Finance Minister Nirmala Sitharaman’s presentation of the Union Budget 2026-27 marks a strategic pivot toward growth acceleration, inclusive development, and targeted relief for consumers and businesses. Against the backdrop of projected GDP growth of 6.8-7.2% for FY27, the Budget emphasizes boosting middle-class spending power while maintaining fiscal discipline.

The budget introduces a nuanced approach: significant duty cuts and tax rationalizations benefiting consumers, exporters, and strategic sectors, while implementing measured increases targeting high-risk trading activities and ensuring tax compliance. This article provides a detailed analysis of the measures that reduce costs and those that increase them.

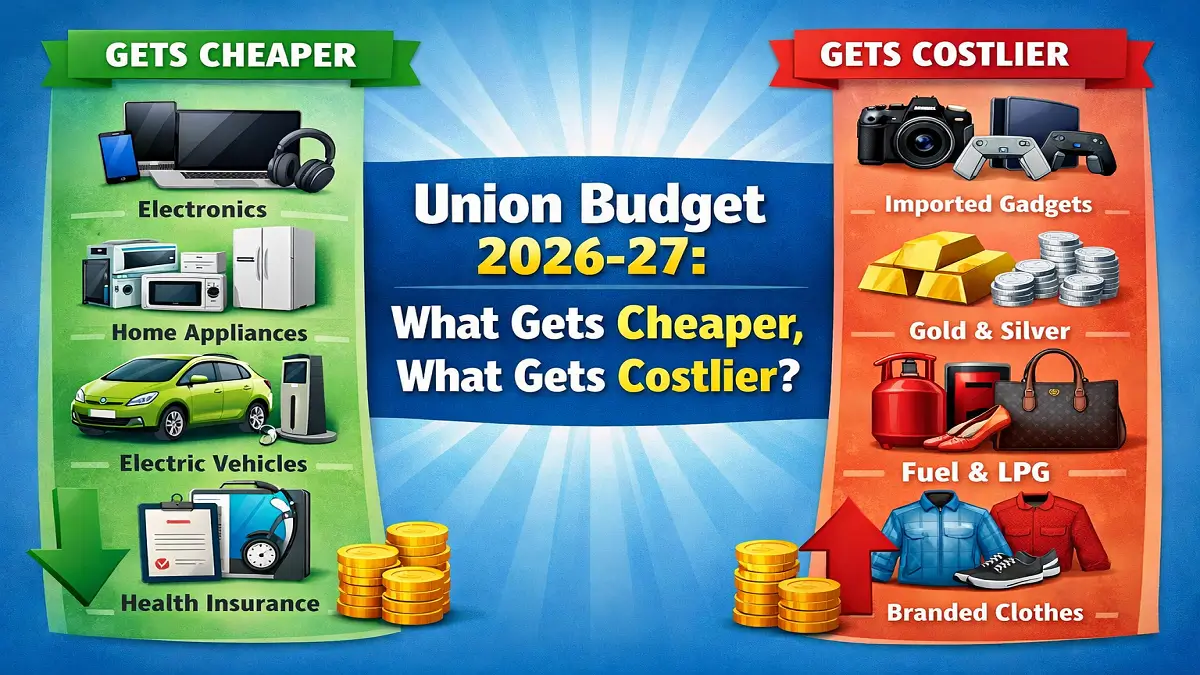

WHAT GETS CHEAPER IN UNION BUDGET 2026-27

Consumer Relief Measures

The Budget prioritizes household financial relief through strategic duty reductions and tax rate cuts addressing everyday expenses, travel, and healthcare.

