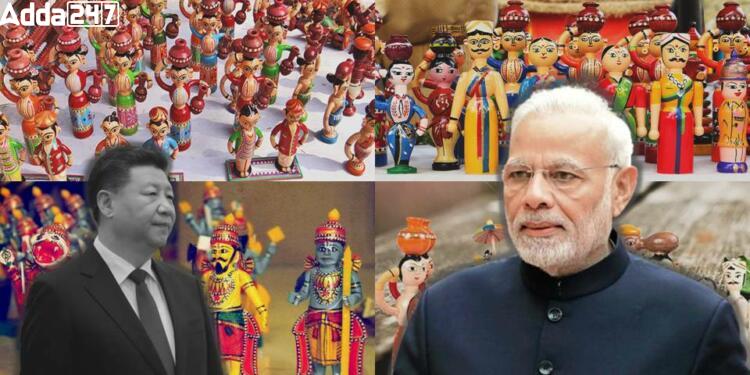

The global toy industry is witnessing a significant shift from China to India, attributed to various factors including regulatory requirements, protectionism, and strategic business decisions by major players. This shift has resulted in substantial growth in India’s toy exports and a decline in imports, positioning the country as a net exporter.

Factors Driving the Shift

1. Bureau of Indian Standards (BIS) Approval Requirement:

- The mandatory BIS approval for toy sales in India has incentivized global toy majors to focus sourcing efforts towards India.

- This regulatory requirement ensures quality control and consumer safety standards, bolstering confidence in Indian toy exports.

2. Protectionism and Trade Policies:

- India’s implementation of protectionist measures, such as increased customs duties on toy imports, has encouraged global manufacturers to explore alternative sourcing destinations.

- The “China-Plus-One” strategy adopted by businesses seeking diversification from China has further propelled India’s emergence as a preferred manufacturing hub.

3. Increased Customs Duty:

- The escalation of basic customs duty on toys from 20% to 70% by the Indian government has incentivized domestic production and reduced reliance on imports.

- This policy measure aims to bolster the competitiveness of the Indian toy industry and foster its growth trajectory.

Key Industry Players and Market Expansion

1. Dependence of Global Brands:

- Leading toy brands like Hasbro, Mattel, and Spin Master are increasingly relying on India for sourcing, indicating a shift in manufacturing bases.

- This dependency underscores India’s growing importance as a strategic manufacturing partner for global toy companies.

2. Transition of Major Manufacturers:

- Notable manufacturers such as Dream Plast, Microplast, and Incas are gradually transitioning their focus from China to India.

- Expansion of production capacities and export markets, facilitated by government policies and regulatory compliance, underscores India’s attractiveness as a manufacturing destination.

Challenges and Industry Perspectives

1. Need for BIS Rule Relaxation:

- The Toy Association of India (TAI) advocates for further relaxation of BIS rules to support micro, small, and medium enterprises (MSMEs) in the toy sector.

- Despite government efforts to promote manufacturing, challenges persist for smaller players, necessitating policy adjustments to foster a more conducive environment.

2. Emergence of Toy Manufacturing Hubs:

- Gujarat is emerging as a prominent toy manufacturing hub, reflecting the geographical diversification of India’s manufacturing landscape.

- The proliferation of startups in the toy industry signifies the growing entrepreneurial ecosystem and potential for regional specialization.

Market Projections and Growth Trajectory

The toy industry in India was valued at $1.7 billion in 2023 and is projected to reach $4.4 billion by 2032, exhibiting a robust growth rate of 10.6% according to a report by market research firm IMARC. This trajectory underscores the transformative shift and promising prospects for India’s toy manufacturing sector.

India’s GDP May Hit 8.1% in Q3FY26: SBI ...

India’s GDP May Hit 8.1% in Q3FY26: SBI ...

Forex Reserves of India Hit Record High ...

Forex Reserves of India Hit Record High ...

India Revises Base Year of Merchandise T...

India Revises Base Year of Merchandise T...