In the Budget for the fiscal year 2024-25, the Union Government demonstrates a robust commitment to bolstering economic growth through substantial investments in infrastructure development. The total expenditure in the Budget is estimated at 47,65,768 crore(47.65 Lakh Crore), with a significant focus on capital expenditure, reaching 11,11,111 crore(11.11 Lakh Crore). This reflects a commendable increase of 16.9% in capital expenditure over the Revised Estimates (RE) for 2023-24.

Capital Expenditure Highlights

- Total Capital Expenditure: The Budget allocates `11,11,111 crore for capital expenditure, marking a 16.9% surge over the RE for 2023-24.

- Effective Capital Expenditure: The effective capital expenditure for 2024-25 is projected at `14,96,693 crore, showcasing a substantial increase of 17.7% over the RE for 2023-24.

State Finances

-

Total Resources to States: In the fiscal year 2024-25, resources transferred to states, including devolution, grants, loans, and centrally sponsored schemes, amount to 22,22,264 crore(22.22 Lakh Crore). This represents a noteworthy increase of 4,13,848 crore over the Actuals of FY 2022-23.

-

Comparison with Previous Years: The total expenditure in the RE for 2023-24 stands at 44,90,486 crore, surpassing the Actuals of FY 2022-23 by 2,97,328 crore. The capital expenditure in the RE for 2023-24 is estimated at `9,50,246 crore.

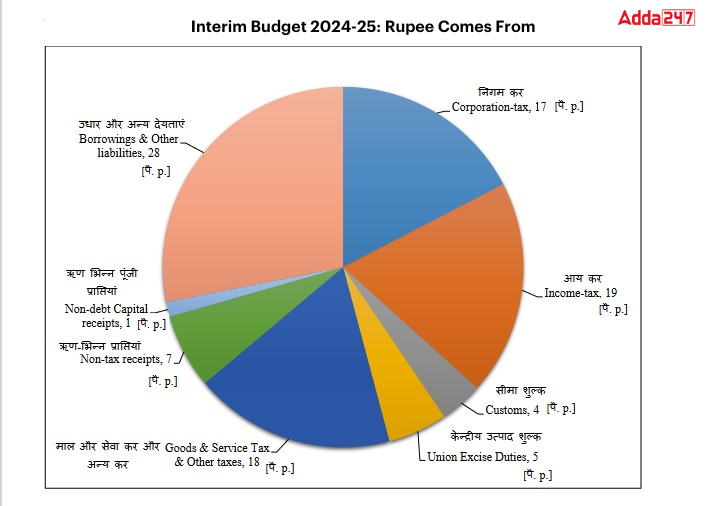

Revenue and Capital Receipts

-

Tax and Non-Tax Revenue: Tax revenue (Net to Centre) is projected at 26,01,574 crore(26.01 Lakh Crore), while non-tax revenue is estimated at 3,99,701 crore.

-

Capital Receipts Breakdown: Capital receipts include recovery of loans (29,000 crore), other receipts (50,000 crore), and borrowings and other liabilities (`16,85,494 crore).

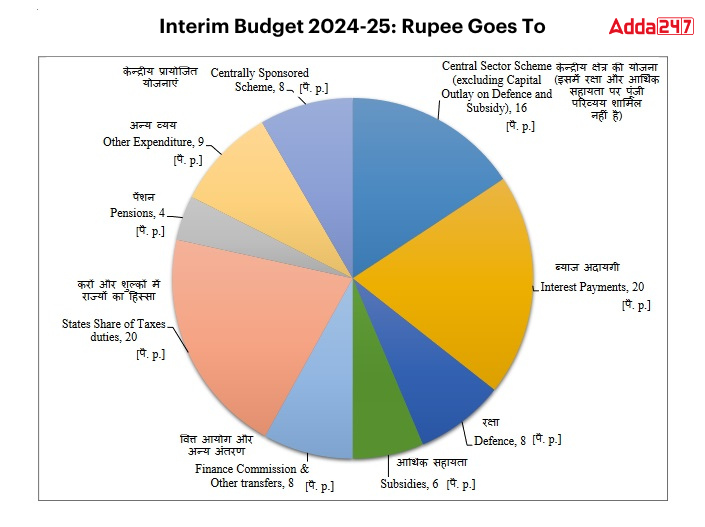

Expenditure Breakdown

-

On Revenue Account: The Budget allocates 36,54,657 crore(36.54 Lakh Crore) on revenue account, covering interest payments (11,90,440 crore) and grants in aid for capital account creation (`3,85,582 crore).