1. OVERSEAS TRAVEL & TOURISM

Overseas Tour Package Tax Relief

Current Situation:

- Tax Collected at Source (TCS) on overseas tour packages: 5-20%

- Inconsistent rates creating compliance complexity

- Burden on travel intermediaries and consumers

Budget Change:

- New Uniform Rate: 2% TCS

- Applicable to: All overseas tour program packages

- No Amount Stipulation: Full coverage across all price points

Impact & Benefit:

- Significant cost reduction for international travelers

- Approximately 60-90% reduction in tax burden

- Enhanced affordability of global tourism

- Boost to travel industry revenues

- Stimulus for foreign exchange earnings

Consumer Example:

- ₹1 lakh tour package: ₹1,000-2,000 TCS (from ₹5,000-20,000)

- Family vacation cost reduction: 5-20% savings on tour packaging

Business Benefit:

- Travel agents and tour operators face lower compliance burden

- Simplified rate structure

- Increased customer demand from lower costs

2. FOREIGN EDUCATION & MEDICAL EXPENSES

Liberalized Remittance Scheme (LRS) Rate Reduction

Current Situation:

- TDS on education remittances: 5%

- TDS on medical remittances: 5%

- Creates friction in overseas education and treatment access

Budget Change:

- New Uniform Rate: 2% TDS

- Scope: Both education and medical-related remittances

- Applicability: All LRS remittances for these purposes

Impact & Benefit:

- 60% reduction in TDS burden

- Enhanced affordability of quality international education

- Better access to world-class medical treatment

- Support for youth skill development abroad

- Medical tourism facilitation

Consumer Impact:

- ₹25 lakh education remittance: ₹12,500 TDS (from ₹25,000)

- ₹10 lakh medical treatment: ₹5,000 TDS (from ₹10,000)

- Annual savings for families pursuing overseas education/healthcare

Strategic Outcome:

- Positions India competitively for retaining talent pursuing higher education

- Improves healthcare accessibility for complex medical conditions

3. PERSONAL GOODS IMPORTS

Personal Use Imports Customs Duty Reduction

Current Situation:

- Basic Customs Duty on personal-use imports: 20%

- Affects returning travelers, expatriates, and gift receivers

- Significant cost burden on international parcels

Budget Change:

- New Rate: 10% BCD on all dutiable personal-use goods

- 50% Reduction: Halves the customs duty load

- Universal Application: All categories of personal-use imports

Impact & Benefit:

- Direct cost savings for international parcel receivers

- Enhanced affordability of imported consumer goods

- Support for diaspora maintaining connections with relatives

- Increased international e-commerce participation

- Relief for expatriate communities

Consumer Example:

- ₹10,000 imported gadget: ₹1,000 duty (from ₹2,000)

- ₹50,000 electronic equipment: ₹5,000 duty (from ₹10,000)

- 50% savings on personal imports across categories

Sectoral Impact:

- E-commerce platforms benefit from reduced import costs

- International gift giving becomes more affordable

- Courier services experience demand boost

Healthcare & Life-Saving Medicines

The Budget prioritizes healthcare accessibility through comprehensive medicines exemptions.

4. CANCER DRUGS DUTY EXEMPTION

Critical Healthcare Relief

Scope:

- 17 major cancer-treating drugs and medicines

- Basic Customs Duty: Fully Exempted

- Applicability: All import channels

Affected Drugs:

- Targeted cancer therapies

- Chemotherapy agents

- Immunotherapy medications

- Biosimilar cancer treatments

Impact & Benefit:

- Eliminates import cost barriers for cancer treatment

- Significantly reduces treatment burden on patients

- Improves medication affordability and accessibility

- Supports cancer care infrastructure development

- Humanitarian focus on vulnerable patient populations

Patient Impact:

- Cancer drug prices: 10-30% reduction through import duty elimination

- Treatment accessibility: Enhanced for economically weaker sections

- Annual cost savings: ₹1-5 lakh per patient (depending on drug)

Healthcare System Benefit:

- Reduces burden on public healthcare budgets

- Encourages private sector investment in oncology

- Aligns with universal healthcare aspirations

5. RARE DISEASE MEDICINES EXPANSION

Widened Access to Rare Disease Treatments

Program Enhancement:

