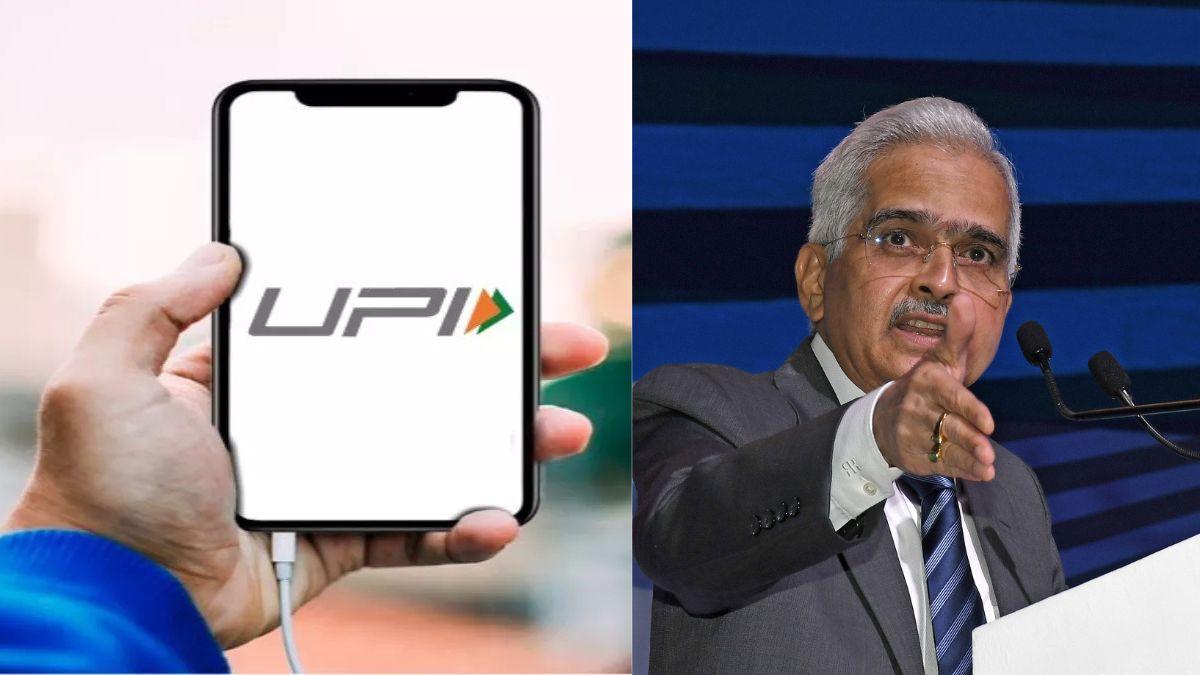

The Reserve Bank of India (RBI) took a significant step on Friday by announcing an increase in the UPI payment limits from Rs 1 lakh to Rs 5 lakh. This decision is expected to reshape the dynamics of financial transactions, particularly in the domains of healthcare and education. RBI Governor Shaktikanta Das, during the Monetary Policy Committee (MPC) announcement, highlighted the rationale behind the move and its potential impact on consumers.

Enhanced UPI Limits for Healthcare and Education

- RBI Governor Shaktikanta Das emphasized that the revised UPI transaction limit aims to facilitate higher payments for medical and educational purposes.

- The announcement signals a positive shift in the landscape of digital transactions, allowing consumers greater flexibility in handling transactions related to healthcare and education.

Current UPI Transaction Limits

- As per the National Payments Corporation of India (NPCI) website, the existing UPI transaction limit for normal payments stands at Rs 1 lakh per transaction.

- However, certain categories, such as capital markets, collections, insurance, and foreign inward remittances, have a higher transaction limit of up to Rs 2 lakh.

- Notably, for Initial Public Offering (IPO) and Retail Direct Scheme, the UPI transaction limit is now increased to Rs 5 lakh per transaction.

RBI Monetary Policy Committee(MPC) Meeting Highlights – December 2023

Digital Payments Landscape: E-Mandate for Recurring Payments

- In addition to the UPI payment limit revision, Governor Das proposed a substantial hike in the e-mandate for recurring payments.

- Currently set at Rs 15,000, the proposed limit for e-mandate transactions for mutual funds, insurance premiums, and credit card payments is Rs 1 lakh.

- This adjustment reflects the growing popularity of e-mandates for recurring transactions among customers.

Proposed Exemptions for Recurring Payments

- The RBI’s proposal also includes exempting the requirement of an additional factor of authentication (AFA) for transactions up to Rs 1 lakh in certain categories.

- Specifically, subscriptions to mutual funds, payment of insurance premiums, and credit card bill payments would be exempt from AFA.

- However, other existing requirements, such as pre and post-transaction notifications and opt-out facilities for users, will continue to apply to these transactions.

Important Questions Related to Exams

Q. What was the UPI transaction limit before the recent announcement by the RBI?

Answer: Rs 1 lakh

Q: What is the new UPI transaction limit proposed by the RBI for payments to hospitals and educational institutions?

Answer: Rs 5 lakh

Q: In which domains does the RBI expect the increased UPI limit to have a transformative impact?

Answer: Healthcare and Education

Q: Which transactions will continue to have existing requirements, such as pre and post-transaction notifications, despite the proposed changes?

Answer: Subscriptions to mutual funds, payment of insurance premiums, and credit card bill payments.

SBI Raises ₹5,000 Crore via AT-1 Bonds...

SBI Raises ₹5,000 Crore via AT-1 Bonds...

HDFC Life's Commitment to DEI: A Dual Re...

HDFC Life's Commitment to DEI: A Dual Re...

RBI Updates Alert List of Unauthorized F...

RBI Updates Alert List of Unauthorized F...