The Reserve Bank of India (RBI), in light of the growing involvement of non-banking financial companies (NBFCs) in the financial system, has issued a set of standards for provisioning for standard assets by large NBFCs. The RBI published a framework for NBFC scale-based regulation in October of last year. NBFCs have a four-layer regulatory structure based on their size, activity, and perceived riskiness.

Buy Prime Test Series for all Banking, SSC, Insurance & other exams

KEY POINTS:

- The central bank defined rates of provision for outstanding loans given by ‘NBFC-Upper Layer’ in a circular issued.

- Individual housing loans and loans to Small and Micro Enterprises (SMEs) have a provision rate of 0.25 percent, whereas housing loans with teaser rates have a provision rate of 0.5%.

- Individual housing loans and loans to Small and Micro Enterprises (SMEs) have a provision rate of 0.25 percent, whereas housing loans extended at teaser rates have a provision rate of 2 percent.

- After one year from the day on which the rates are raised, the latter will drop to 0.4%.

- The rate of provision for the Commercial Real Estate Residential Housing (CRE – RH) sector is 0.75 percent, while the rate for CRE other than residential housing is 1%.

- The provision rate for medium-sized businesses has been set at 0.4%.

Role of NBFCs:

- The NBFCs in the higher layer are those that the RBI has identified as warranting increased regulatory requirements based on a set of parameters and scoring methodology.

- Regardless of other factors, the top ten qualifying NBFCs in terms of asset size will always be in the upper stratum.

- Base Layer, Middle Layer, Upper Layer, and Top Layer are the four layers of the scale-based regulation for NBFCs.

India-US Vajra Prahar 2026: Special Forc...

India-US Vajra Prahar 2026: Special Forc...

Forex Reserves of India Hit Record High ...

Forex Reserves of India Hit Record High ...

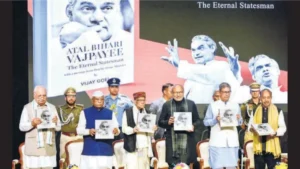

VP C. P. Radhakrishnan Unveils 'Atal Bih...

VP C. P. Radhakrishnan Unveils 'Atal Bih...