- Previous Coverage: Select rare diseases

- New Addition: 7 additional rare diseases

- Scope: Personal imports of drugs, medicines, FSMP (Food for Special Medical Purposes)

Exemption Scope:

- Basic Customs Duty: Fully exempted

- Applicable to: All imported rare disease medications

- Coverage: Diagnostic foods and specialized nutritional products

New Diseases Covered:

- Specific genetic disorders

- Metabolic disorders

- Neurological conditions

- Inherited diseases

- Complex systemic disorders

Impact & Benefit:

- Extends rare disease treatment access to more patient populations

- Reduces financial barriers to specialized medications

- Encourages medical tourism for rare disease treatment

- Supports patient advocacy and disease awareness

- Improves quality of life for rare disease patients

Economic Impact:

- Rare disease treatment costs: 20-50% reduction through duty exemption

- Patient families: Significant financial relief from medical expenses

- Healthcare outcomes: Enhanced treatment options and accessibility

Manufacturing & Export Promotion

Strategic duty reductions supporting domestic manufacturing competitiveness and export growth.

6. SEAFOOD EXPORT INPUT DUTY REDUCTION

Enhanced Input Import Facility

Program:

- Duty-Free Imports Scheme for seafood processing inputs

- Expansion of existing facility

Current Limits:

- Maximum Import Allowance: 1% of FOB (Free on Board) value of previous year’s export turnover

- Specified inputs only

Budget Enhancement:

- New Limit: 3% of FOB value

- 300% Increase: Tripled input import capacity

- Applicability: All specified inputs for seafood processing exports

Affected Input Categories:

- Processing chemicals and additives

- Packaging materials

- Quality assurance inputs

- Food safety compliance materials

Impact & Benefit:

- Enhanced production capacity for seafood exporters

- Improved cost competitiveness in global markets

- Increased export volumes and foreign exchange earnings

- Support for coastal state economies

- Fisheries sector growth acceleration

Exporter Impact:

- Production costs: 5-10% reduction through increased duty-free input allowance

- Export competitiveness: Improved pricing in global seafood markets

- Margin expansion: Enhanced profitability for seafood processors

Economic Outcome:

- India’s seafood export growth: Projected 15-20% increase

- Employment in fisheries sector: Significant job creation

- Coastal region development: Enhanced economic opportunities

7. LEATHER PRODUCTS EXPORT EXPANSION

Shoe Uppers Duty-Free Import Access

Previous Structure:

- Duty-Free Inputs: Available for leather/synthetic footwear exports only

- Gap: Shoe uppers (key intermediate product) excluded

Budget Change:

- Extension: Duty-Free imports now apply to Shoe Uppers exports

- Scope: All specified inputs used in shoe uppers manufacturing

- Applicability: Full production value chain for shoe upper exports

Extended Export Timeline:

- Previous Allowance: 6 months from initial export clearance

- New Allowance: 1 year from clearance date

- Applicable Products: Leather/textile garments, leather/synthetic footwear, leather products

Impact & Benefit:

- Expanded product coverage for export duty support

- Longer supply chain management window

- Enhanced operational flexibility for exporters

- Increased export value-addition

- Competitive pricing in global leather markets

Exporter Impact:

- Input costs: 10-15% reduction for shoe uppers manufacturers

- Production timeline: Extended 1-year window improves supply chain management

- Export volumes: Anticipated 20-25% growth in leather product exports

Sectoral Impact:

- Leather industry: Enhanced global competitiveness

- Employment: Significant job creation in leather processing

- Regional development: Tamil Nadu, Karnataka, Punjab leather clusters

8. MINERALS & MINERAL PRODUCTS

Scrap & Minerals Customs Duty Rationalization

Affected Categories:

- Alcoholic liquor

- Scrap materials

- Minerals

- Tendu leaves

Rate Changes:

Alcoholic Liquor, Scrap & Minerals:

- Current Rate: Variable (5%-20%)

- New Rate: 2% Unified Customs Duty

- Rationalization: Simplified structure

Tendu Leaves (Special Rate Reduction):