-

On Capital Account: Capital account expenditure is estimated at 11,11,111 crore, contributing to the effective capital expenditure of 14,96,693 crore.

Deficit Metrics

- Fiscal Deficit: The fiscal deficit for 2024-25 is projected at `16,85,494 crore, constituting 5.1% of the Nominal GDP.

-

Revenue Deficit and Effective Revenue Deficit: The revenue deficit is anticipated to be 6,53,383 crore, while the effective revenue deficit is projected at 2,67,801 crore.

-

Primary Deficit: The primary deficit for 2024-25 is estimated at `4,95,054 crore.

Government’s Effective Capital Expenditure (in ₹ Crore) Overview

In the fiscal year 2024-25 Budget, the government’s focus on effective capital expenditure is evident, with allocations specified for key sectors. The below information provides a breakdown of major items, showcasing the allocation and expenditure trends from the past fiscal years to the estimated figures for 2024-25.

Effective Capital Expenditure Breakdown

-

Capital Expenditure: The Budget allocates ₹11,11,111 crore for capital expenditure in 2024-25, reflecting a strategic commitment to investment in critical areas.

- Grants in Aid for Capital Assets: Under this category, ₹3,85,582 crore is allocated for creating capital assets, emphasizing the government’s investment in long-term infrastructure development.

-

Total Expenditure of Major Items: The effective capital expenditure for major items is detailed, covering key sectors critical for economic growth.

Expenditure of Major Items (in ₹ Crore)

- Pension: ₹2,39,612 crore is allocated, recognizing the importance of honoring commitments to retired personnel.

- Defence: A substantial allocation of ₹4,54,773 crore emphasizes the government’s commitment to national security.

-

Subsidies: Noteworthy subsidies include Fertiliser (₹1,64,000 crore), Food (₹2,05,250 crore), and Petroleum (₹11,925 crore), addressing key sectors crucial for public welfare.

-

Agriculture and Allied Activities: ₹1,46,819 crore is earmarked for the development of agriculture and allied sectors.

- Education: A significant allocation of ₹1,24,638 crore underscores the importance of investing in education for national progress.

-

Health: ₹90,171 crore is allocated to the health sector, reflecting the government’s commitment to public well-being.

- Interest Payments: With ₹11,90,440 crore allocated, managing interest payments remains a critical component of fiscal planning.

-

Others: Various sectors such as IT and Telecom, Rural Development, and Social Welfare receive targeted allocations, emphasizing holistic development.

Allocations for specific ministries

- Defence Ministry: ₹6.1 lakh crore

- Ministry of road transport and highways: ₹2.78 lakh crore

- Ministry of railways: ₹2.55 lakh crore

- Ministry of consumer affairs, food & public distribution: ₹2.13 lakh crore

- Ministry of home affairs: ₹2.03 lakh crore

- Ministry of rural development: ₹1.77 lakh crore

- Ministry of chemicals and fertilizers: ₹1.68 lakh crore

- Ministry of communications: ₹1.37 lakh crore

- Ministry of agriculture and farmer’s welfare: 1.27 lakh crore

- Ministry of Education: ₹1.24 Lakh Crore

- Ministry of Health: ₹90,171 Crore

Transfer of Resources to States and Union Territories with Legislature (in ₹ Crore) Overview

The allocation and transfer of resources to states and union territories play a crucial role in fostering balanced development across regions. The below information provides a breakdown of actuals for 2022-23, revised estimates for 2023-24, and budget estimates for 2024-25.

Devolution of States Share in Taxes

I. Actual Devolution (2022-23): ₹9,48,406 crore was devolved to states, forming a critical component of their fiscal resources.

