Staying updated with the latest current affairs 2026- daily, weekly, and monthly is essential for every competitive exam aspirant. Adda247 offers reliable and easy-to-read current affairs coverage, including Today’s Current Affairs and a comprehensive 2026 compilation.

Whether you’re preparing for Bank, SSC, Railway, or Insurance exams, Adda247 keeps you ahead with the latest national and international updates. Access Daily current affairs weekly highlights, and monthly PDF capsules to strengthen your general awareness and improve your exam scores.

Today’s Latest Current Affairs

- Andhra Pradesh Set to Launch Amaravati Quantum Valley ProjectFebruary 7, 2026The Andhra Pradesh government is set to launch the ambitious Amaravati Quantum Valley (AQV) project on February ...

- Which Country is the Largest Sweet Potato Producing Country in the World?February 7, 2026Did you know a humble root vegetable feeds millions of people across the world every single day? ...

- US Lifts Additional 25% Tariff After India’s Russian Oil CommitmentFebruary 7, 2026United States has lifted the additional 25% tariff on Indian goods that was imposed over India’s purchases ...

- From Odisha to Orbit-Ready Precision: Agni-III Passes Key TestFebruary 7, 2026India has successfully test-fired the Agni-III intermediate-range ballistic missile from the Integrated Test Range (ITR) at Chandipur ...

- Check The Full List of Under-19 World Cup Winners ListFebruary 6, 2026The ICC Under-19 Men’s World Cup has been the launching pad for many international cricket legends. From ...

- ICC U-19 World Cup 2026 Final: India Outclass England and Lift The TrophyFebruary 6, 2026India once again stamped its authority in world cricket. In the ICC Under-19 Men’s Cricket World Cup ...

- Which Country is known as the Britain of the South?February 6, 2026Did you know some countries are famous for looking and feeling like another nation far away? Because ...

- Sooryavanshi Smashes Record 175 in U-19 World Cup Final Against EnglandFebruary 6, 2026Indian cricket has witnessed a historic moment on the global stage. A 14-year-old prodigy Vaibhav Suryavanshi delivered ...

- Which is the Largest Country in terms of Biomass Energy Production in 2026? Check the List of Top-5 CountriesFebruary 6, 2026Ever wondered how some countries turn everyday waste like crop leftovers, wood chips, and food scraps into ...

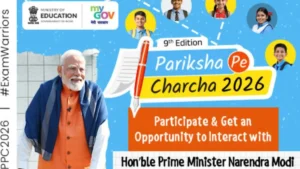

- PM Modi Interacts With Record 4.5 Crore Participants at Pariksha Pe Charcha”February 6, 2026Pariksha Pe Charcha 2026 once again took centre stage. On February 6, 2026, Prime Minister Narendra Modi ...

General Knowledge 2026

- Which Country is the Largest Sweet Potato Producing Country in the World?February 7, 2026Did you know a humble root vegetable feeds millions of people across the world every single day? Sweet potato is not just tasty, it is ...

- Which Country is known as the Britain of the South?February 6, 2026Did you know some countries are famous for looking and feeling like another nation far away? Because of climate, culture, and history, people often give ...

- Which is the Largest Country in terms of Biomass Energy Production in 2026? Check the List of Top-5 CountriesFebruary 6, 2026Ever wondered how some countries turn everyday waste like crop leftovers, wood chips, and food scraps into electricity? This amazing process is called biomass energy, ...

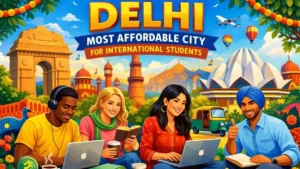

- Which is the Most Affordable City for International Students?February 6, 2026Ever wondered why some students manage to study abroad without spending a fortune? The secret often lies not in scholarships alone, but in choosing the ...

- Which Indian States has the Highest Number of Prime Ministers?February 6, 2026Have you ever wondered if one particular region of India has played a bigger role in shaping the country’s national leadership? Over the decades, India ...

- Which Mountain is known as the King of Mountains? Is it Mount Everest?February 6, 2026Ever wondered why some mountains are given royal titles? Around the world, people admire towering peaks not only for their height but also for their ...

- Which is the Strongest Country in the World by Military Power in 2026? Check the List of Top-10 CountriesFebruary 6, 2026Have you ever wondered which countries are the strongest when it comes to military power? Around the world, nations invest heavily in defence to protect ...

Important Days 2026

- International Day of Zero Tolerance for FGM Observed 2026: Date, Theme February 6, 2026

- World Interfaith Harmony Week 2026 Observed from February 1 to 7 February 5, 2026

- International Day of Human Fraternity: Dialogue Over Division February 4, 2026

- World Cancer Day 2026: United by Unique February 4, 2026

- Rheumatoid Arthritis Awareness Day 2026: Why It Deserves Our Attention February 2, 2026

- World Wetlands Day 2026: Can Traditional Knowledge Save Disappearing Wetlands? February 2, 2026

Latest Current Affairs 2026

Staying updated with the Latest Current Affairs 2026 from adda247 current affairs can significantly enhance your general awareness and give you a competitive edge in exams like IBPS PO, SBI PO & Clerk, UPSC IAS, SSC CGL & CHSL, RRB NTPC, Group D, and many others.

Since Current Affairs 2026 forms a crucial part of the General Awareness syllabus, thorough preparation is essential for success. With Adda247’s structured resources, your exam journey becomes more efficient, result-oriented, and confidence-driven.

For government exam aspirants, keeping up with the Daily News Current Affairs Today is vital, as it directly impacts performance in highly competitive tests. The Current Affairs section evaluates candidates’ awareness of ongoing developments, making it a key element of the preparation strategy.

Staying informed not only boosts your chances of securing a government job but also builds a strong foundation for long-term career growth.

Access Daily Current Affairs Updates for Exam Success

To access Daily Current Affairs Updates, candidates can visit the Current Affairs Adda website and explore dedicated sections for Daily, Weekly, and Monthly Current Affairs 2026. This ensures effective preparation strategies that help aspirants excel in Banking, SSC, Railways, UPSC, and Insurance exams.

Because exams are getting more competitive every year, the General Awareness (GA) section is very important, especially for questions from the latest current affairs of 2026. If you stay updated, revise regularly, and practice recent events, you can score better, be well prepared, and increase your chances of success.

By consistently following Current Affairs 2026, aspirants can strengthen their exam preparedness, enhance accuracy in the general knowledge section, and stay ahead with reliable, exam-oriented updates tailored for government exam preparation.