- Current Rate: 5% Customs Duty

- New Rate: 2% Customs Duty

- Reduction: 60% rate cut

Impact & Benefit:

- Simplified tariff structure reducing compliance complexity

- Lower raw material costs for dependent industries

- Enhanced export competitiveness for mineral-based products

- Support for tribal communities dependent on tendu leaf collection

- Cost reduction across mineral-dependent manufacturing sectors

Industry Impact:

- Scrap metal processors: 10-20% cost reduction in raw materials

- Mineral-dependent industries: Improved competitiveness

- Tendu leaf-dependent industries: Enhanced profitability

Energy & Strategic Infrastructure

9. RENEWABLE ENERGY EQUIPMENT

Energy Transition Support Duties Exemption

Lithium-Ion Battery Manufacturing:

Current Exemption: Capital goods for Lithium-Ion Cell manufacturing Budget Extension: Also include battery energy storage systems (BESS) manufacturing

Exemption Scope:

- Basic Customs Duty: Fully exempted

- Applicable to: All capital equipment for BESS production

- Equipment Types: Storage cells, integration systems, testing apparatus

Solar Glass Manufacturing:

Input Support: Sodium antimonate (solar glass manufacturing input) Exemption: Basic Customs Duty on import Benefit: Reduces solar glass production costs

Impact & Benefit:

- Renewable energy equipment costs: 15-25% reduction

- Solar manufacturing: Enhanced competitiveness

- Battery storage ecosystem: Rapid development support

- Clean energy transition acceleration

- Domestic battery and storage manufacturing growth

Strategic Impact:

- India’s renewable energy expansion: Facilitated through cost reduction

- Energy security: Enhanced through domestic battery production

- Global climate commitments: Supported through manufacturing incentives

10. NUCLEAR POWER SECTOR SUPPORT

Nuclear Equipment & Materials Duty Exemption

Program Enhancement:

- Current Exemption: Capital goods for Nuclear Power Projects (limited timeline and capacity)

- Budget Expansion:

- Timeline Extended: Till year 2035 (long-term certainty)

- Scope Expanded: All nuclear plants irrespective of capacity

Exemption Scope:

- Basic Customs Duty: Fully exempted on all nuclear project capital goods

- Applicability: All nuclear power plants across capacities

- Equipment Types: Reactor components, safety systems, infrastructure

Impact & Benefit:

- Nuclear power expansion: Cost-reduced, long-term support

- Energy security: Enhanced through nuclear capacity additions

- Climate goals: Supported through clean energy infrastructure

- Technology investment: Attracted through duty exemption certainty

- Employment: Job creation in nuclear sector and manufacturing

Economic Impact:

- Nuclear plant construction costs: 8-12% reduction through duty exemptions

- India’s nuclear capacity: Projected growth supported

- Foreign investment: Attracted through long-term certainty

11. CRITICAL MINERALS PROCESSING

Capital Goods Import Duty Exemption

Strategic Focus: Domestic processing of critical minerals

Exemption Scope:

- Capital goods: Required for critical minerals processing in India

- Basic Customs Duty: Fully exempted

- Applicability: All mineral processing equipment imports

Strategic Minerals Covered:

- Rare earth elements

- Lithium and battery minerals

- Strategic metals

- Industrial minerals

Impact & Benefit:

- Domestic processing establishment: Encouraged through cost reduction

- Import dependency: Reduced through local processing capacity

- Value-addition: Enhanced through domestic processing investment

- Supply chain resilience: Built through local mineral ecosystem

- Employment: Job creation in mineral processing sector

Economic Impact:

- Processing equipment costs: 20-25% reduction

- Domestic processing capacity: Rapid expansion enabled

- Mineral export value: Enhanced through value-addition

Aerospace & Manufacturing

12. CIVILIAN AIRCRAFT MANUFACTURING

Aircraft Components Duty Exemption

Scope:

