The International Financial Services Centres Authority (IFSCA) and the Reserve Bank of India (RBI) have entered into a Memorandum of Understanding (MoU) for collaboration in the field of regulation and supervision of regulated entities in their respective jurisdictions.

Bank Maha Pack includes Live Batches, Test Series, Video Lectures & eBooks

What Has Been Said:

“The Memorandum of Understanding (MoU) facilitates technical cooperation and exchange of information,” the IFSC Authority said in a statement. “The MoU opens up avenues for cooperation between the two regulators, thereby strengthening the safety, stability and soundness of respective financial ecosystems and nurturing environments conducive to optimal business development and economic growth,”

About IFSCA:

IFSCA is a statutory authority established under the IFSCA Act 2019, headquartered at GIFT City, Gandhinagar. It was established with a mandate to develop and regulate the financial products, financial services, and financial institutions in the International Financial Services Centres (IFSCs).

The IFSCA, being a unified regulator responsible for development and regulation of financial products, financial services and financial institutions in the International Financial Services Centre(s) (IFSC) established in India, is, inter-alia, entrusted with the responsibility of regulation and supervision of authorized banks and non-banking financial institutions operating in such IFSCs.

About RBI’s Regulation:

The RBI is the central bank and monetary authority of India carrying on, inter-alia, the regulation and supervision of banks and non-banking financial institutions as well as undertaking other functions and exercising powers in accordance with various statutes.

Other Important Regulators In India:

RBI, Securities and Exchange Board of India (Sebi), Pension Fund Regulatory and Development Authority (PFRDA) and Insurance Regulatory and Development Authority (IRDAI) regulated the business in IFSC.

Find More News Related to Banking

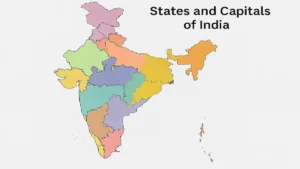

States and Capitals of India, Check the ...

States and Capitals of India, Check the ...

Which Indian District is Famous for the ...

Which Indian District is Famous for the ...

Which is the Largest District of Maharas...

Which is the Largest District of Maharas...