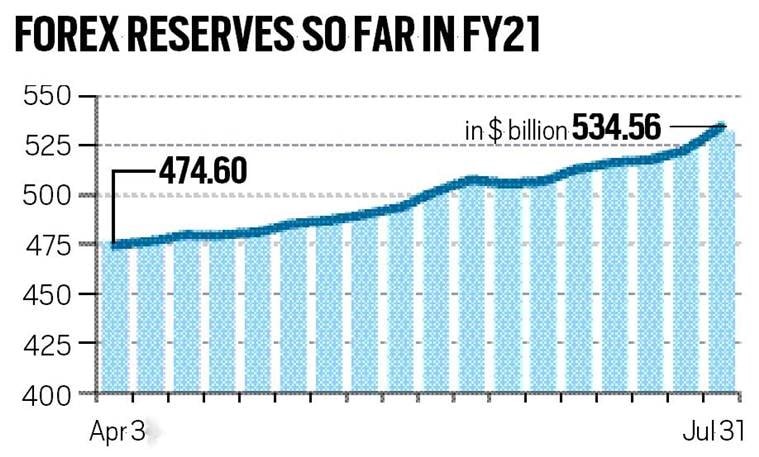

India’s foreign exchange reserves saw a drop after nearly three weeks, falling $1.5 billion to $575.27 billion in the week ended February 3. The fall was the result of the decline in the Foreign Currency Assets (FCA), a major component of the overall reserves, the Reserve Bank of India’s weekly statistical supplement said on February 10.

Buy Prime Test Series for all Banking, SSC, Insurance & other exams

Reason of The Forex Fall:

According to analysts, the fall in reserves last week was likely owing to dollar sales by the RBI as it stemmed volatility in the rupee following the Adani crisis. Shares of the Adani group plunged following allegations of malpractice by US-based research firm Hindenburg.

With the stock slide culminating in the Adani group calling off its follow-on public offer, foreign portfolio investors were said to have sold Indian equities.

The Rise and Fall of Forex Reserves:

The FCA fell $1.32 billion to $507.69 billion for the week ending February 3. Gold reserves were down $246 million to $43.78 billion. In the previous three-week reporting period, the reserves had risen over $15 billion and touched a six-month high of $576.76 billion during the week ended January 27. On February 10, the rupee ended at 82.50 against the US dollar.

The Volatility of The Indian Rupee:

The rupee has remained one of the least volatile currencies among its Asian peers in the calendar year 2022 and continued to be so in the new year as well, RBI Governor Shaktikanta Das said on February 8. The depreciation and the volatility in the rupee during the current phase of multiple shocks was far lower than it was during the global financial crisis and the taper tantrum. “In a fundamental sense, the movements of the rupee reflect the resilience of the Indian economy,” Das added.

Google Expands Opal AI App Builder to 15...

Google Expands Opal AI App Builder to 15...

e-NAM Adds 9 New Commodities, Expands Co...

e-NAM Adds 9 New Commodities, Expands Co...

RBI Launches Retail Sandbox for Digital ...

RBI Launches Retail Sandbox for Digital ...