Bloomberg has announced the inclusion of India’s Fully Accessible Route (FAR) bonds in its Emerging Market (EM) Local Currency Government Index and related indices, with a phased approach over ten months starting January 31, 2025. This follows JP Morgan’s similar move earlier, signaling increased foreign investment potential in Indian government securities.

Phased Inclusion Process

- Bloomberg will phase in the inclusion of FAR bonds over a ten-month period, starting January 31, 2025.

- Weight of FAR bonds will increase in increments of 10% of their full market value each month until October 2025 when they will be fully weighted.

Indices Included

- FAR bonds will be included in indices such as the Bloomberg EM Local Currency Government Index and the Bloomberg EM Local Currency Government Index 10% Country Capped Index, along with related sub-indices.

- This move aims to attract significant foreign investment into the Indian government securities market.

Market Impact and Expectations

- Inclusion of FAR bonds could potentially lead to a decline in Indian bond yields and strengthen the rupee.

- India is expected to join China and South Korea in reaching the 10% cap within the Bloomberg Emerging Market 10% Country Capped Index.

- India is projected to become the third-largest country, by market cap, within the index, after China and South Korea.

Stakeholder Perspectives

- Bloomberg Indices’ decision follows consultation with market participants and stakeholders.

- Nick Gendron, Global Head of Fixed Income Index Product at Bloomberg Index Services Limited (BISL), highlights increased access to and participation in Indian markets.

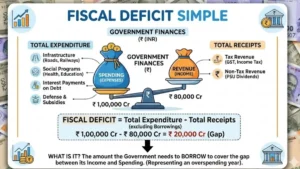

India’s Fiscal Deficit Hits ₹9.8 Trillio...

India’s Fiscal Deficit Hits ₹9.8 Trillio...

India’s GDP Growth Slows to 7.8% in Q3FY...

India’s GDP Growth Slows to 7.8% in Q3FY...

ICRA Projects India’s GDP Growth to Mode...

ICRA Projects India’s GDP Growth to Mode...