- Components and parts: For civilian, training, and other aircraft manufacturing

- Basic Customs Duty: Fully exempted

- Applicability: All aircraft types (commercial, training, cargo)

Equipment Coverage:

- Airframe components

- Avionics systems

- Propulsion components

- Interior components

Impact & Benefit:

- Aircraft manufacturing costs: 10-15% reduction

- Aviation industry development: Cost-incentivized growth

- Maintenance & repair ecosystem: Established through components availability

- Aviation manufacturing: Emerging sector supported

13. DEFENCE AIRCRAFT MAINTENANCE

MRO Sector Support

Raw Materials: For maintenance, repair, overhaul (MRO) of defence aircraft

Exemption Scope:

- Basic Customs Duty: Fully exempted on MRO-related imports

- Beneficiary: Defence sector units

- Equipment Types: Replacement parts, service materials, consumables

Impact & Benefit:

- Defence aircraft MRO costs: 15-20% reduction

- Maintenance capability: Enhanced for defence forces

- Operational readiness: Improved through cost-effective maintenance

- Self-reliance: Supported through domestic MRO capability

14. CIVILIAN ELECTRONICS & APPLIANCES

Microwave Oven Manufacturing

Component Support:

- Specified parts: Used in microwave oven manufacturing

- Basic Customs Duty: Fully exempted

- Strategic Goal: Deepen consumer electronics value-addition

Impact & Benefit:

- Microwave oven manufacturing costs: 8-12% reduction

- Consumer electronics sector: Cost-competitiveness enhanced

- Domestic manufacturing: Incentivized through duty exemption

- Consumer prices: Downstream cost reduction potential

Trade & Export Facilitation

15. FISHERIES SECTOR EXPANSION

Marine Resources Economic Maximization

Exclusive Economic Zone (EEZ) & High Seas

Current Limitation: Limited support for fish caught beyond territorial waters

Budget Enhancement:

Duty-Free Fish Catch:

- Scope: Fish caught in EEZ or High Seas by Indian fishing vessels

- Customs Duty: Fully exempted

- Applicability: All fish species caught outside territorial waters

Export Classification:

- Fish landed on foreign ports: Treated as goods export

- Export benefits: All export incentives applicable

- Trade benefits: Standard export procedures followed

Safeguards:

- Catch verification: Anti-misuse mechanisms

- Transit monitoring: Transshipment compliance

- Regulatory oversight: Prevention of illegal catch

Impact & Benefit:

- Fisheries sector revenue: Significant enhancement

- Fishermen income: 15-25% increase from expanded EEZ access

- Foreign exchange earnings: Increased through fish exports

- Global seafood markets: Enhanced Indian participation

- Coastal employment: Expanded opportunities for fishing communities

Economic Impact:

- High seas fish catch: Economically viable through duty exemption

- Export competitiveness: Enhanced pricing power

- Fisheries GDP contribution: Projected growth

16. E-COMMERCE EXPORT SUPPORT

Courier Exports Value Cap Removal

Current Limitation:

- Value Ceiling: ₹10 lakh per consignment

- Restriction: Limits small business and artisan export capacity

- Constraint: Prevents scaling of cross-border e-commerce

Budget Change:

- New Limit: NO LIMIT (Complete removal)

- Applicability: All e-commerce courier exports

- Beneficiaries: Small businesses, artisans, start-ups

Additional Measure:

- Rejected/Returned Consignments: Technology-enabled handling

- Identification: Advanced systems for tracking returns

- Processing: Efficient procedures for returned goods

Impact & Benefit:

- Small business export capacity: Unlimited growth potential

- Artisan global market access: Significantly enhanced

- Start-up e-commerce: Scaling friction removed

- Cross-border e-commerce: Facilitation and growth support

- MSMEs: Global market participation enabled

Economic Impact:

- E-commerce exports: Projected 100%+ growth

- Small business revenue: Significant expansion opportunity

- Global market penetration: Enhanced for Indian products

- Employment: Job creation in e-commerce logistics

Consumer & Business Benefit:

