The Economic Survey for 2022-23 has pegged India’s GDP growth for the next fiscal 2023-24 in a broad range of 6-6.8 percent. The Survey’s baseline forecast for real GDP growth is 6.5 per cent. The Economic Survey 2023 is being presented at a time when India’s economy is being hailed as a bright spot amid recessionary fears in advanced economies. The Survey comes just a day before Finance Minister Nirmala Sitharaman presents Budget 2023.

Buy Prime Test Series for all Banking, SSC, Insurance & other exams

The 10 major highlights from the Economic Survey 2023 :

1. GDP Growth: Recovery from Covid is complete:

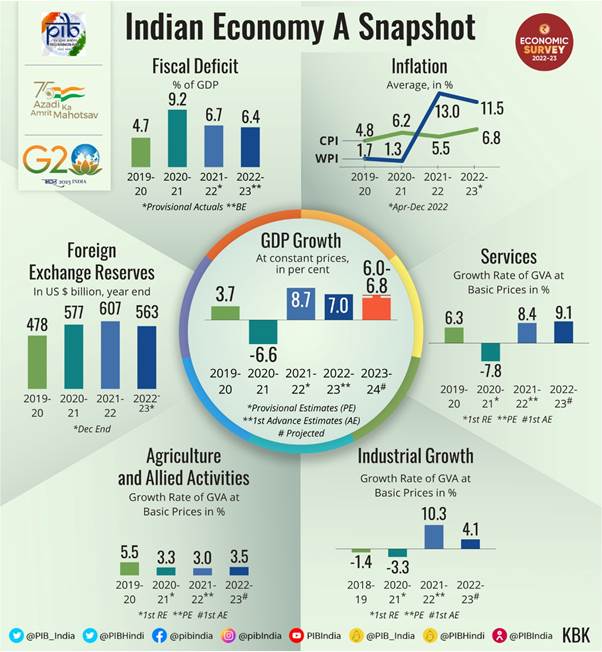

India to remain the fastest-growing major economy in the world. Recovering from pandemic-induced contraction, Russian-Ukraine conflict and inflation, Indian economy is staging a broad based recovery across sectors, positioning to ascend to the pre-pandemic growth path in FY23.

- India’s GDP growth is expected to remain robust in FY23 at 7 per cent (in real terms). This follows an 8.7 per cent growth in the previous financial year.

- GDP forecast for FY24 to be in the range of 6-6.8 %, depending on the trajectory of economic and political developments globally.

- Economic Survey 2022-23 projects a baseline GDP growth of 11 per cent in nominal terms and 6.5 per cent in real terms in FY 24.

2. Inflation within target but a further tightening of rates expected:

Economic Survey highlighted that the retail inflation is back within RBI’s target range in November 2022, as the government adopted a multi-pronged approach to tame the increase in price levels. While the year 2022 witnessed a return of high inflation in the advanced world after three to four decades, India caps the rise in prices by reducing the export duty of petrol and diesel, waiving of custom duty on cotton imports and many more.

- Borrowing cost may remain ‘higher for longer‘, entrenched inflation may prolong tightening cycle.

- India’s inflation management has been particularly noteworthy and can be contrasted with advanced economies that are still grappling with sticky inflation rates.

3. Employment generation:

Enhanced employment generation has been observed and the urban unemployment rate has declined. Higher net registration numbers have been seen in Employee Provident Fund scheme. Labour markets have recovered beyond pre-Covid levels, in both urban and rural areas, with unemployment rates falling from 5.8 per cent in 2018-19 to 4.2 per cent in 2020-21.

4. Boost in the Agricultural sector:

Private investment in agriculture has increased to 9.3 per cent in 2020-21. Institutional Credit to the Agricultural Sector continued to grow to 18.6 lakh crore in 2021-22. In terms of credit growth, institutional Credit to the Agricultural Sector continued to grow to 18.6 lakh crore in 2021-22.

5. MSME Sector growth:

Credit to Micro, Small and Medium Enterprises (MSMEs) has grown by an average of around 30 per cent since January 2022 and credit to large industry has been showing double-digit growth since October 2022.

6. Foreign Direct Investment (FDI):

Foreign Direct Investment (FDI) in the manufacturing sector moderated in the first half of FY23. However, inflows stayed well above the pre-pandemic levels, driven by structural reforms and measures improving the ease of doing business, making India one of the most attractive FDI destinations in the world.

7. External Sector Performance:

The growth of exports may have moderated in the second half of FY23. However, their surge in FY22 and the first half of FY23 induced a shift in the gears of the production processes from mild acceleration to cruise mode.

8. Pharma and Mobile Exports:

The Indian Pharmaceuticals industry plays a prominent role in the global pharmaceuticals industry. The cumulative FDI in the pharma sector crossed the $20 billion mark by September 2022.

In the mobile phone segment, India has become the second-largest mobile phone manufacturer globally, with the production of handsets going up from 6 crore units in FY15 to 29 crore units in FY21.

9. Credit Growth Remarkably High:

Credit growth to the Micro, Small and Medium Enterprises (MSME) sector has been remarkably high, over 30.5 per cent, on average during Jan-Nov 2022.

Capital expenditure of the central government, which increased by 63.4 per cent in the first eight months of FY 23, was another growth driver of the Indian economy in the current year.

10. Current Account Deficit may Widen:

The Economic Survey cautions that the challenge of the depreciating rupee, although better performing than most other currencies, persists with the likelihood of further increases in policy rates by the US Fed.

CAD may continue to widen as global commodity prices remain elevated, economic growth momentum stays strong. Rupee may come under pressure if Current Account Defict widens.

Which District of Uttar Pradesh is Known...

Which District of Uttar Pradesh is Known...

Daily Current Affairs 08th October 2025,...

Daily Current Affairs 08th October 2025,...

Top-10 Indian States with the Highest Da...

Top-10 Indian States with the Highest Da...