The Reserve Bank of India (RBI) launched the first pilot of Digital Rupee- Retail segment (e₹-R) on December 01, 2022. This was stated by the Union Minister of State for Finance, Shri Pankaj Chaudhary, in a written reply to a question in Lok Sabha.

Buy Prime Test Series for all Banking, SSC, Insurance & other exams

Key Thighs To Note Regarding CBDCs:

- The Minister stated that the pilot is covering select locations in closed user group (CUG) comprising participating customers and merchants.

- It is being issued in the same denominations that paper currency and coins are currently issued. It is being distributed through financial intermediaries, i.e., banks.

- The e₹-R offers features of physical cash like trust, safety and settlement finality. As in the case of cash, it will not earn any interest and can be converted to other forms of money, like deposits with banks.

Selected Cities:

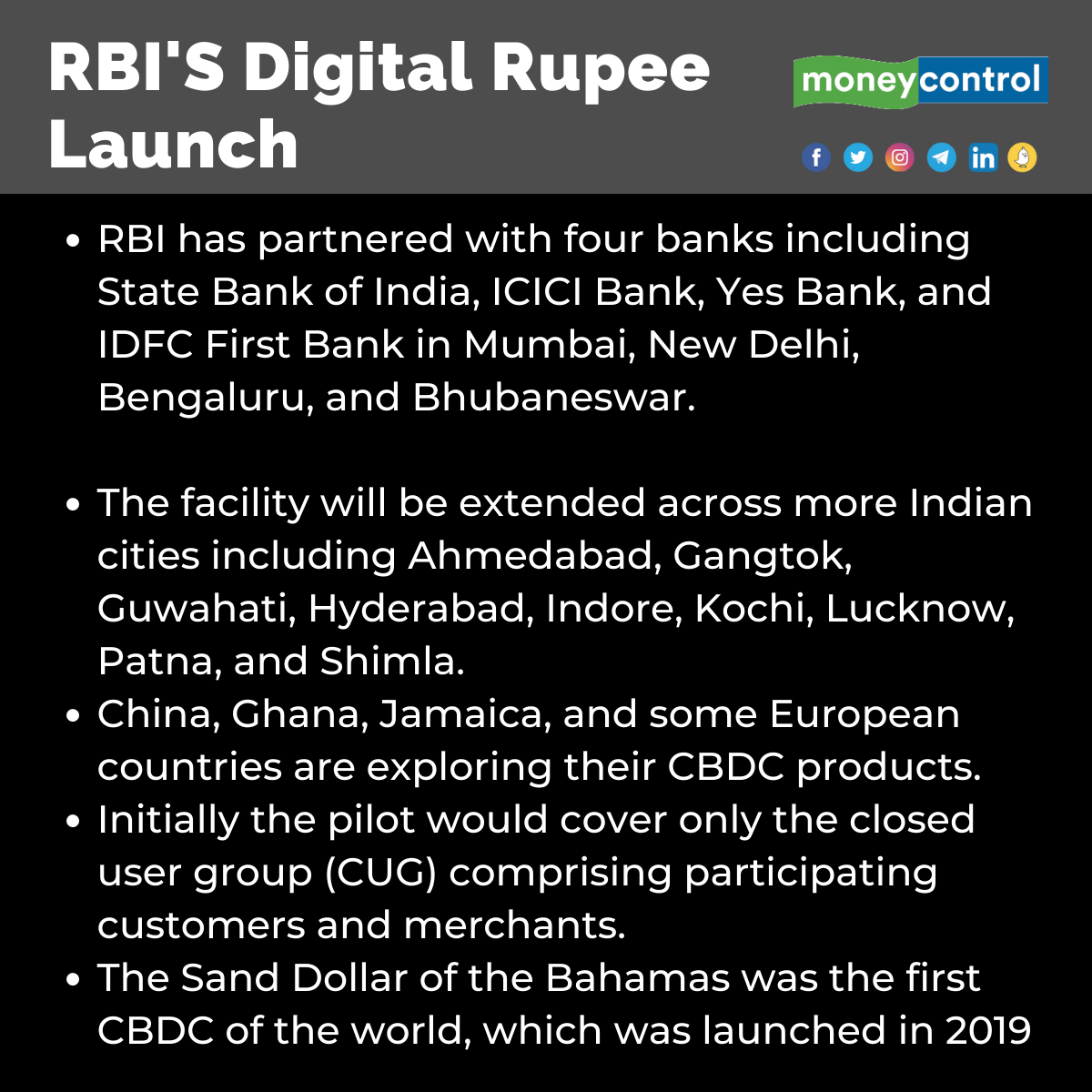

The e₹-R pilot currently covers the five cities of Mumbai, New Delhi, Bengaluru, Bhubaneswar and Chandigarh. The e₹-R is in the form of a digital token that represents legal tender.

Selected banks for Digital Rupee:

(image credit: Money Control)

RBI has identified eight banks for phase-wise participation in the retail pilot project. These include the State Bank of India, the ICICI Bank, the Yes Bank and the IDFC First Bank, the Bank of Baroda, the Union Bank of India, the HDFC Bank and the Kotak Mahindra Bank. The participating banks have selected individuals/account holders for the trials.

- The Minister further stated that a separate e₹ wallet has been conceived in the pilot considering that e₹ forms part of the currency system while other digital wallets form part of the payments system. Users will be able to transact with e₹-R through a digital wallet offered by the participating banks and stored on mobile phones / devices.

- The RBI issues only one digital currency on behalf of Government of India, Central Bank Digital Currency (CBDC), which is a liability of the Central Bank, the Minister stated.

Types of CBDC to be issued:

(image credit: India Today)

There are two categories of Central Bank Digital Currency: general purpose or retail (CBDC-R) and wholesale. According to the RBI report dated October 7, 2022, “CBDC can be classified into two broad types viz. general purpose or retail (CBDC-R) and wholesale (CBDC-W). Retail CBDC would be potentially available for use by all viz. private sector, non-financial consumers and businesses while wholesale CBDC is designed for restricted access to select financial institutions. While Wholesale CBDC is intended for the settlement of interbank transfers and related wholesale transactions, Retail CBDC is an electronic version of cash primarily meant for retail transactions.”

Legendary Bengali Author Shankar Passes ...

Legendary Bengali Author Shankar Passes ...

List of Dadasaheb Phalke Award Winners f...

List of Dadasaheb Phalke Award Winners f...

Which Dance Form is known as the Ballad ...

Which Dance Form is known as the Ballad ...