Central banks are the backbone of a nation’s financial system, playing a pivotal role in maintaining economic stability and fostering growth. Their primary responsibilities include implementing stable monetary policies and ensuring financial stability. As we delve into the rankings of the world’s wealthiest central banks in 2024, we gain valuable insights into the global economic landscape and the financial prowess of various nations.

The Significance of Central Bank Wealth

Economic Indicators

The total wealth of a central bank serves as a crucial indicator of a country’s economic health. This wealth is primarily assessed through the central bank’s assets, with the balance sheet acting as a key metric. A robust central bank balance sheet often correlates with a strong and stable economy.

Regulatory Role

Central banks globally maintain specialized departments dedicated to regulation and supervision. These departments are staffed with experts who diligently monitor compliance with established financial laws and regulations, ensuring the integrity of the financial system.

Regional Dominance and Disparities

European Dominance

A striking observation in the 2024 rankings is the dominance of European central banks. Seven out of the top ten central banks are based in Europe, with a combined worth of an astounding $11.09 trillion. This underscores the economic strength and financial stability of the European region.

African Absence

Notably absent from the top 10 list are African central banks. This absence can be attributed to several challenges facing the region, including:

- Rising inflation

- Fragile financial markets

- Weak monetary policy transmission systems

These factors highlight the economic disparities and developmental challenges that persist in certain regions.

India’s Position

While not in the top 10, India’s Reserve Bank of India (RBI) holds a respectable 12th position globally. As of March 31, 2024, the RBI’s balance sheet grew by 11.08% year-on-year, reaching Rs 70.47 trillion. This growth is primarily attributed to the bank’s liquidity management and foreign currency (forex) activities, reflecting India’s growing economic influence on the global stage.

Top 10 Richest Central Banks in the World

Based on data compiled by the Sovereign Wealth Fund Institute (SWFI), here are the top 10 wealthiest central banks in the world by total assets:

| Rank | Name of the Central Bank | Total Assets (USD) | Country | Region |

|---|---|---|---|---|

| 1 | Federal Reserve System | $7,835,559,000,000 | USA | North America |

| 2 | People’s Bank of China | $6,004,919,369,845 | China | Asia |

| 3 | Bank of Japan | $5,543,058,448,125 | Japan | Asia |

| 4 | Deutsche Bundesbank | $2,776,759,343,640 | Germany | Europe |

| 5 | Bank of France | $2,011,001,711,400 | France | Europe |

| 6 | Norges Bank | $1,632,986,563,336 | Norway | Europe |

| 7 | Bank of Italy | $1,383,293,987,542 | Italy | Europe |

| 8 | Bank of England | $1,288,250,668,160 | United Kingdom | Europe |

| 9 | Bank of Spain | $1,049,435,626,385 | Spain | Europe |

| 10 | Swiss National Bank | $944,013,351,477 | Switzerland | Europe |

Analysis of the Top 10

Global Distribution

The list showcases a diverse geographical representation:

- 1 North American central bank

- 2 Asian central banks

- 7 European central banks

Economic Powerhouses

The central banks featured in this list represent some of the world’s largest and most significant economies. Their substantial asset bases reflect their crucial role in the global financial system.

Regional Observations

- North America: The Federal Reserve System of the USA tops the list, highlighting the country’s economic dominance.

- Asia: China and Japan’s central banks occupy the 2nd and 3rd positions, underscoring Asia’s growing economic influence.

- Europe: The strong presence of European central banks demonstrates the region’s collective economic strength and financial stability.

Implications and Insights

Economic Influence

The vast assets held by these central banks signify their substantial influence on global economic policies and financial markets. Their decisions can have far-reaching consequences on international trade, currency valuations, and economic stability.

Financial Stability

The robust asset bases of these central banks provide a strong foundation for managing economic crises and implementing effective monetary policies. This financial strength is crucial for maintaining stability during economic turbulence.

Global Economic Balance

The distribution of wealth among these central banks reflects the current balance of economic power globally. It highlights the continued economic strength of traditional powerhouses while also showcasing the rising influence of emerging economies, particularly in Asia.

Top 10 Most Valuable Technology Brands i...

Top 10 Most Valuable Technology Brands i...

Top 10 highest-revenue unlisted Indian c...

Top 10 highest-revenue unlisted Indian c...

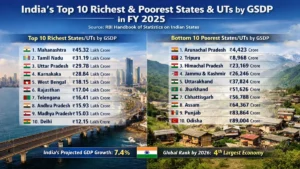

India’s Top 10 Richest and Poorest State...

India’s Top 10 Richest and Poorest State...