The government has designated “zero coupon zero principal instruments” as securities in preparation for the creation of a social stock exchange. A Not for Profit Organization (NPO) that will be registered with the social stock exchange segment of a recognised stock exchange will issue a zero coupon, zero principal instrument. According to a formal announcement released on Friday, the Securities and Exchange Board of India (Sebi) will establish the laws that would apply to these instruments.

Buy Prime Test Series for all Banking, SSC, Insurance & other exams

KEY POINTS:

- The Social Stock Exchange (SSE), a revolutionary idea in India, aims to benefit private and nonprofit sector providers by increasing their access to money.

- Nirmala Sitharaman, the finance minister, proposed the concept in her Budget Speech for 2019–20.

- SSE will be a distinct division of the current stock markets.

- According to the notification, “zero coupon zero principal instruments” have been designated as securities for the purposes of the Securities Contracts (Regulation) Act, 1956.

- Sebi’s board approved a framework for SSE for social businesses to raise money in September 2021.

- The recommendations of a working group and technical group assembled by the regulator served as the foundation for the development of the SSE framework.

Important Takeaways For All Competitive Exams:

- Finance minister, Govt of India: Nirmala Sitharaman

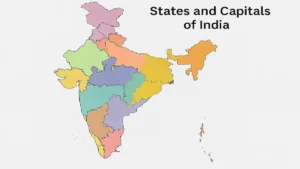

States and Capitals of India, Check the ...

States and Capitals of India, Check the ...

Top-10 Glowing Plants in the World, Know...

Top-10 Glowing Plants in the World, Know...

Daily Current Affairs 22nd September, 20...

Daily Current Affairs 22nd September, 20...