- Global reach: Indian artisans and small businesses access worldwide customers

- Competitive advantage: Unrestricted export capacity

- Revenue growth: Unlimited scaling opportunity

Nuclear & Strategic Sectors

17. NUCLEAR POWER GOODS

Nuclear Equipment & Materials Support

Scope:

- All goods required for nuclear power projects

- Exemption: Basic Customs Duty

- Duration: Extended through 2035

Strategic Benefit:

- Nuclear sector development: Cost-supported expansion

- Energy security: Enhanced through nuclear capacity

- Climate goals: Supported through clean energy infrastructure

WHAT GETS COSTLIER IN UNION BUDGET 2026-27

Tax Compliance & Penalty Increases

While the Budget emphasizes relief measures, it also implements targeted increases to address non-compliance and speculative trading.

1. INCOME TAX MISREPORTING PENALTY

Enhanced Penalty for Intentional Misreporting

Current Framework:

- Underreporting immunity: Available with tax payment framework

- Misreporting: Previously subject to different penalty structure

Budget Change:

Penalty Enhancement:

- Penalty Rate: 100% of tax amount (as additional income tax)

- Applicability: Cases of income/asset misreporting

- Calculation: Over and above regular tax and interest due

Mechanism:

- Taxpayer must pay: Full tax + Interest + 100% penalty (as additional income tax)

- Immunity: Both penalty immunity and prosecution immunity available

- Purpose: Encourage voluntary disclosure while maintaining deterrence

Scope of Misreporting:

- Intentional misclassification of income

- False asset valuations

- Incorrect deduction claims

- Deliberately wrong expense reporting

Impact & Disincentive:

- Effective tax rate doubling: Creates strong deterrence

- Voluntary disclosure: Encouraged through immunity framework

- Compliance: Enhanced through penalty increase

- Tax integrity: Improved through stronger enforcement

Taxpayer Impact:

- Misreported ₹10 lakh income: Additional ₹10 lakh penalty (beyond base tax)

- Effective consequence: Doubles tax liability plus interest

- Behavior change: Incentivizes accurate initial reporting

2. NON-DISCLOSURE OF MOVABLE ASSETS

Penalty Introduction for Undisclosed Personal Assets

Current Situation:

- Non-immovable foreign assets <₹20 lakh: No penalty

- Recently expanded: Prosecution immunity also provided

New Penalty:

- Movable Assets: Now attract penalties for non-disclosure

- Applicability: Undisclosed personal movable property

- Asset Types: Jewelry, vehicles, financial instruments, art, collectibles

Penalty Structure:

- Rate: Proportional to asset value

- Additional Tax: Levied as additional income tax

- Enforcement: Triggered during income tax assessments

Impact:

- Asset declaration: Incentivized through penalty risk

- Tax compliance: Improved for personal asset reporting

- Hidden wealth: Increased visibility to tax authorities

- Revenue: Incremental from asset-related tax compliance

Taxpayer Impact:

- Undisclosed jewelry worth ₹50 lakh: Subject to penalty and back taxes

- Behavioral change: Enhanced asset disclosure in tax returns

- Compliance burden: Increased documentation requirements

Rationale:

- Tax integrity: Ensures complete asset visibility

- Wealth taxation: Improves effectiveness through comprehensive asset reporting

- Black money: Reduces through disclosure requirements

Securities Trading Taxes

3. SECURITIES TRANSACTION TAX (STT) INCREASES

Enhanced STT on Derivatives Market

Strategic Purpose:

- Derivatives market speculation: Address excessive volatility

- Trading volume: Moderate through cost increase

- Market stability: Enhance through reduced speculative activity

Futures STT Increase:

Current Rate: 0.02% STT on futures New Rate: 0.05% STT Increase: 150% (2.5x increase)

Impact:

