The Securities and Exchange Board of India (SEBI) has implemented new guidelines requiring retail investors to use the Unified Payments Interface (UPI) to block funds when applying for public issues of debt securities amounting up to ₹5 lakh.

This regulation aims to streamline the application process for individual investors engaging with public debt issues, including non-convertible redeemable preference shares, municipal debt securities, and securitized debt instruments. The new rule will take effect on November 1, 2024, and is part of SEBI’s effort to enhance efficiency and align the process with equity share applications.

Key Provisions

UPI Mandate: Investors applying through intermediaries for amounts up to ₹5 lakh must utilize UPI for blocking funds, while they can still access other payment methods via stock exchange platforms.

Bank Account Linking: Investors are required to provide UPI-linked bank account details in their application forms.

Shorter Review Periods: SEBI has reduced the public comment period on draft offer documents from 7 working days to just 1 day for issuers with listed securities, and to 5 days for other issuers.

Flexibility in Price Band Revisions: Issuers can now extend the bidding period by one working day if there are price band or yield revisions, while the minimum subscription period has been shortened from 3 days to 2 days.

Alternative Options: Investors still have the choice to use Self-Certified Syndicate Banks or the stock exchange platform for their applications.

Rationale and Benefits

The rationale behind these changes includes the alignment of debt security applications with those for equity shares, promoting a more efficient and streamlined process. The adoption of UPI is expected to reduce paperwork, enhance convenience, and expedite transactions, benefiting investors by simplifying the application process for public issues.

India’s Forex Reserves Fall $2.11 Billio...

India’s Forex Reserves Fall $2.11 Billio...

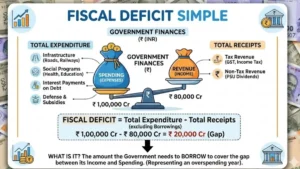

India’s Fiscal Deficit Hits ₹9.8 Trillio...

India’s Fiscal Deficit Hits ₹9.8 Trillio...

India’s GDP Growth Slows to 7.8% in Q3FY...

India’s GDP Growth Slows to 7.8% in Q3FY...