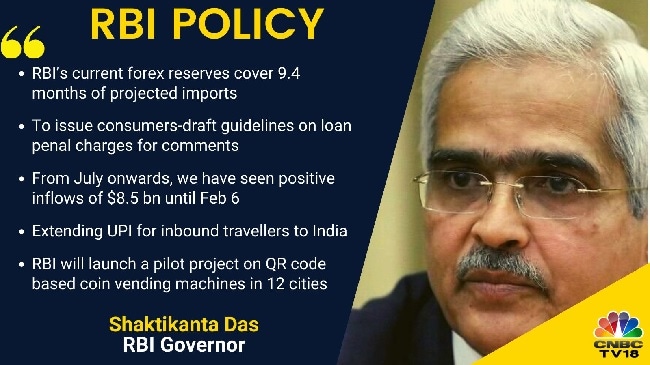

Recently, RBI Governor Shaktikanta Das had stated during the most recent Monetary Policy Committee (MPC) address that the apex banking regulator, in collaboration with banks, would launch a pilot project to evaluate the operation of a QR-code based coin vending machine.

Buy Prime Test Series for all Banking, SSC, Insurance & other exams

More about the project:

- The vending machines would dispense coins, with the appropriate amount debited from the customer’s account via the United Payments Interface (UPI), instead of physically tendering banknotes.

- Customers would be able to withdraw coins in the desired quantities and denominations.

- The central concept here is to make coins more accessible.

About Coin Vending Machines:

- The vending machines would dispense coins with the requisite amount being debited from the customer’s account using United Payments Interface (UPI) instead of physical tendering of banknotes.

- Customers would be endowed the option of withdrawing coins in required quantities and denominations.

- The central idea here is to ease the accessibility to coins.

- With particular focus on ease and accessibility, the machines are intended to be installed at public places such as railway stations, shopping malls and marketplaces.

Where will coin vending machines be launched:

The pilot project is planned to be initially rolled out at 19 locations in 12 cities across the country. These vending machines are intended to be installed at public places such as railway stations, shopping malls, and marketplaces to enhance ease and accessibility.

Indian Economy :recent status of coins:

- Circulation of Coins : As of December 30, last year, the total value of circulation of rupee coins was Rs.28,857 crore. The figure is an increase of 7.2% from the previous year.

- The circulation of small coins remained constant at Rs.743 crore. Coins in India are issued in denominations of one rupee, two rupees, five rupees, ten rupees, and twenty rupees.

- Volume of digital payments: According to the Digidhan Dashboard, the volume of digital payments until December 2022 was approximately Rs.9,557.4 crore. The number includes mobile banking, internet banking, IMPS, BHIM-UPI, and NEFT, among other services.

You may also read these:

- Bank credit growth slowed to 16.8% in third quarter: RBI

- RBL Bank signs an agreement with Exim Bank for trade finance

BCCI Announces ₹131 Crore Reward for Tea...

BCCI Announces ₹131 Crore Reward for Tea...

Which River is known as the Rhine of Ind...

Which River is known as the Rhine of Ind...

Indian Railways Launches ‘SHINE’ App: A ...

Indian Railways Launches ‘SHINE’ App: A ...