- Futures trading costs: Increased significantly

- Speculative volume: Likely reduction

- Market stability: Enhanced through higher transaction costs

- Hedging: Still economically viable, speculation deterred

Options STT Increases:

Options Premium:

- Current Rate: 0.10% STT

- New Rate: 0.15% STT

- Increase: 50%

Options Exercise:

- Current Rate: 0.125% STT

- New Rate: 0.15% STT (convergence)

- Increase: 20%

Combined Effect: Uniform 0.15% rate across options transactions

Impact & Rationale:

- Options trading costs: Increased to moderate volume

- Speculative strategies: Higher cost disincentive

- Legitimate hedging: Still viable with manageable costs

- Market liquidity: Preserved while reducing speculation

- Volatility: Potentially reduced through higher transaction costs

Trader Impact:

- Trading costs: 50-150% increase in STT burden

- Strategy economics: Speculative strategies become unprofitable

- Market participation: Institutional and legitimate hedging continues

- Volumes: Anticipated reduction in speculative volume

Market Impact:

- Derivatives market: Expected moderation in volume

- Price stability: Potential improvement through reduced speculation

- Liquidity: Managed through institutional participation maintenance

COMPARATIVE ANALYSIS: CHEAPER VS. COSTLIER

Summary Table

| Category | Item | Impact | Change |

|---|---|---|---|

| Travel & Tourism | Overseas tour packages | CHEAPER | TCS: 5-20% → 2% |

| Education | Foreign education remittances | CHEAPER | TDS: 5% → 2% |

| Medical | Medical tourism/treatment | CHEAPER | TDS: 5% → 2% |

| Personal Imports | Goods for personal use | CHEAPER | Duty: 20% → 10% |

| Healthcare | Cancer drugs | CHEAPER | Duty: 20% → 0% (exemption) |

| Healthcare | Rare disease medicines | CHEAPER | Duty: 20% → 0% (exemption) |

| Exports | Seafood inputs | CHEAPER | Limit: 1% → 3% of export value |

| Exports | Shoe uppers | CHEAPER | Duty: 20% → 0% (exemption) |

| Raw Materials | Scrap, minerals | CHEAPER | Duty: 5-20% → 2% |

| Energy | Battery manufacturing | CHEAPER | Duty: 20% → 0% (exemption) |

| Energy | Solar glass | CHEAPER | Duty: 20% → 0% (exemption) |

| Energy | Nuclear equipment | CHEAPER | Extended exemption till 2035 |

| Manufacturing | Aircraft components | CHEAPER | Duty: 20% → 0% (exemption) |

| Electronics | Microwave components | CHEAPER | Duty: 20% → 0% (exemption) |

| Fisheries | High-seas fish catch | CHEAPER | Duty: 20% → 0% (exemption) |

| E-Commerce | Courier exports | CHEAPER | Limit removed (₹10L → unlimited) |

| Tax Compliance | Misreporting penalty | COSTLIER | Standard rate → 100% surcharge |

| Asset Disclosure | Undisclosed movables | COSTLIER | No penalty → Penalties imposed |

| Trading | Futures contracts | COSTLIER | STT: 0.02% → 0.05% |

| Trading | Options premium | COSTLIER | STT: 0.10% → 0.15% |

| Trading | Options exercise | COSTLIER | STT: 0.125% → 0.15% |

ECONOMIC IMPACT ASSESSMENT

GDP Growth Context

FY27 GDP Growth Projection: 6.8%-7.2%

Budget’s Role in Growth:

Cost Reduction Measures (Growth Acceleration):

- Consumer relief measures enhance household spending power

- Export duty reductions support manufacturing competitiveness

- Energy sector incentives facilitate transition and capacity addition

- E-commerce facilitation enables digital economy growth

- Strategic sector support promotes manufacturing ecosystems

Cost Increase Measures (Tax Integrity):

- Tax compliance enhancements improve revenue efficiency

- Speculative trading moderation reduces market volatility

- Asset disclosure requirements expand tax base

- Misreporting penalties enhance tax integrity

Net Effect: Balanced approach supporting growth while maintaining fiscal discipline