II. Revised Estimates (2023-24): The revised estimate for 2023-24 is ₹11,04,494 crore, indicating an increase in the devolution share.

III. Budget Estimates (2024-25): The budget proposes a further increase, with ₹12,19,783 crore earmarked for devolution, emphasizing the government’s commitment to empowering states financially.

Some Important Items of Transfer

I. Actual Transfer (2022-23): ₹1,20,366 crore was allocated for essential items, supporting various initiatives at the state level.

II. Revised Estimates (2023-24): The revised estimate for 2023-24 stands at ₹1,60,986 crore, reflecting adjustments in response to evolving fiscal needs.

III. Budget Estimates (2024-25): The budget earmarks ₹1,88,703 crore for important items of transfer, underscoring the government’s focus on targeted financial support.

Finance Commission Grants

I. Actual Grants (2022-23): Finance Commission Grants amounted to ₹1,72,760 crore, addressing specific developmental needs identified by the Finance Commission.

II. Revised Estimates (2023-24): The revised estimate for 2023-24 is ₹1,40,429 crore, reflecting adjustments based on the Commission’s recommendations and evolving fiscal priorities.

III. Budget Estimates (2024-25): The budget allocates ₹1,32,378 crore for Finance Commission Grants, highlighting continued support for state-level development.

Government of India’s Budget Allocation for Major Schemes (2024-2025)

In the proposed budget for the fiscal year 2024-2025, the Government of India has outlined a comprehensive allocation for various major schemes. These schemes are strategically categorized into three sections, emphasizing their significance and funding priorities.

1. Core of the Core Schemes (A):

-

- Mahatma Gandhi National Rural Employment Guarantee Program: ₹86,000 crore

- National Social Assistance Program: ₹9,652 crore

- Umbrella Programme for Development of Minorities: ₹913 crore

- Umbrella Programme for Development of Other Vulnerable Groups: ₹2,150 crore

- Umbrella Programme for Development of Scheduled Tribes: ₹4,241 crore

- Umbrella Scheme for Development of Schedule Castes: ₹9,560 crore

2. Core Schemes (B):

-

- Pradhan Mantri Awas Yojna (PMAY): ₹80,671 crore

- Jal Jeevan Mission/National Rural Drinking Water Mission: ₹70,163 crore

- National Health Mission: ₹38,183 crore

- Samagra Shiksha: ₹37,500 crore

- Pradhan Mantri Gram Sadak Yojna: ₹19,000 crore

- National Livelihood Mission – Ajeevika: ₹15,047 crore

- Pradhan Mantri Poshan Shakti Nirman: ₹12,467 crore

- Pradhan Mantri Krishi Sinchai Yojna: ₹11,391 crore

- Urban Rejuvenation Mission (AMRUT and Smart Cities): ₹10,400 crore

- Rashtriya Krishi Vikas Yojna: ₹7,553 crore

- Ayushman Bharat-Pradhan Mantri Jan Arogya Yojana: ₹7,500 crore

- Krishionnati Yojana: ₹7,447 crore

- Swachh Bharat Mission (Gramin): ₹7,192 crore

- Assistance to States Agencies for Intra-State Movement of Foodgrains: ₹7,075 crore

- PM Schools for Rising India: ₹6,050 crore

- Swachh Bharat Mission: ₹5,000 crore

- Pradhan Mantri Ayushman Bharat Health Infrastructure Mission: ₹4,108 crore

- Modernisation of Police Forces: ₹3,720 crore

- Interlinking of Rivers: ₹3,500 crore

- Mission Shakti: ₹3,146 crore

- Blue Revolution: ₹2,352 crore

- Pradhan Mantri Uchchatar Shiksha Abhiyan: ₹1,815 crore

- Mission VATSALYA: ₹1,472 crore

- Strengthening Teaching-Learning and Results for States: ₹1,250 crore

- Rashtriya Gram Swaraj Abhiyan: ₹1,064 crore

- Vibrant Villages Programme: ₹1,050 crore

- Infrastructure Facilities for Judiciary: ₹1,000 crore

- Prime Minister Formalisation of Micro Food Processing Enterprises Scheme: ₹880 crore

