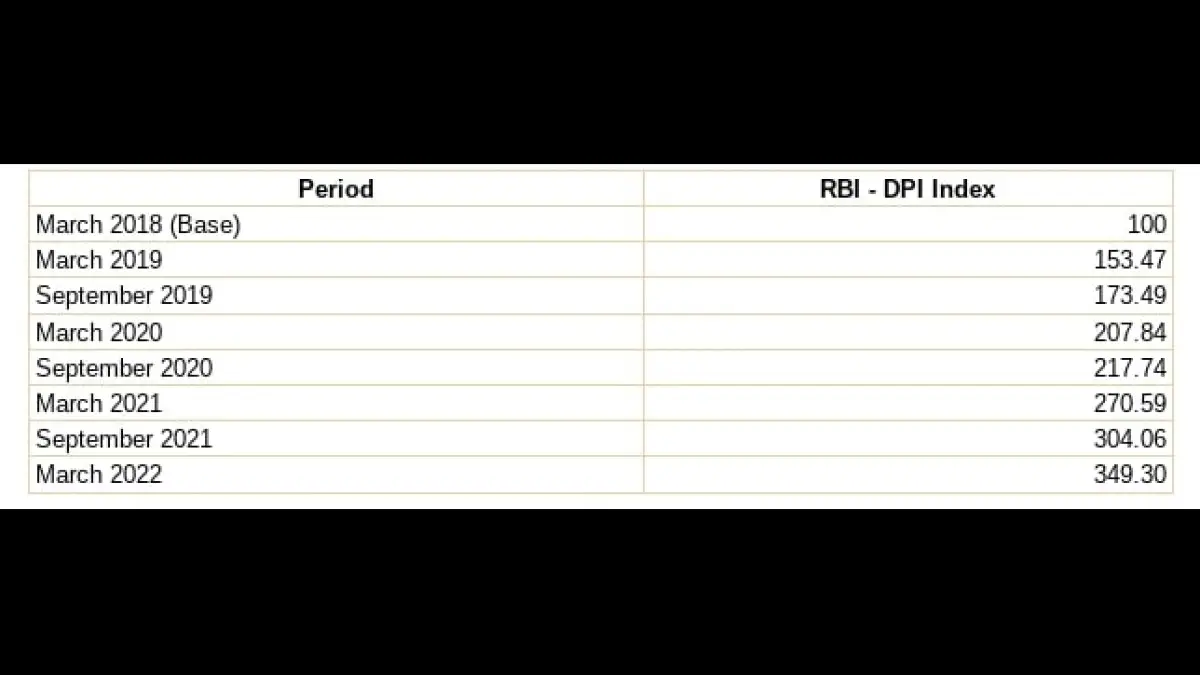

Digital payments across the country registered a growth of 24.13 per cent in a year through September 2022, as per the RBI’s Digital Payments Index which measures the adoption of online transactions. The newly-constituted RBI’s Digital Payments Index (RBI-DPI) stood at 377.46 in September 2022 against 349.30 in March 2022 and 304.06 in September 2021. The index is published on a semi-annual basis(i.e. twice a year) from March 2021 onwards with a lag of four months.

Buy Prime Test Series for all Banking, SSC, Insurance & other exams

More About The RBI’s Digital Payments Index (RBI-DPI):

The RBI-DPI Index has increased across all parameters driven by significant growth in payment infrastructure and payment performance across the country over the period, Reserve Bank of India (RBI) said.

What is RBI’s Digital Payments Index (RBI-DPI):

- The Reserve Bank had announced construction of a composite RBI-DPI with March 2018 as base to capture the extent of digitisation of payments across the country.

- The RBI-DPI index has demonstrated significant growth representing the rapid adoption and deepening of digital payments across the country in recent years.

- The index for March 2022 stands at 349.30 as against 304.06 for September 2021, which was announced on January 19, 2022.

- Among the digital modes of payments, the number of transactions using Real Time Gross Settlement (RTGS) increased by 30.5 percent during 2021-22.

- Payment transactions carried out through credit cards increased by 27 per cent and 54.3 per cent in terms of volume and value, respectively and transactions through debit cards decreased by 1.9 per cent in terms of volume, though in terms of value, it increased by 10.4 per cent.

- Prepaid Payment Instruments (PPIs) recorded an increase in volume and value terms by 32.3 per cent and 48.5 percent, respectively.

Parameters of Digital Payment Index(DPI):

The RBI-DPI comprises 5 broad parameters that enable measurement of deepening and penetration of digital payments in the country over different time periods. These parameters are-

-

- Payment Enablers (weight 25%).

- Payment Infrastructure – Demand-side factors.

- Payment Infrastructure – Supply-side factors (15%).

- Payment Performance (45%).

- Consumer Centricity (5%).

Which Planet is known as the Green Plane...

Which Planet is known as the Green Plane...

Which Herb is known as the King of Herbs...

Which Herb is known as the King of Herbs...

Explained: Why Kharg Island Matters to G...

Explained: Why Kharg Island Matters to G...