Knight Frank, a global real estate consultancy, released its Wealth Report 2023, which provides insights into the trends and performance of the prime residential property market across the world. Among Indian respondents, the consultant said 88 per cent saw a rise in UHNWI’s (ultra-high-net-worth individuals) wealth in 2022.

Buy Prime Test Series for all Banking, SSC, Insurance & other exams

India and Knight Frank’s wealth report 2023:

- Out of which 35 per cent respondents said that Indian UHNWIs saw an increase in their wealth in excess of 10 per cent last year.

- Going forward, the Indian respondents expect wealth of the ultra-wealthy to continue to increase in 2023.

- While 47 per cent expect wealth to increase by more than 10 per cent, 53 per cent expect wealth to rise by at least 10 per cent over the previous year.

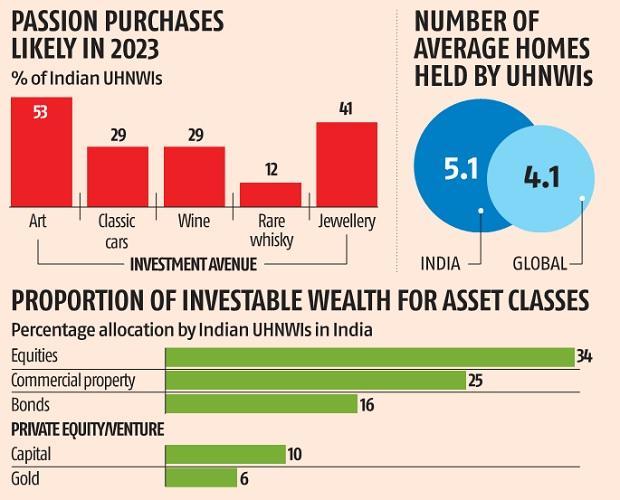

- The survey also found that investable wealth of Indian UHNWIs is largely allocated between equities, real estate and bonds.

- Out of the total investable wealth, highest allocation is in equities at 34 per cent, followed by commercial property (25 per cent), bonds (16 per cent), private equity/venture capital (10 per cent), gold (6 per cent) and passion led investment (like art, car and wine) at 4 per cent.

- Allocation in equities is higher by Indian UHNWIs than wealthy people globally.

- The optimism of the ultra-wealthy on wealth generation here is far higher than their global counterparts and this shall serve as the bedrock of investment and consumption decisions.

Indian super rich owns more residential properties than global average:

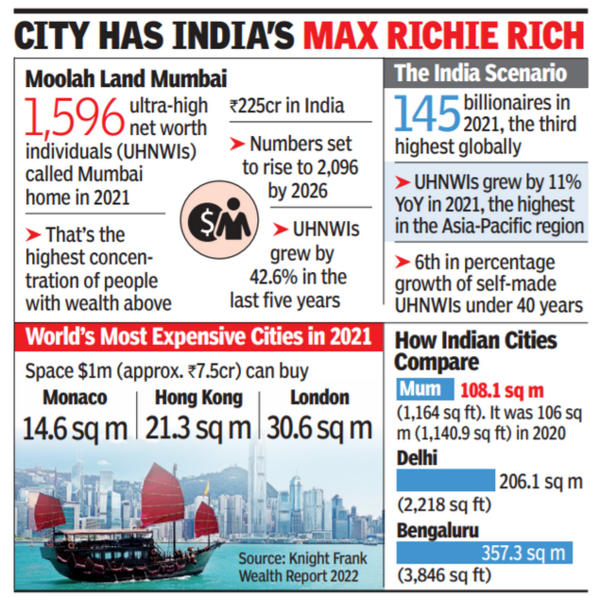

Among other findings, the survey report said that on an average Indian super rich owns more than 5 (5.1) residential properties compared to the global average of 4.2 units.

Around 37 per cent of the total wealth’s allocation is towards primary and secondary homes by Indian UHNWIs, of which 15 per cent allocation was towards residential property held outside India.

Knight Frank said that 14 per cent of UHNWIs purchased a home in 2022 and about 10 per cent are expected to make a new home purchase in 2023.

United Kingdom: The Most Preferred Foreign Location:

Amongst foreign locations the United Kingdom, United Arab Emirates and United States are the most preferred locations for purchasing homes.

The United Kingdom was the first preference with 47 per cent of respondents showing affinity towards it.

The second spot was taken by UAE (41 per cent), followed by USA (29 per cent) and Canada (18 per cent).

Paris Olympics 2024 Medal Tally, India M...

Paris Olympics 2024 Medal Tally, India M...

Which District of Madhya Pradesh is Famo...

Which District of Madhya Pradesh is Famo...

EC Signs Electoral Cooperation Pact with...

EC Signs Electoral Cooperation Pact with...