- Environment, Forestry and Wildlife: ₹714 crore

- National River Conservation Plan – Other Basins: ₹592 crore

3. Major Central Sector Schemes (C):

-

- Crop Insurance Scheme: ₹14,600 crore

- Pradhan Mantri Kisan Samman Nidhi: ₹60,000 crore

- Formation and Promotion of 10,000 Farmer Producer Organizations: ₹582 crore

- Modified Interest Subvention Scheme: ₹22,600 crore

- Pradhan Mantri Annadata Aay Sanrakshan Yojna: ₹1,738 crore

- Agriculture Infrastructure Fund: ₹600 crore

- Crop Science for Food and Nutritional Security: ₹930 crore

- Research and Development Projects: ₹1,200 crore

- Nuclear Power Projects: ₹2,228 crore

- Feedstock: ₹1,253 crore

- R&D projects of Bhabha Atomic Research Centre: ₹1,100 crore

- Fuel Recycle Projects: ₹805 crore

- Nuclear Fuel Fabrication Projects: ₹764 crore

- Urea Subsidy: ₹1,19,000 crore

- Nutrient Based Subsidy: ₹45,000 crore

- Development of Industry (Pharmaceutical): ₹1,300 crore

- Production Linked Incentive Scheme (Pharmaceutical): ₹2,143 crore

- Regional Connectivity Scheme: ₹502 crore

- Interest Equalisation Scheme: ₹1,700 crore

- Industrial Development Scheme for Himachal Pradesh & Uttarakhand: ₹567 crore

- Fund of Funds: ₹1,200 crore

- Refund of Central and Integrated GST to Industrial Units in North Eastern Region and Himalayan States: ₹1,382 crore

- Compensation to Service Providers for creation and augmentation of telecom infrastructure: ₹2,000 crore

- Domestic Industry Incentivisation Scheme: ₹1,911 crore

- Pradhan Mantri Garib Kalyan Anna Yojana: ₹2,05,250 crore

- Works under Border Roads Development Board: ₹6,500 crore

- Other works: ₹1,500 crore

- Border Area Development Programme: ₹2,000 crore

- Pradhan Mantri Bhartiya Janaushadhi Pariyojana: ₹300 crore

- Solar Rooftop Scheme: ₹2,000 crore

- Interest Subsidy Scheme for Housing the Urban Poor: ₹10,000 crore

- Pradhan Mantri Awaas Yojana (Urban): ₹9,500 crore

- Subsidy for Interest on Loans under Atal Bimit Vyakti Kalyan Yojana: ₹408 crore

International Assistance Schemes Allocation

1. Scheme for Bhutan:

-

- Actual 2022-2023: ₹2467 crore

- Budget Estimates 2023-2024: ₹2401 crore

- Revised Estimates 2023-2024: ₹2399 crore

- Budget Estimates 2024-2025: ₹2069 crore

2. Scheme for Nepal:

-

- Actual 2022-2023: ₹434 crore

- Budget Estimates 2023-2024: ₹550 crore

- Revised Estimates 2023-2024: ₹650 crore

- Budget Estimates 2024-2025: ₹700 crore

3. Maldives Assistance:

-

- Actual 2022-2023: ₹183 crore

- Budget Estimates 2023-2024: ₹400 crore

- Revised Estimates 2023-2024: ₹771 crore

- Budget Estimates 2024-2025: ₹600 crore

4. Support to International Training/Programmes:

-

- Actual 2022-2023: ₹480 crore

- Budget Estimates 2023-2024: ₹435 crore

- Revised Estimates 2023-2024: ₹1105 crore

- Budget Estimates 2024-2025: ₹769 crore

Forex Reserves of India Hit Record High ...

Forex Reserves of India Hit Record High ...

India Revises Base Year of Merchandise T...

India Revises Base Year of Merchandise T...

India’s Core Sector Growth Slows to 4% i...

India’s Core Sector Growth Slows to 4% i...