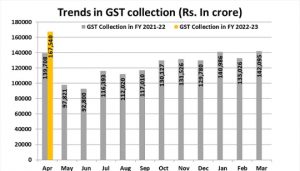

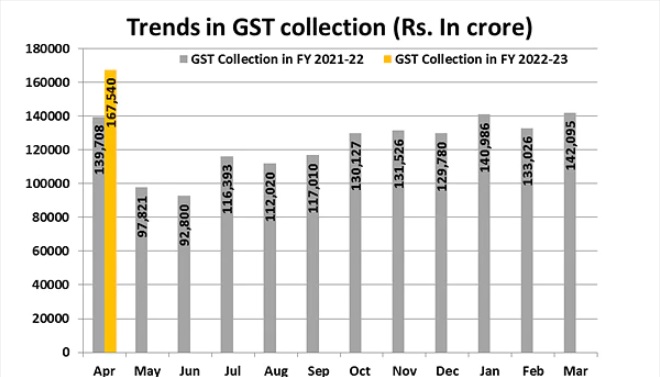

Goods and services tax (GST) collections hit an all-time high of Rs 1.68 lakh crore in April, indicating strong economic activity despite multiple headwinds and better tax compliance. The April number is up 20% from the year-earlier and Rs 25,000 crore more than the previous highest of Rs 1.42 lakh crore in March this year.

Buy Prime Test Series for all Banking, SSC, Insurance & other exams

In April 2022, 10.6 million GST returns were filed compared with 9.2 million in the year earlier. Of the total, central GST amounted to Rs 33,159 crores, state GST was Rs 41,793 crore, integrated GST was Rs 81,939 crore while Rs 36,705 crore was collected on the import of goods. Cess collection was Rs 10,649 crore, including Rs 857 crore on import of goods. The government has settled Rs 33,423 crore toward central GST and Rs 26,962 crore toward state GST from the integrated GST.

List of previous months’ GST Collection

- March 2022: Rs 1.42 Lakh crores

- February 2022: Rs 1.33 Lakh crores

- January 2022: Rs 1.38 Lakh crores

- December 2021: Rs 1.29 Lakh crores

- November 2021: Rs 1.31 lakh crores

Which Painting is known as the Indian Mo...

Which Painting is known as the Indian Mo...

Which Indian State was the First to Chan...

Which Indian State was the First to Chan...

Govt To Launch CBDC-Based Food Subsidy P...

Govt To Launch CBDC-Based Food Subsidy P...