SECTORAL IMPACT ANALYSIS

Beneficiary Sectors

1. Tourism & Hospitality

- Impact: 15-20% growth in overseas tour bookings

- Mechanism: 60-90% TCS reduction on tour packages

- Beneficiaries: Travel agencies, tour operators, hospitality sector

2. Healthcare & Pharmaceuticals

- Impact: Enhanced drug accessibility and affordability

- Mechanism: Duty-free imports of cancer and rare disease medicines

- Beneficiaries: Patients, hospitals, pharmaceutical companies

3. Seafood & Fisheries

- Impact: 15-25% growth in export volumes

- Mechanism: Enhanced input import allowance and EEZ access

- Beneficiaries: Seafood exporters, fishing communities, coastal economy

4. Leather & Textiles

- Impact: 20-25% growth in leather product exports

- Mechanism: Duty-free shoe uppers imports and extended timeline

- Beneficiaries: Leather manufacturers, artisans, leather clusters

5. Renewable Energy

- Impact: 25-30% cost reduction in equipment

- Mechanism: Duty exemptions for batteries, solar glass, critical minerals

- Beneficiaries: Solar manufacturers, battery makers, energy companies

6. Electronics & Appliances

- Impact: 8-15% cost reduction in manufacturing

- Mechanism: Components and parts duty exemptions

- Beneficiaries: Appliance manufacturers, consumer electronics companies

7. Aerospace & Defence

- Impact: 10-20% cost reduction in manufacturing and MRO

- Mechanism: Aircraft components and defence materials exemptions

- Beneficiaries: Aviation companies, defence contractors

8. E-Commerce & MSMEs

- Impact: Unlimited export capacity

- Mechanism: Value cap removal on courier exports

- Beneficiaries: Small businesses, artisans, start-ups

Affected Sectors (Increased Costs)

1. Financial Markets

- Impact: Reduced speculative derivatives trading

- Mechanism: STT increases on futures and options

- Affected: Active traders, proprietary trading firms

- Positive Effect: Potentially reduced market volatility

2. Tax Compliance Risk

- Impact: Higher costs for non-compliant taxpayers

- Mechanism: Penalty increases for misreporting and non-disclosure

- Affected: Individuals with undisclosed assets or income

- Deterrent Effect: Enhanced compliance incentives

CONSUMER PRICE IMPLICATIONS

Direct Price Reduction Likelihood

High Probability (>50% price reduction):

- Overseas tour packages: 5-15% reduction

- International education costs: 2-5% reduction

- Cancer drug prices: 10-30% reduction

- Imported electronics: 2-8% reduction

Moderate Probability (20-50% price reduction):

- Renewable energy equipment: 5-10% reduction (long-term effect)

- Seafood export prices: Competitive improvement (not direct consumer impact)

Indirect Price Effects

Price Stability/Enhancement:

- Battery and energy storage: Potential long-term affordability through ecosystem development

- Manufacturing costs: Improved competitiveness may sustain prices during growth phase

FISCAL IMPLICATIONS

Revenue Impact

Revenue-Positive Measures:

- Income tax misreporting penalties: Enhanced compliance and revenue

- Securities transaction taxes: Slight increase in derivatives market tax revenue

- Non-disclosure penalties: Expanded tax base through asset disclosure

Revenue-Neutral Measures:

- Duty exemptions: Offset by increased volumes in exempt sectors (e-commerce, exports)

- TCS/TDS reductions: Offset by increased transaction volumes at lower rates

Consolidated Fiscal Impact: Designed to be broadly neutral while improving growth and tax integrity

India Revises Base Year of Merchandise T...

India Revises Base Year of Merchandise T...

India’s Core Sector Growth Slows to 4% i...

India’s Core Sector Growth Slows to 4% i...

Unemployment Rises to 5%! Why India’s Jo...

Unemployment Rises to 5%! Why India’s Jo...