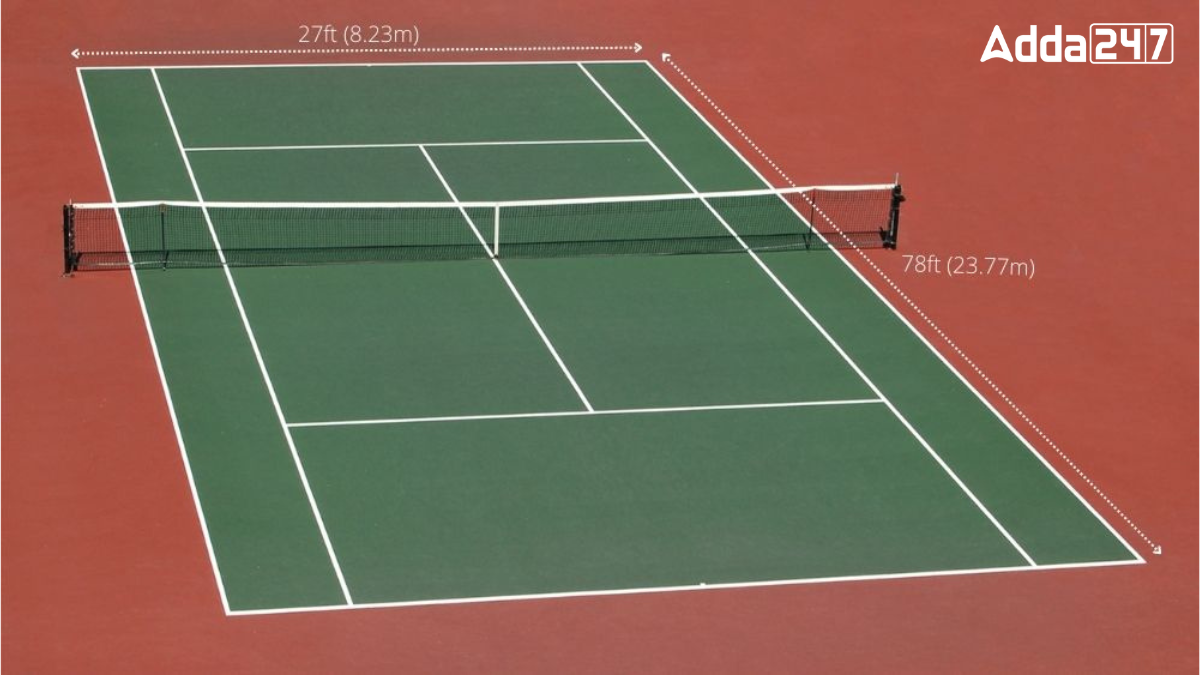

A tennis court is a standard playing field for the sport of tennis, with specific dimensions that must be adhered to for professional play. These dimensions ensure a consistent playing experience across different courts around the world. Know about the size and dimensions of the tennis court.

Standard Size of a Tennis Court

All professional ATP (Association of Tennis Professionals) and ITF (International Tennis Federation) courts have the same standard size. While minor discrepancies may exist, professional courts are designed to be uniform. Recreational courts, on the other hand, may vary in size, especially those created for personal use or for variations of the game like Touch Tennis.

Length of a Tennis Court

The length of a tennis court is 78 feet (23.77 meters). This measurement remains the same for both singles and doubles matches.

Width of a Tennis Court

The width of a tennis court differs based on the type of match:

- Singles matches: 27 feet (8.23 meters)

- Doubles matches: 36 feet (10.97 meters)

The court includes markings that distinguish the areas used for singles and doubles play.

Service Line in Tennis Court

The service line is an important marking on a tennis court. It is located 21 feet (6.4 meters) from the net. This line indicates the boundary for the service boxes, where players must aim their serves.

Total Area of a Tennis Couirt

The total playing area of a tennis court varies depending on whether it is used for singles or doubles matches:

- Singles court: 195.65 square meters (2,106 square feet)

- Doubles court: 260.87 square meters (2,808 square feet)

Singles Tennis Court Dimensions

A singles tennis court measures 78 feet (23.77 meters) in length and 27 feet (8.23 meters) in width. The service line, positioned 21 feet (6.4 meters) from the net, creates the service boxes within which serves must land. The total playing area for singles matches is 195.65 square meters (2,106 square feet).

Doubles Tennis Court Dimensions

A doubles tennis court shares the same length as a singles court, 78 feet (23.77 meters), but is wider, measuring 36 feet (10.97 meters). The service line remains 21 feet (6.4 meters) from the net. The total playing area for doubles matches is larger, encompassing 260.87 square meters (2,808 square feet).

Which Country is known as the Sugar Bowl...

Which Country is known as the Sugar Bowl...

Which Spices are Exported Most from Indi...

Which Spices are Exported Most from Indi...

Which River is known as the Black River?...

Which River is known as the Black River?...